- United States

- /

- Electric Utilities

- /

- NasdaqGS:EVRG

Is Evergy’s (EVRG) Data Center Push and Dividend Hike Shaping Its Long-Term Investment Story?

Reviewed by Sasha Jovanovic

- In the past week, Evergy, Inc. announced a 4% dividend increase and reported third quarter results showing steady revenue and earnings, while also highlighting progress on major data center agreements totaling about US$200 million in commitments.

- This combination of higher dividends and expanding partnerships with large-scale data center customers points to a growing focus on long-term demand growth and shareholder returns.

- We'll explore how Evergy's recent data center customer agreements and dividend boost could influence the company's outlook and investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Evergy Investment Narrative Recap

To invest in Evergy, you need to believe that growing electricity demand from new data centers and large commercial customers will support steady long-term profits, making the company’s planned capital spending worthwhile. The latest news, with a modest dividend increase, reaffirmed earnings guidance, and nearly US$200 million in data center agreements, strengthens near-term momentum but does not significantly change the short-term catalyst: the pace and success of new large customer ramp-ups. The predominant risk remains Evergy’s sizable external funding needs, which could expose investors to higher capital costs if market conditions worsen.

Among recent developments, Evergy’s US$200 million in multiple new service agreements with leading data center customers stands out as particularly relevant. These contracts are directly tied to expected load growth, reinforcing the company’s investment case while linking its outlook to the timely execution of these partnerships and the reliability of customer expansion.

On the other hand, investors should not overlook the risk that, if interest rates climb or equity markets become less favorable, Evergy’s hefty external capital requirements could result in...

Read the full narrative on Evergy (it's free!)

Evergy's narrative projects $6.8 billion revenue and $1.2 billion earnings by 2028. This requires 5.0% yearly revenue growth and a $359.9 million earnings increase from $840.1 million.

Uncover how Evergy's forecasts yield a $82.05 fair value, a 6% upside to its current price.

Exploring Other Perspectives

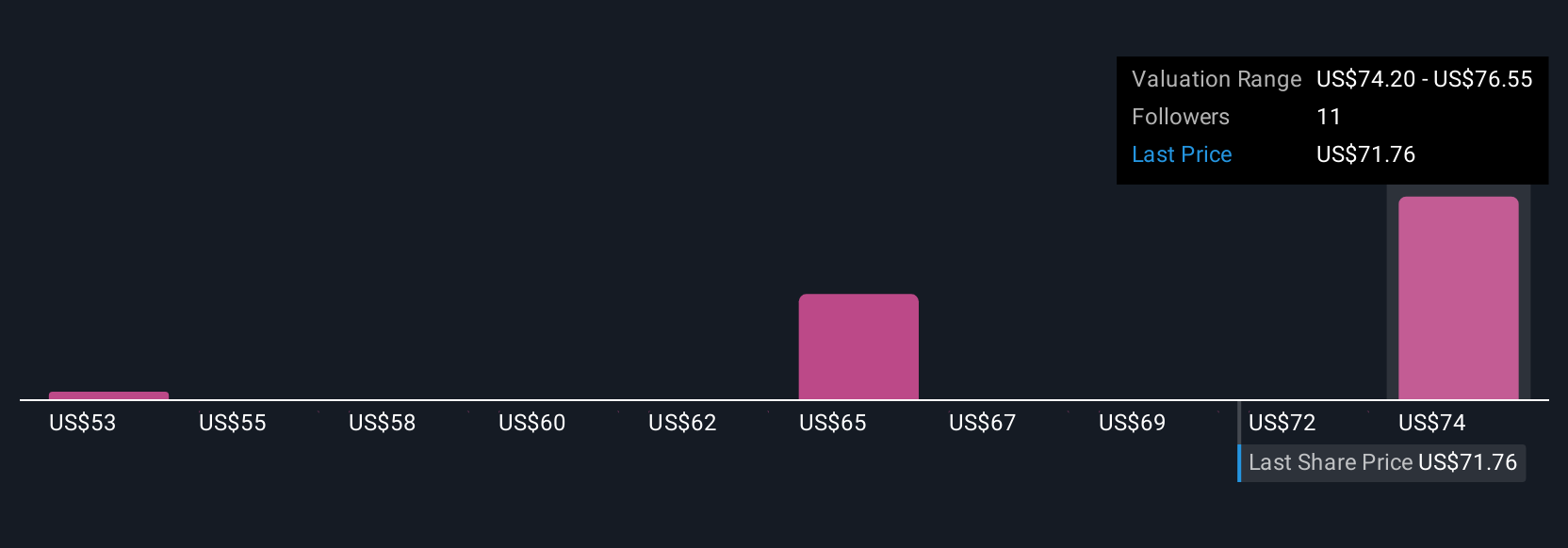

Four distinct community fair value estimates for Evergy range from US$53 to US$82.04 per share, showing how Simply Wall St Community members differ in their outlooks. Against this diversity, the company’s ability to deliver on major data center deals could prove crucial for its future financial performance.

Explore 4 other fair value estimates on Evergy - why the stock might be worth as much as 6% more than the current price!

Build Your Own Evergy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Evergy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Evergy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Evergy's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evergy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EVRG

Evergy

Engages in the generation, transmission, distribution, and sale of electricity in the United States.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives