- United States

- /

- Electric Utilities

- /

- NasdaqGS:CEG

Will Constellation Energy’s (CEG) Dividend Hike Reflect a Deeper Clean Energy Commitment?

Reviewed by Sasha Jovanovic

- The Board of Directors of Constellation Energy declared a quarterly dividend of US$0.3878 per share, payable on December 5, 2025, to shareholders of record as of November 17, 2025.

- This comes as Constellation expands its role in clean energy solutions, with new initiatives such as emission-free energy certificates and notable collaborations to power technology infrastructure.

- We'll examine how the continued emphasis on clean energy innovation and new product offerings could shape Constellation's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Constellation Energy Investment Narrative Recap

To own shares in Constellation Energy, an investor likely needs to believe in the mounting demand for carbon-free, reliable power, especially from hyperscalers and large corporates seeking long-term energy contracts. While the newly declared quarterly dividend signals financial consistency and shareholder alignment, it isn't expected to directly influence the short-term catalyst, which remains the successful execution of large power purchase agreements and capacity expansions; it also doesn't significantly change ongoing risks in regulatory compliance and competitive threats.

Among this month’s news, the launch of emission-free energy certificates (EFECs) via Xpansiv’s platform stands out as particularly relevant. This move aligns with near-term catalysts tied to growing corporate demand for traceable clean energy solutions, reinforcing Constellation’s positioning as a provider of premium decarbonized power for clients like Meta and Google seeking 24/7 carbon-free electricity contracts.

But while clean energy momentum appears strong, investors should also consider the less visible risks around regulatory compliance and the mounting costs of aging nuclear fleets…

Read the full narrative on Constellation Energy (it's free!)

Constellation Energy's outlook anticipates $26.7 billion in revenue and $3.6 billion in earnings by 2028. This scenario assumes a 2.5% annual revenue growth and a $0.6 billion increase in earnings from the current $3.0 billion level.

Uncover how Constellation Energy's forecasts yield a $386.00 fair value, in line with its current price.

Exploring Other Perspectives

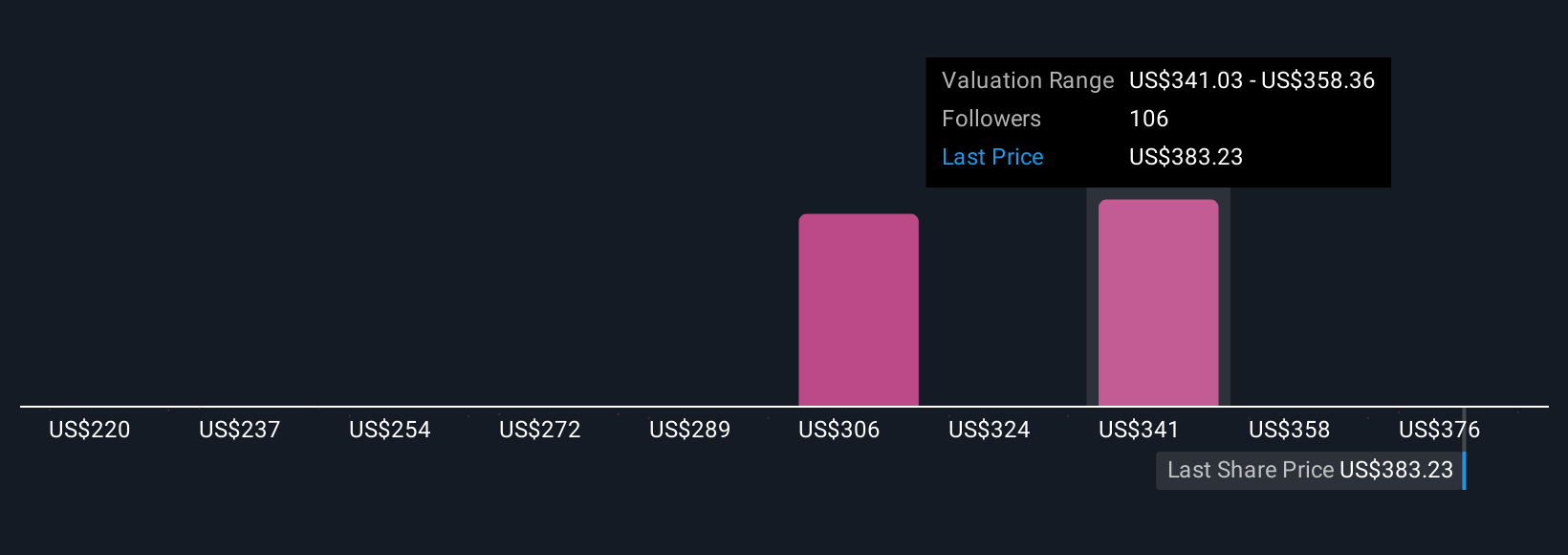

Fourteen Simply Wall St Community fair value estimates for Constellation Energy range from US$219.78 to US$393. Participants place sharply different weights on future growth, regulatory risks, and the outlook for contract wins. Explore how these varied viewpoints shape expectations for the company’s future.

Explore 14 other fair value estimates on Constellation Energy - why the stock might be worth 43% less than the current price!

Build Your Own Constellation Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Constellation Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Constellation Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Constellation Energy's overall financial health at a glance.

No Opportunity In Constellation Energy?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CEG

Constellation Energy

Produces and sells energy products and services in the United States.

Proven track record with limited growth.

Similar Companies

Market Insights

Community Narratives