- United States

- /

- Electric Utilities

- /

- NasdaqGS:CEG

Constellation Energy Shares Dip 5.7% After 49% Surge Is Opportunity Still There in 2025

Reviewed by Bailey Pemberton

- Curious if Constellation Energy is still a good buy, or if recent momentum has pushed the stock above its fair value? You are not alone, especially with how quickly things can change for utility stocks.

- After rallying an impressive 49.6% year-to-date and soaring 56.2% over the last 12 months, the stock dipped 5.7% this past week, suggesting the market is recalibrating its outlook.

- Much of this volatility has coincided with sector-wide attention on clean energy transformation and policy shifts, which keep Constellation Energy in the spotlight. Investor sentiment has also been shaped by news of major strategic partnerships in renewables and increased regulatory focus on energy infrastructure.

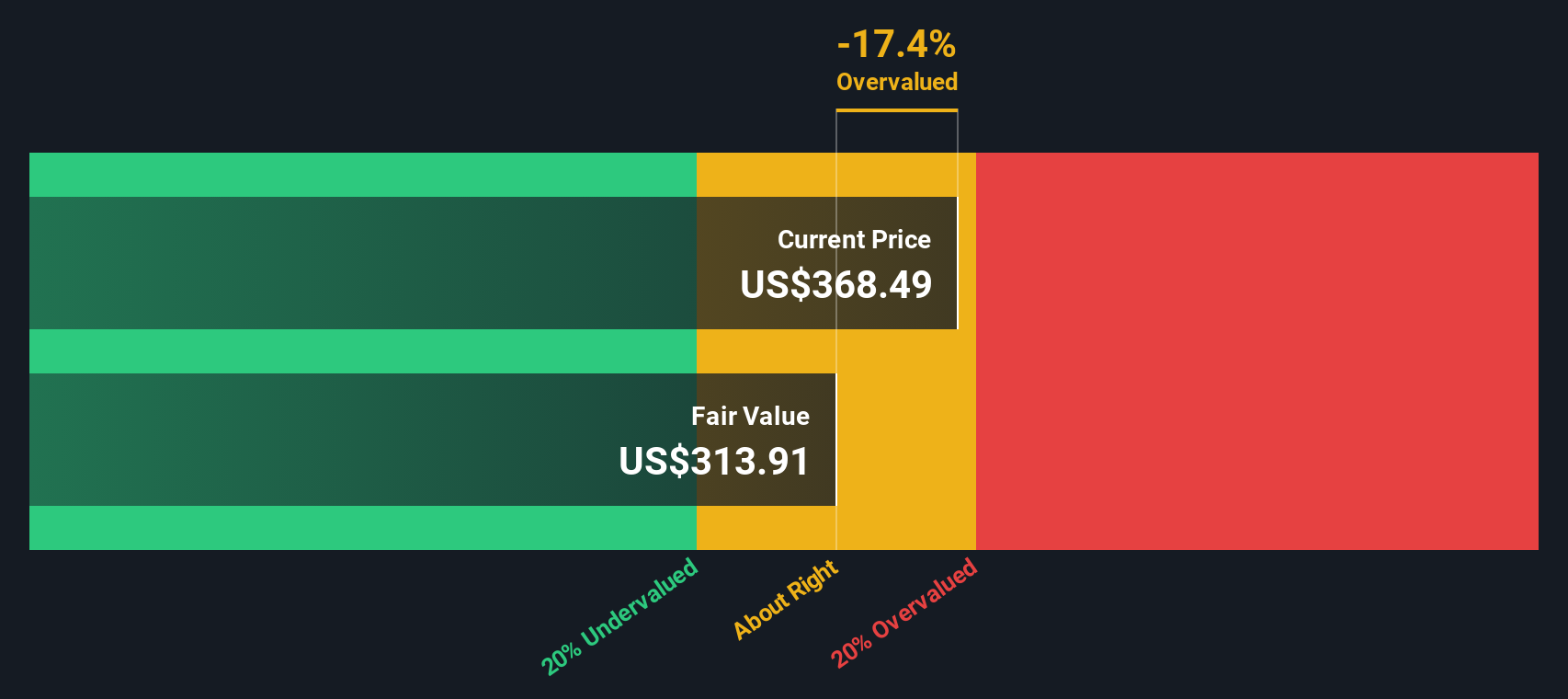

- With a valuation score of 3 out of 6 based on our standard checks, there is plenty to unpack as we look at different ways to think about value here. As we go deeper, keep an eye out as we will share a more holistic approach to valuation that looks beyond the obvious numbers.

Approach 1: Constellation Energy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's dollars. This approach aims to answer what Constellation Energy is worth right now, based on what it can reasonably be expected to earn over time.

Looking at the numbers, Constellation Energy's last twelve months Free Cash Flow (FCF) was negative, at -$2.6 billion. However, analysts expect a major turnaround, with projected FCF reaching as high as $5.4 billion by the end of 2029. Projections for the next decade, partly from analysts and partly extrapolated by Simply Wall St, suggest continued strong growth in FCF until at least 2035.

After applying the DCF approach and discounting all these future cash flows back to the present, the model computes an intrinsic value of $470.06 per share. With the current stock price trading at a 22.8% discount to this value, the model indicates that Constellation Energy may be undervalued at recent prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Constellation Energy is undervalued by 22.8%. Track this in your watchlist or portfolio, or discover 839 more undervalued stocks based on cash flows.

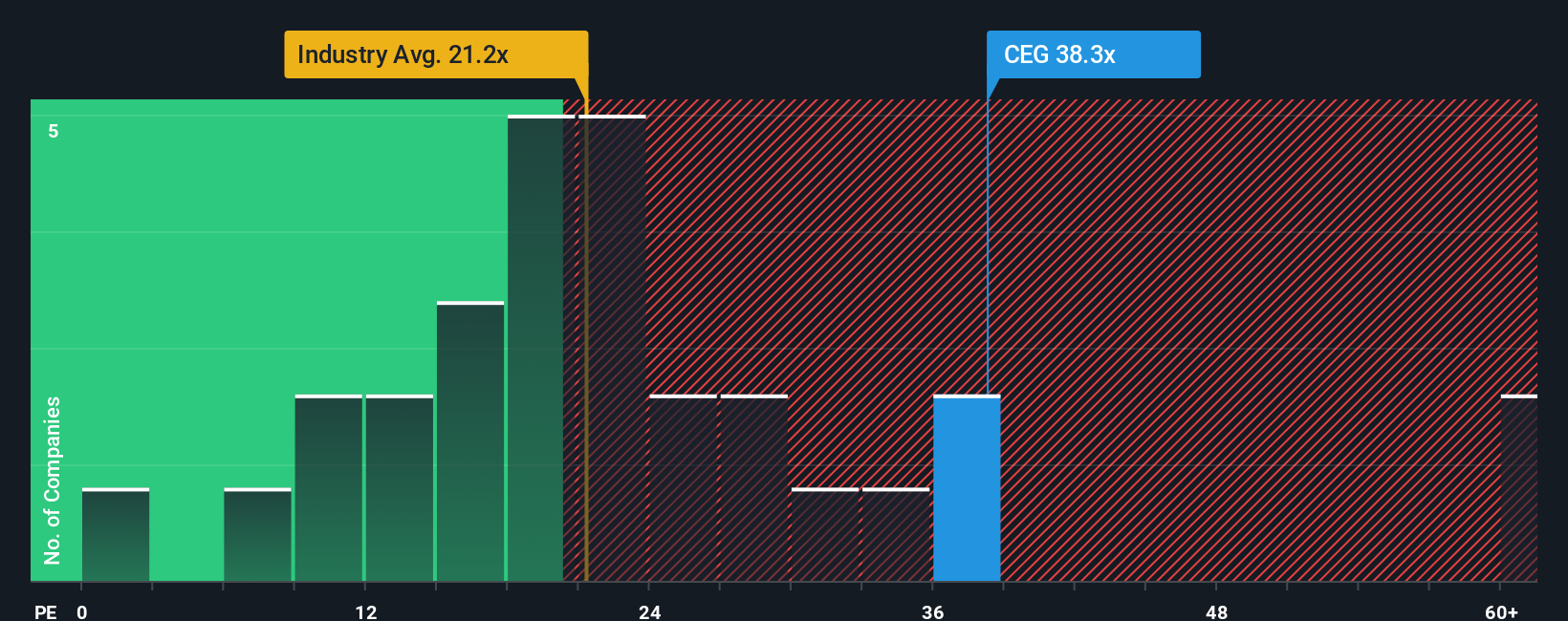

Approach 2: Constellation Energy Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation tool for established and profitable companies like Constellation Energy. It helps investors assess how much they are paying for every dollar of the company’s earnings.

Interpreting a "normal" or "fair" PE ratio involves more than just looking at a number. Companies with strong future growth prospects and low risk typically command higher PE ratios. Businesses facing slow growth or higher risks generally have lower ones. In short, a higher PE can be justified if earnings are expected to grow quickly or are seen as particularly stable.

At present, Constellation Energy trades at a PE ratio of 37.67x. This is notably higher than the Electric Utilities industry average of 21.57x and also above the peer average of 21.75x. However, Simply Wall St’s proprietary Fair Ratio stands at 38.71x. The Fair Ratio is specifically designed to reflect what would be reasonable for Constellation and takes into account its growth outlook, industry position, profit margins, market cap and the unique risks it faces. This makes it a more insightful benchmark than simply relying on peers or industry averages because it is tailored to the company’s own circumstances rather than broad market trends.

When we compare Constellation’s current PE ratio of 37.67x to the Fair Ratio of 38.71x, the valuation is within a very close range. This suggests the stock is priced about right relative to its intrinsic characteristics and expected performance.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

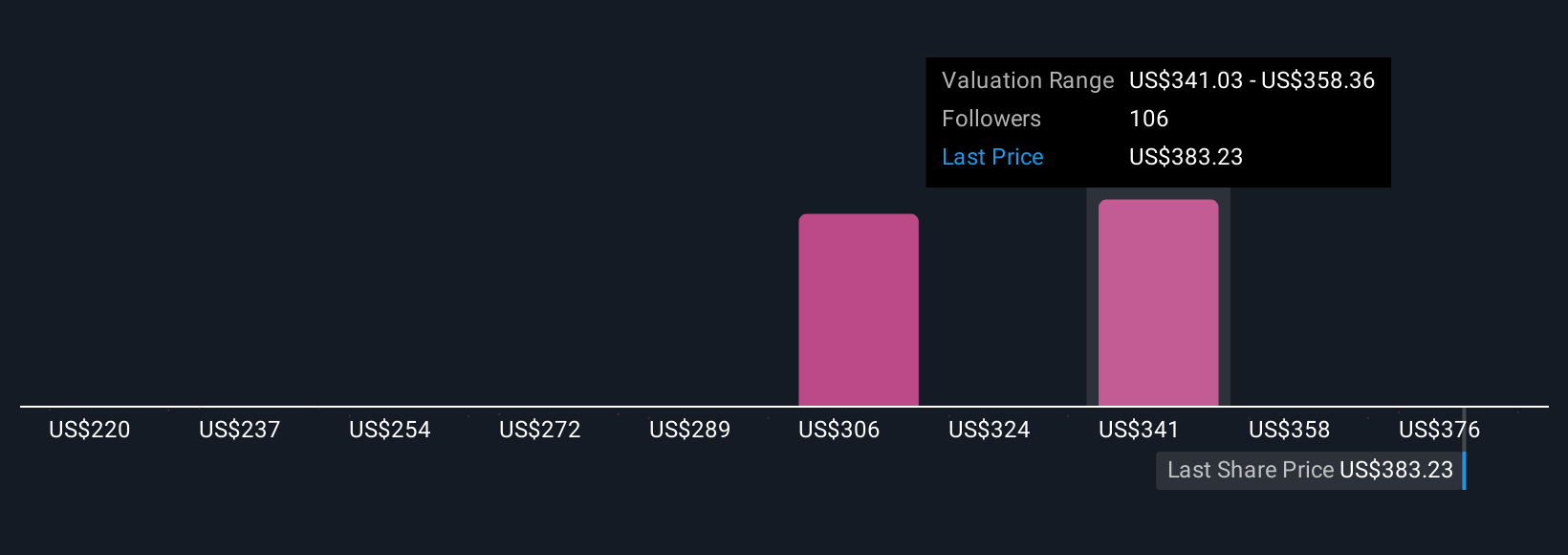

Upgrade Your Decision Making: Choose your Constellation Energy Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. This powerful, story-driven approach to investment connects the company’s future to its value in a more holistic way.

A Narrative is your way of telling the story behind the numbers. You describe your perspective on a company’s prospects, connect that to key forecasts (like future revenue, margins, and earnings), and see the fair value it implies, all in one place. Narratives bring your investment ideas to life by linking the company’s business story with a dynamic financial forecast. This helps you make more informed buy or sell decisions by directly comparing your view of Fair Value to the latest share price.

Available to millions of investors on Simply Wall St’s Community page, Narratives are simple to create and update automatically as news breaks or earnings are announced. This unlocks a flexible, “living” view of a company’s valuation that moves as expectations change.

For example, Constellation Energy’s Narratives range from bullish investors projecting aggressive growth driven by surging data center demand and strategic nuclear investments, with fair values above $390, to more cautious views emphasizing regulatory and customer risks, with targets as low as $184. No matter your perspective, Narratives let you transparently compare scenarios on equal footing and shape your decisions with confidence.

Do you think there's more to the story for Constellation Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CEG

Constellation Energy

Produces and sells energy products and services in the United States.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives