- United States

- /

- Electric Utilities

- /

- NasdaqGS:LNT

Alliant Energy (LNT): Assessing Valuation as Analyst Upgrades Highlight Data Center-Driven Growth Prospects

Reviewed by Simply Wall St

Alliant Energy (LNT) has drawn increased attention after UBS Securities highlighted its prospects amid rising energy demand from expanding data centers. Analyst upgrades point to greater earnings potential and future growth as new capacity investments are underway.

See our latest analysis for Alliant Energy.

Alliant Energy’s stock has been on a strong run lately, with a year-to-date share price return of nearly 18% and a current price of $68.97. Recent analyst upgrades, along with a steady flow of projects tied to booming data center demand, have helped build positive momentum. This is reflected in a robust 1-year total shareholder return of almost 17% and an impressive 45% over three years.

If the buzz around Alliant’s latest projects has you curious about fresh investing opportunities, now’s your chance to explore fast growing stocks with high insider ownership

With Alliant Energy’s shares at multi-year highs and Wall Street raising targets on data center-driven growth, the key question is whether the upside is already reflected in the price or if there is still an opportunity for new investors.

Most Popular Narrative: Fairly Valued

Compared to Alliant Energy’s last close of $68.97, the most popular narrative pegs its fair value almost exactly at the market price. The narrative’s calculation builds on the company’s momentum in population-driven demand, infrastructure investments, and flexible regulation.

The accelerating construction and onboarding of large-scale data centers in Alliant's Midwest service areas highlight a strong, sustained uptick in electricity demand, directly linked to population and economic growth in the region. This is expected to drive significant increases in revenue and top-line growth over the next several years.

Want the full story behind this razor-sharp fair value estimate? The narrative factors in accelerating demand, strategic investments, and a profit outlook that is generating serious buzz among market-watchers. Discover what rests at the core of these market-moving projections.

Result: Fair Value of $69.70 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential setbacks such as delays in major data center projects or regulatory pushback could easily alter this positive outlook for Alliant Energy.

Find out about the key risks to this Alliant Energy narrative.

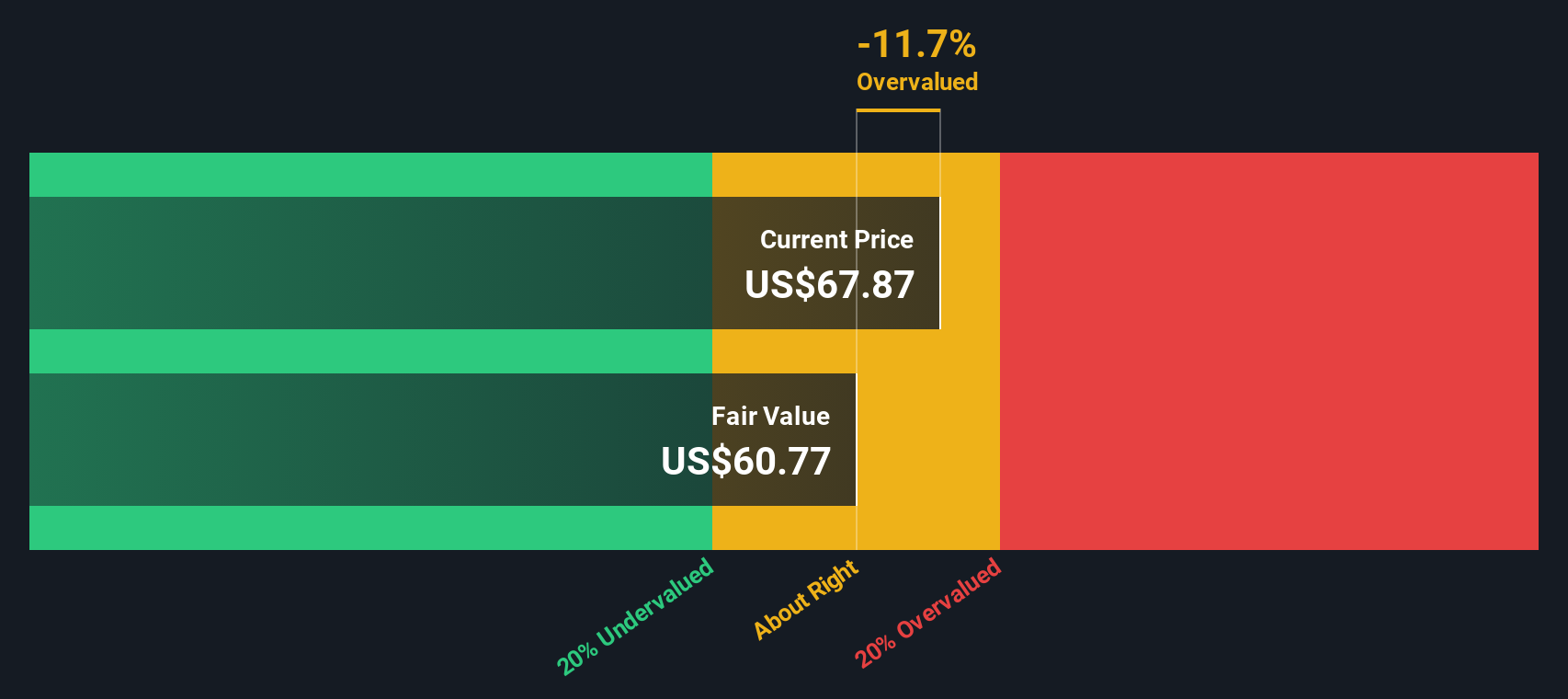

Another View: Our DCF Model Challenges the Market Price

While the most popular narrative views Alliant Energy as fairly valued at current levels, the SWS DCF model paints a different picture. According to our discounted cash flow analysis, Alliant is trading above its estimated fair value of $60.77. This suggests the market may be pricing in more optimism than fundamentals support. Is the crowd too bullish, or is there long-term upside that the model is missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Alliant Energy Narrative

If you see things differently or want to run your own numbers, you can easily craft your own take in just a few minutes. Do it your way

A great starting point for your Alliant Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Smart Investing Opportunities?

Don’t wait on the sidelines while others seize tomorrow’s growth. Simply Wall Street Screener puts the best stock ideas at your fingertips and is primed for action now.

- Uncover big yield potential by targeting these 17 dividend stocks with yields > 3% with generous payouts and strong financials. This can help you grow wealth through stable and rising returns.

- Capitalize on booming technology trends by starting with these 27 AI penny stocks, where emerging innovators are using artificial intelligence to disrupt entire industries for early-mover advantage.

- Boost your portfolio’s growth prospects by reviewing these 28 quantum computing stocks, which are set to benefit as quantum computing pushes the boundaries of what’s possible in tomorrow’s markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LNT

Alliant Energy

Operates as a utility holding company that provides regulated electric and natural gas services in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives