- United States

- /

- Electric Utilities

- /

- NasdaqGS:LNT

We Think That There Are Some Issues For Alliant Energy (NASDAQ:LNT) Beyond Its Promising Earnings

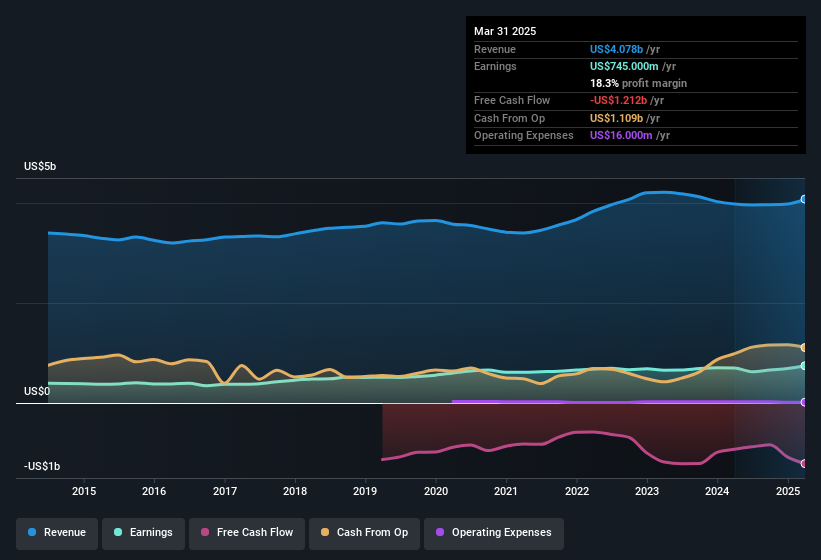

Alliant Energy Corporation's (NASDAQ:LNT) healthy profit numbers didn't contain any surprises for investors. We believe that shareholders have noticed some concerning factors beyond the statutory profit numbers.

We've discovered 2 warning signs about Alliant Energy. View them for free.

An Unusual Tax Situation

Alliant Energy reported a tax benefit of US$151m, which is well worth noting. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man. The receipt of a tax benefit is obviously a good thing, on its own. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Alliant Energy's Profit Performance

As we have already discussed Alliant Energy reported that it received a tax benefit, rather than paying tax, in the last year. As a result we don't think its profit result, which includes that tax-boost, is a good guide to its sustainable profit levels. Because of this, we think that it may be that Alliant Energy's statutory profits are better than its underlying earnings power. But at least holders can take some solace from the 6.9% per annum growth in EPS for the last three. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. For instance, we've identified 2 warning signs for Alliant Energy (1 is concerning) you should be familiar with.

This note has only looked at a single factor that sheds light on the nature of Alliant Energy's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LNT

Alliant Energy

Operates as a utility holding company that provides regulated electric and natural gas services in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026