- United States

- /

- Electric Utilities

- /

- NasdaqGS:LNT

Is Alliant Energy’s (LNT) Steady Dividend Policy a Sign of Enduring Strength or Missed Expansion?

Reviewed by Simply Wall St

- The Alliant Energy Corporation Board of Directors recently declared a quarterly cash dividend of US$0.5075 per share, payable on August 15, 2025, to shareholders of record as of July 31, 2025.

- This latest dividend affirmation highlights Alliant Energy's focus on providing consistent shareholder returns, reflecting ongoing confidence in its financial stability and cash flow.

- We will explore how this dividend declaration may signal further support for Alliant Energy's earnings growth and capital allocation narrative.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Alliant Energy Investment Narrative Recap

To be a shareholder in Alliant Energy, you generally need to believe in the ongoing transition toward cleaner energy, stable regulated utility revenues, and the company's ability to balance capital investment with consistent shareholder returns. The recent dividend declaration reinforces management’s focus on yield, but does not materially affect the most pressing catalyst, the ramp-up of additional data center load in the Midwest, or the biggest risk, which is a heavy dependence on debt and the potential for rising interest rates to pressure net margins. Among recent announcements, Alliant Energy's completion of the Grant County Solar Project is especially connected to the company’s catalysts. Bringing 200 MW of zero-fuel-cost solar capacity online supports the revenue growth potential tied to new data center agreements and economic development, both of which rely heavily on additional low-cost, clean power coming to the grid. However, with rising debt levels and an interest coverage warning, investors should also consider...

Read the full narrative on Alliant Energy (it's free!)

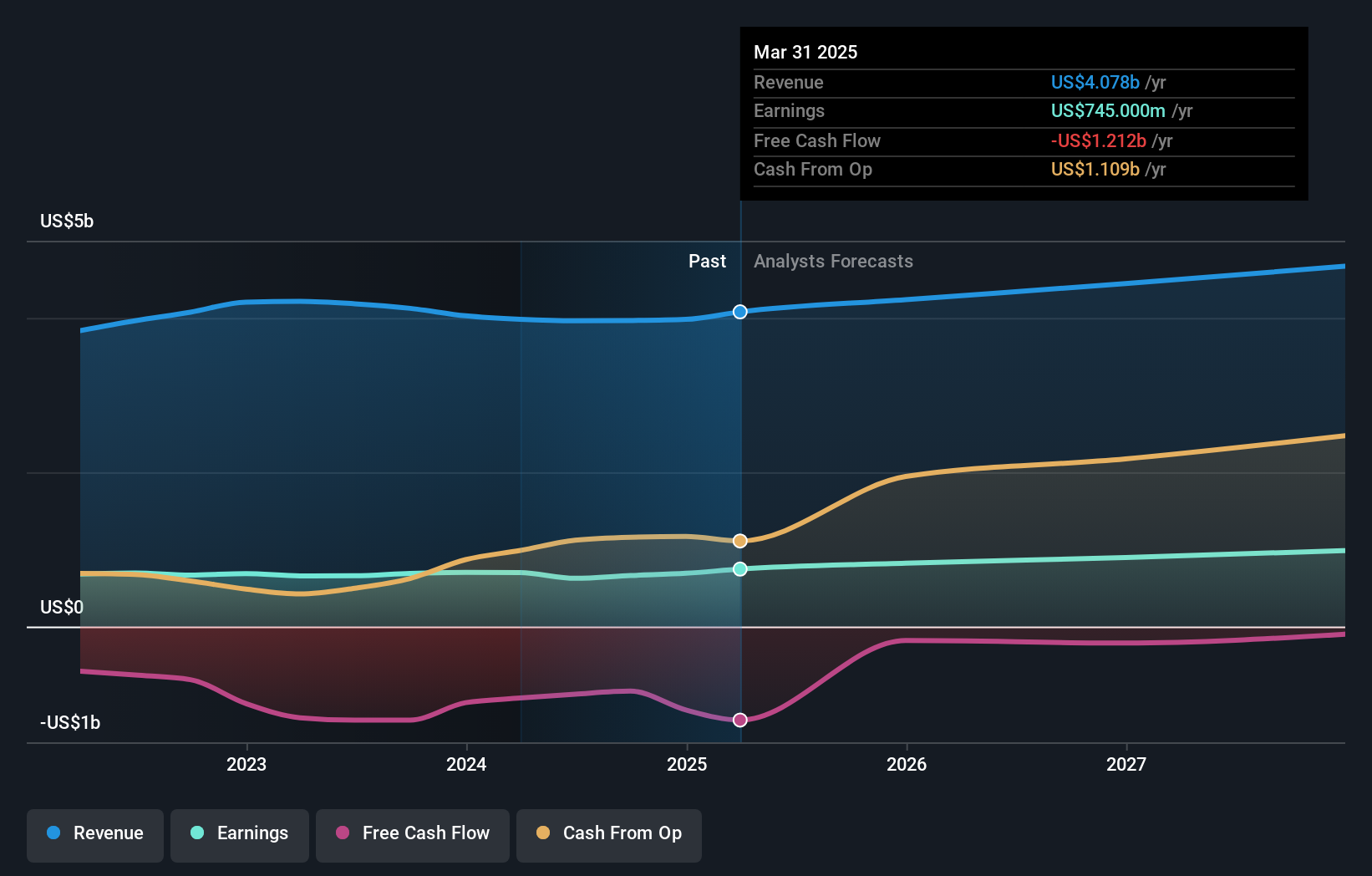

Alliant Energy is projected to reach $4.8 billion in revenue and $1.0 billion in earnings by 2028. This outlook is based on an expected annual revenue growth rate of 5.3% and a $255 million increase in earnings from the current earnings of $745.0 million.

Uncover how Alliant Energy's forecasts yield a $66.01 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members have placed fair values for Alliant Energy between US$64.64 and US$66.01, drawing from two personal forecasts. While some focus on the potential from new data center contracts, others point to risks like the company’s elevated debt exposure affecting future returns.

Explore 2 other fair value estimates on Alliant Energy - why the stock might be worth just $64.64!

Build Your Own Alliant Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alliant Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Alliant Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alliant Energy's overall financial health at a glance.

No Opportunity In Alliant Energy?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LNT

Alliant Energy

Operates as a utility holding company that provides regulated electric and natural gas services in the United States.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives