- United States

- /

- Renewable Energy

- /

- NasdaqGS:RNW

ReNew Energy Global (NasdaqGS:RNW): A Fresh Look at Valuation After Strong Shareholder Returns

Reviewed by Simply Wall St

See our latest analysis for ReNew Energy Global.

Despite a softer patch in recent weeks, ReNew Energy Global’s 1-year total shareholder return stands at an impressive 38.86%, well ahead of many sector peers. This momentum suggests that investors remain optimistic about the company’s growth prospects, especially given its steady financial performance and a year-to-date share price return of 10.88%.

If the recent run-up in renewables has you looking further afield, now is a smart time to discover fast growing stocks with high insider ownership

With shares not far from analyst targets despite strong recent returns, the key question for investors is whether ReNew Energy Global is currently undervalued, or if expectations around future growth are already fully reflected in the price.

Most Popular Narrative: 5% Undervalued

With a widely followed fair value of $7.96 versus a last close of $7.54, the market currently values ReNew Energy Global slightly below what analysts project. This difference sets the stage for a debate about future growth and profitability, hinging on ambitious expansion plans and disciplined management highlighted by the most prevalent narrative.

Expansion in renewable assets, manufacturing capacity, and strategic partnerships is driving diversified revenue streams and improved profitability. Emphasis on technological innovation, operational efficiency, and supportive policy frameworks supports sustained growth and lowers long-term risks.

Want to see what’s fueling this value call? The narrative’s payoff depends on big gains in earnings and margins, with a forward-looking profit multiple that stands out compared to the sector’s norm. The full story is all about bold growth bets and whether current assumptions can deliver the premium.

Result: Fair Value of $7.96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition in renewables bidding and potential project execution delays remain significant risks that could hinder the growth story of ReNew Energy Global.

Find out about the key risks to this ReNew Energy Global narrative.

Another View: What Do Valuation Ratios Say?

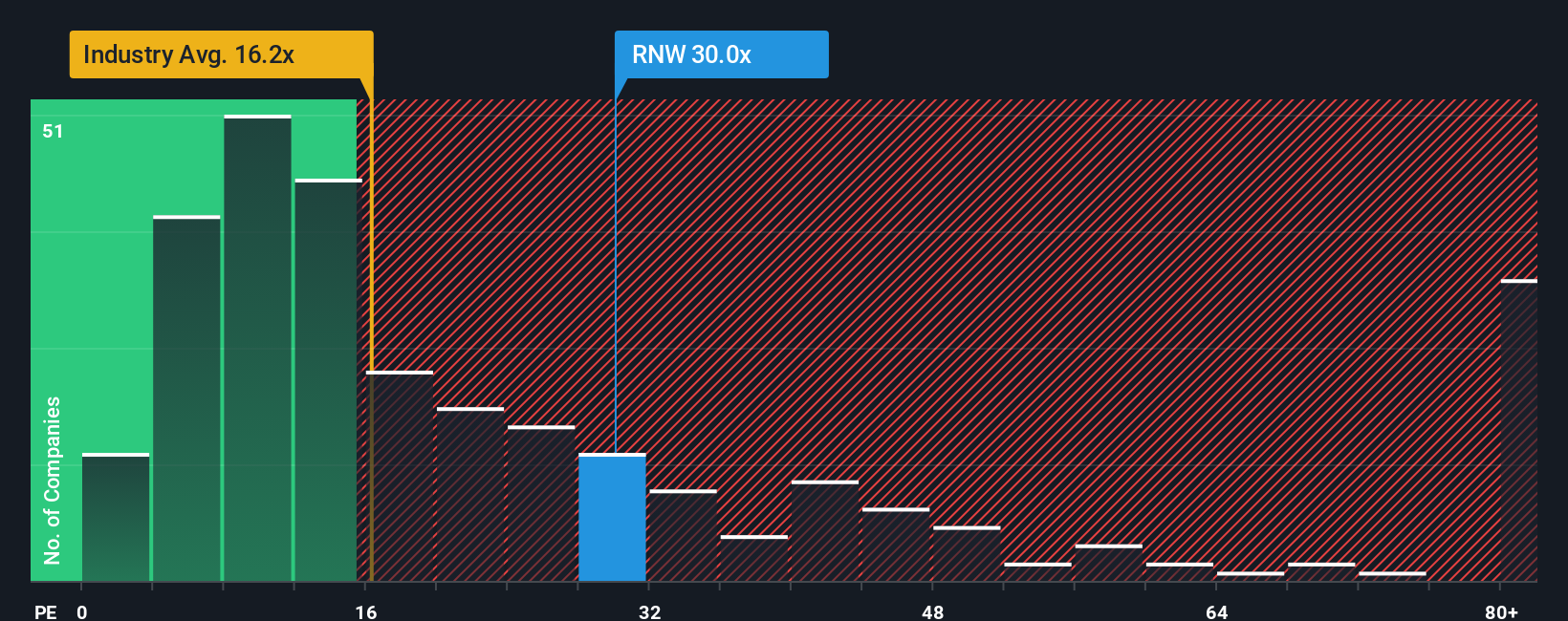

From another angle, ReNew Energy Global trades at a price-to-earnings ratio of 27.9x. This figure is well below the US renewable energy industry average of 46.2x and its peer average of 56.1x, but sits a bit above its own fair ratio of 29.7x. This mix of numbers suggests a possible value opportunity, but also implies some valuation risk if sector optimism falters. Which way could sentiment tip next?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ReNew Energy Global Narrative

Not convinced by these conclusions, or prefer to dig into the numbers yourself? You can craft your perspective on ReNew Energy Global in minutes: Do it your way

A great starting point for your ReNew Energy Global research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why limit your strategy to just one company? Take advantage of unique trends, strong income opportunities, and cutting-edge innovation with stock ideas tailored to different markets.

- Grow your income potential by tapping into these 22 dividend stocks with yields > 3% with high-yield opportunities for investors who want steady returns.

- Power up your portfolio with these 26 AI penny stocks featuring companies at the forefront of artificial intelligence breakthroughs and next-generation automation.

- Capture tomorrow’s winners first by targeting these 832 undervalued stocks based on cash flows that are trading below their intrinsic value, giving you a possible edge ahead of the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RNW

ReNew Energy Global

Engages in the generation of power through non-conventional and renewable energy sources in India.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives