- United States

- /

- Other Utilities

- /

- NasdaqGS:NWE

NorthWestern Energy (NWE): Is the Recent Rally Justified by Current Valuation?

Reviewed by Simply Wall St

NorthWestern Energy Group (NWE) shares drifted slightly lower in today’s trading session, giving back recent gains after a solid run over the past month. Investors are likely assessing recent price action in light of the company’s fundamentals.

See our latest analysis for NorthWestern Energy Group.

NorthWestern Energy Group’s share price has climbed more than 12% year to date, building positive momentum after a strong multi month rally. The company’s steady 18.7% total shareholder return over the past year hints that market sentiment is firming up, reflecting renewed confidence in its fundamentals and growth prospects.

If you want to see what else investors are getting excited about, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

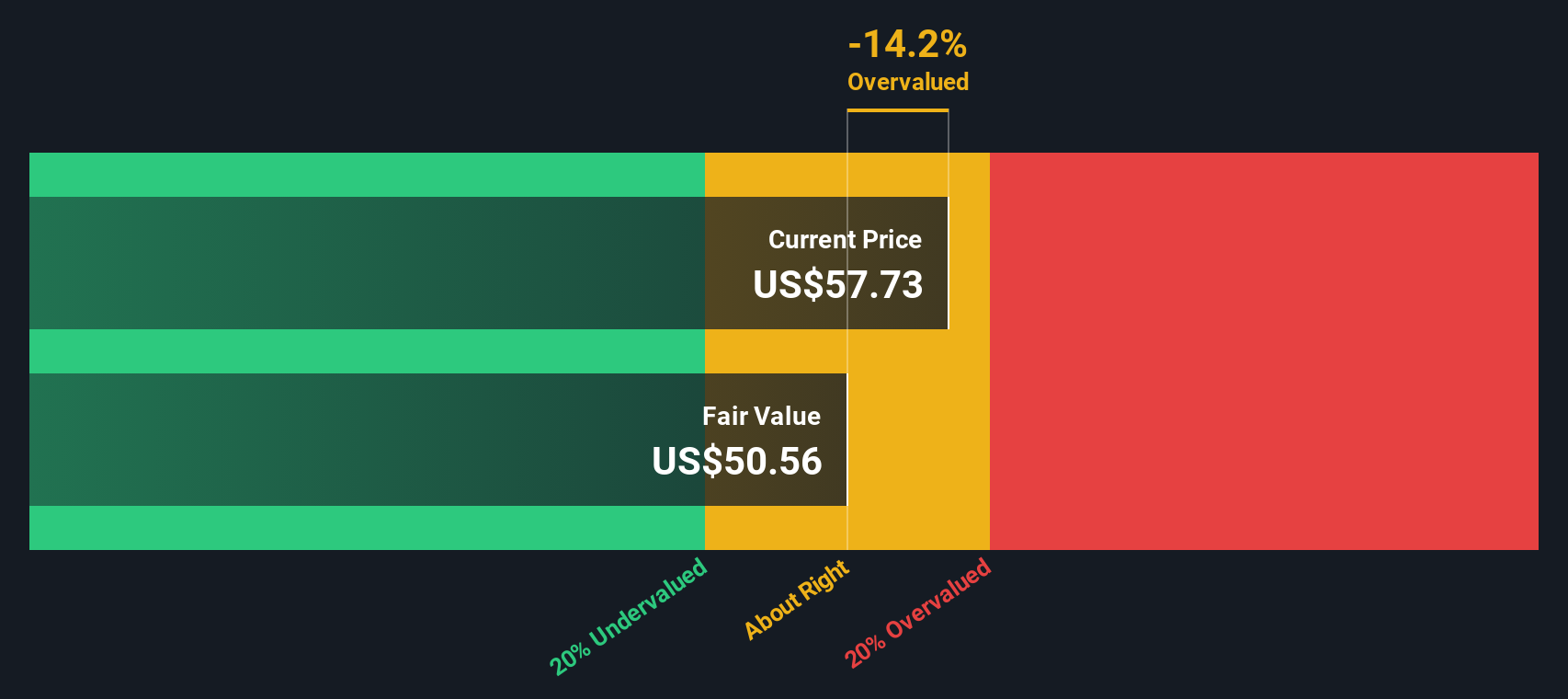

With steady gains and upbeat fundamentals, the key question now is whether NorthWestern Energy Group’s current valuation leaves room for more upside or if the recent rally means the market has already factored in future growth.

Most Popular Narrative: 0.5% Overvalued

With NorthWestern Energy Group’s last close price almost matching the widely followed narrative’s fair value, investors are scrutinizing what’s really driving the current share price and whether the market is pricing in future growth a bit too eagerly.

NorthWestern is poised to benefit from outsized load growth driven by accelerating data center demand in Montana and South Dakota, which is likely to support above-trend revenue and earnings growth as long-term electrification of industry and digital infrastructure unfolds.

Want to know the logic behind this razor-thin valuation gap? The secret recipe: bold expectations for revenue gains, margin shifts, and a profit multiple that’s unusually punchy for a utility. Think you can predict the number crunch behind this confidence? There’s more to the projections than meets the eye—see what really powers the analysts’ consensus.

Result: Fair Value of $59.4 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as heavier infrastructure spending and reliance on the Colstrip coal plant could quickly change NorthWestern Energy Group’s positive outlook.

Find out about the key risks to this NorthWestern Energy Group narrative.

Another View: DCF Tells a Different Story

While the consensus price target treats NorthWestern Energy Group as fairly valued, our DCF model estimates a fair value closer to $51.80, which is well below where shares trade today. This suggests the market may be pricing in more optimism than the company’s future cash flows justify. Which valuation method will prove correct as market realities unfold?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own NorthWestern Energy Group Narrative

If you see things differently or want the facts to tell your own story, the data is here for you to shape your personal view in minutes: Do it your way.

A great starting point for your NorthWestern Energy Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that the best opportunities are often just beyond the obvious. Take advantage of unique stock picks using these specialized tools and never miss the next market mover.

- Unlock reliable income streams when you review these 22 dividend stocks with yields > 3% earning consistent yields above 3 percent. This can help strengthen the defensive core of your portfolio.

- Stay ahead of the curve by evaluating these 26 AI penny stocks, which are transforming industries with artificial intelligence breakthroughs and next-level automation.

- Capture undervalued opportunities early by researching these 831 undervalued stocks based on cash flows, which balance strong fundamentals with compelling upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NorthWestern Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NWE

NorthWestern Energy Group

NorthWestern Energy Group, Inc., doing business as NorthWestern Energy, provides electricity and natural gas to residential, commercial, and various industrial customers.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives