- United States

- /

- Electric Utilities

- /

- NasdaqGS:AEP

AEP’s Grid Expansion and Data Center Partnerships Could Be a Game Changer for American Electric Power (AEP)

Reviewed by Sasha Jovanovic

- Earlier this month, American Electric Power Company announced long-term agreements with Quanta Services to deliver on its US$72 billion capital plan, enhance domestic supply chain resilience, and expand grid infrastructure for the fast-growing data center market, while also partnering on a 1-gigawatt high-performance computing site development in Texas with Cipher Mining.

- This newly unveiled collaboration not only secures key supply chain components but positions AEP as an essential energy partner for emerging high-demand industries across its operating regions.

- We'll look at how AEP's expanded grid manufacturing and project partnerships could reshape its investment narrative and growth outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

American Electric Power Company Investment Narrative Recap

To be a shareholder in American Electric Power Company (AEP), you need to believe in the company's ability to drive continued growth through ambitious capital investments targeting grid modernization and data center demand, while managing challenges like cost control and regulatory uncertainty. The recent agreement with Quanta Services to expand grid infrastructure may mitigate short-term supply chain risks that could otherwise threaten project timelines, a positive catalyst for maintaining growth momentum, but it does not fundamentally alter the impact of regulatory shifts in Ohio, which remain the most important near-term risk for AEP.

Among recent announcements, the partnership with Quanta Services stands out, as it targets increased efficiency and resilience across AEP’s transmission operations. This collaboration aims to secure critical grid components and access to large-scale equipment manufacturing, which could help reduce exposure to supply chain-driven cost overruns, a key operational risk as AEP accelerates grid investments to meet rising commercial energy demand.

However, investors should also be aware that, in contrast, potential regulatory changes in Ohio could introduce...

Read the full narrative on American Electric Power Company (it's free!)

American Electric Power Company's narrative projects $24.6 billion revenue and $4.1 billion earnings by 2028. This requires 6.0% yearly revenue growth and a $0.5 billion earnings increase from $3.6 billion today.

Uncover how American Electric Power Company's forecasts yield a $127.32 fair value, a 5% upside to its current price.

Exploring Other Perspectives

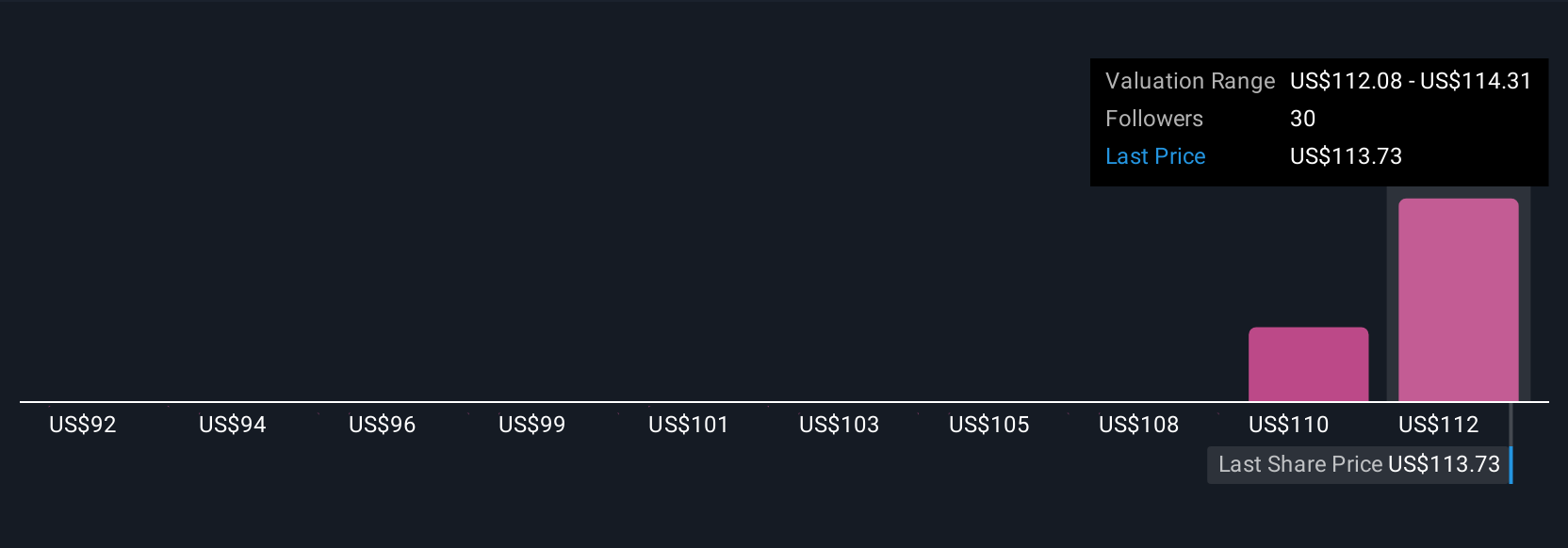

Three members of the Simply Wall St Community gave fair value estimates ranging from US$92 to US$127.32 per share. While many see upside potential tied to ambitious capital expansion and rising commercial demand, uncertainty around future regulation means investor views could shift quickly, consider reviewing other perspectives for a fuller picture.

Explore 3 other fair value estimates on American Electric Power Company - why the stock might be worth 24% less than the current price!

Build Your Own American Electric Power Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Electric Power Company research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free American Electric Power Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Electric Power Company's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AEP

American Electric Power Company

An electric public utility holding company, engages in the generation, transmission, and distribution of electricity for sale to retail and wholesale customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives