- United States

- /

- Electric Utilities

- /

- NasdaqGS:EVRG

Is Evergy Still Attractive After Its 19% 2025 Rally and Dividend Valuation Check?

Reviewed by Bailey Pemberton

- Wondering if Evergy is still a smart buy after its strong run, or if most of the upside is already priced in? Let us unpack what the current share price is really telling us about its value.

- Despite slipping 0.7% over the last week and 3.1% over the past month, Evergy is still up 18.9% year to date and 24.0% over the last year, with longer term gains of 31.6% over three years and 67.5% over five.

- Recent moves in Evergy's share price have been shaped by ongoing regulatory developments, grid modernization initiatives, and investor attention on stable dividend payers as rates fluctuate. Together, these factors have pushed utilities like Evergy back into focus as a potential combination of income and defensive growth.

- On our valuation framework, Evergy scores just 1 out of 6 for undervaluation. This suggests the market may already be pricing in a lot of good news, at least on the surface. Next, we will dig into how different valuation methods judge the stock today, and then finish with a more nuanced way to think about Evergy’s true worth beyond the usual multiples and models.

Evergy scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Evergy Dividend Discount Model (DDM) Analysis

The Dividend Discount Model estimates what a stock is worth by projecting all future dividend payments and discounting them back to today, asking whether the current price fairly reflects those cash returns to shareholders.

For Evergy, the model starts with an annual dividend per share of about $2.93, supported by a return on equity of roughly 8.4% and a payout ratio near 72%. That payout level suggests Evergy is returning most of its earnings to investors, while still retaining a small portion to reinvest. This underpins an estimated long term dividend growth rate of about 2.4% a year, calculated from retained earnings times ROE.

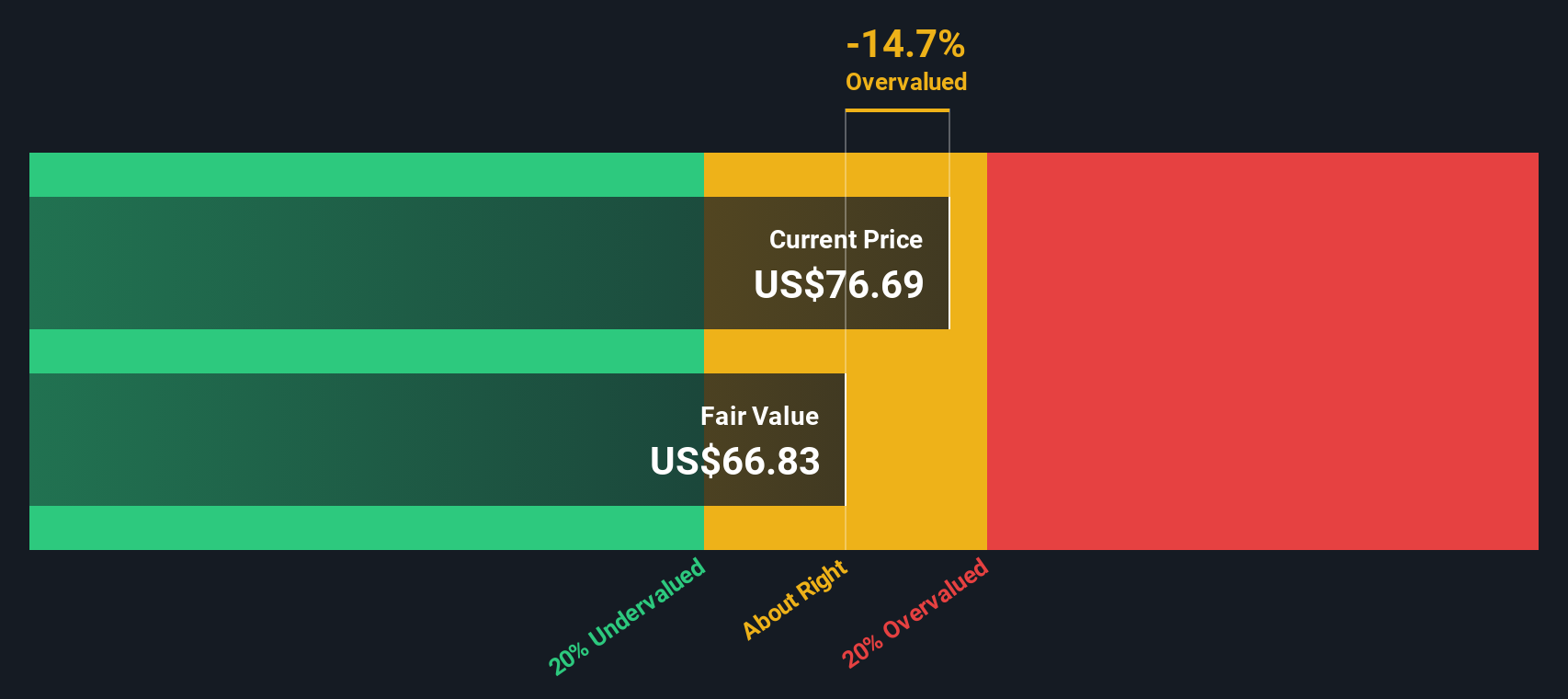

Using these inputs, the DDM produces an intrinsic value of roughly $63.89 per share. Compared with the current market price, this implies the stock is about 14.7% overvalued, signalling that investors are paying up for Evergy’s dividend stability and modest growth outlook.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Evergy may be overvalued by 14.7%. Discover 916 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Evergy Price vs Earnings

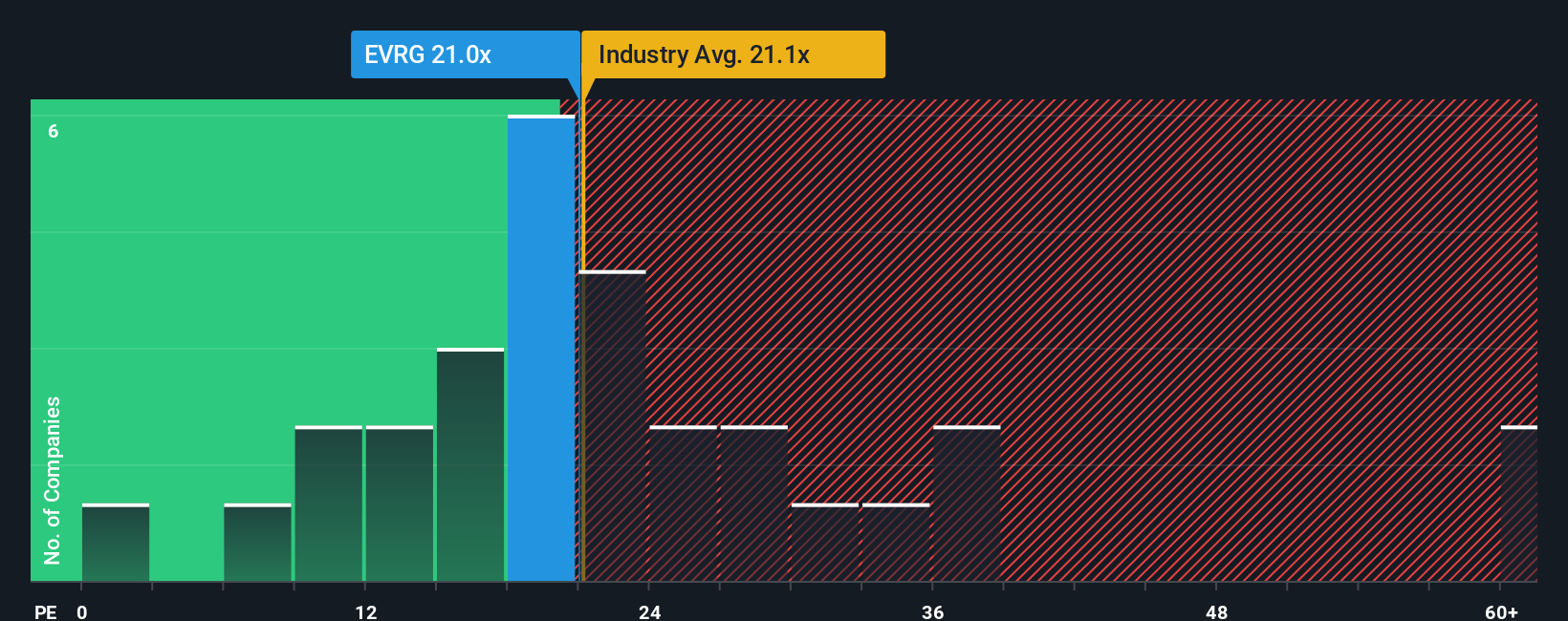

For profitable companies like Evergy, the price to earnings ratio is a practical way to gauge value because it directly compares what investors are paying with the profits the business is generating today. In general, faster growth and lower risk justify a higher PE, while slower growth or higher regulatory and financial risk usually warrant a lower multiple.

Evergy currently trades at about 19.9x earnings, which is slightly above the Electric Utilities industry average of roughly 19.7x and the broader peer average of around 17.8x. To move beyond simple comparisons, Simply Wall St uses a proprietary Fair Ratio, which estimates what Evergy’s PE should be given its earnings growth outlook, risk profile, profit margins, industry positioning and market cap. This makes it more informative than a basic peer or sector check, which can miss company specific strengths or weaknesses.

Evergy’s Fair Ratio is 22.4x, notably higher than its current 19.9x PE. That gap suggests the market is still pricing Evergy at a discount to what its fundamentals and risk profile would typically warrant.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1455 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Evergy Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. These are simple stories that investors create on Simply Wall St’s Community page to explain what they think Evergy is worth, how its revenue, earnings and margins might evolve, and how that forecast links through to a fair value they can compare with today’s share price to decide whether to buy or sell. All of this is then dynamically updated as new news or earnings arrive. For example, one investor might build a bullish Evergy Narrative around accelerating data center demand, supportive regulators and a fair value in the mid to high $80s. Another might take a more cautious view focused on funding and execution risks and land on a fair value closer to the low $70s. This shows how different perspectives on the same company can be turned into clear, data-driven decisions.

Do you think there's more to the story for Evergy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Evergy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EVRG

Evergy

Engages in the generation, transmission, distribution, and sale of electricity in the United States.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion