- United States

- /

- Electric Utilities

- /

- NasdaqGS:AEP

A Look at American Electric Power (AEP) Valuation Following $3.5 Billion Equity Offering

Reviewed by Simply Wall St

American Electric Power Company (AEP) has just announced a follow-on equity offering worth $3.5 billion, structured as an at-the-market transaction. This move has drawn attention as investors consider what it might mean for the company’s future plans and capital needs.

See our latest analysis for American Electric Power Company.

With American Electric Power Company's latest $3.5 billion equity raise making headlines, the market has already been showing strong momentum. This year’s share price return stands at an impressive 31%, and five-year total shareholder return is up nearly 73%. While the offering introduces fresh capital and a possible shift in risk perception, long-term investors have enjoyed substantial gains, and interest in the stock appears to be building for now.

If moves like AEP’s capital raise have you thinking bigger, now is the perfect chance to expand your search with our fast growing stocks with high insider ownership screener fast growing stocks with high insider ownership

But with the stock posting a robust rally this year and trading close to analyst price targets, the real question is whether shares still offer hidden value or if the market is already anticipating AEP’s future growth.

Most Popular Narrative: 6% Undervalued

With American Electric Power Company’s most widely followed narrative assigning a fair value of $128.68, the stock last closed at $120.51. This difference has caught the eye of many investors looking for signs of undervaluation, especially after a period of strong momentum and capital-raising news.

Recent price target increases are tied to improvements in the company’s balance sheet. This demonstrates strong near-term credit metrics and a healthy financial outlook.

What backs that higher fair value? The narrative hinges on ambitious growth targets, major investment in new infrastructure, and projections that could influence future earnings. Don’t miss the specifics behind these bold calls. Discover the underlying forecasts and assumptions that set this valuation apart.

Result: Fair Value of $128.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory uncertainty in Ohio and ongoing supply chain challenges could prove disruptive. These factors may potentially impact AEP’s growth outlook and projected margin improvements.

Find out about the key risks to this American Electric Power Company narrative.

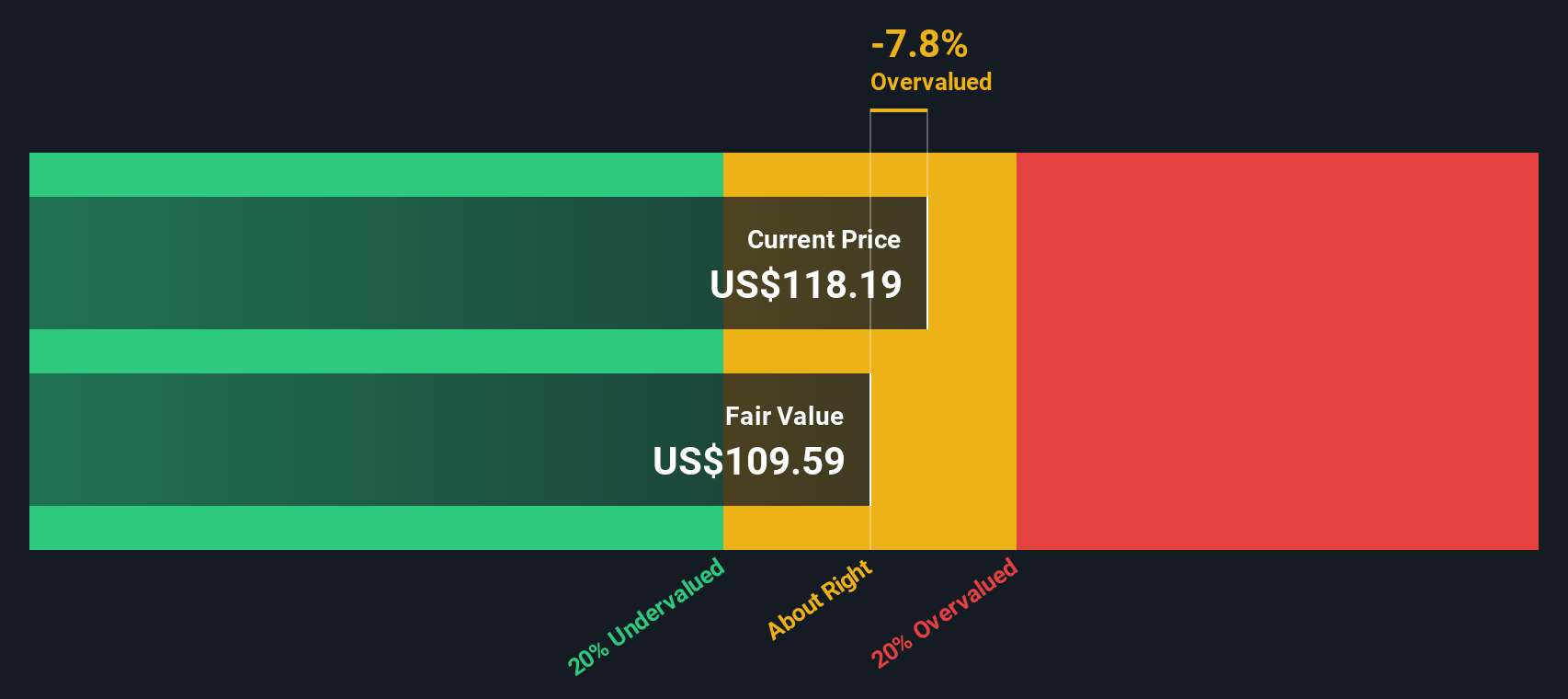

Another View: SWS DCF Model Offers a Different Take

While many investors are focused on the fair value derived from market multiples, our SWS DCF model offers a more conservative perspective. Based on the DCF analysis, AEP appears to be trading above its intrinsic value today. This suggests the market might be pricing in more growth or stability than fundamentals currently justify.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out American Electric Power Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 923 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own American Electric Power Company Narrative

If you have a different perspective or want to dig into the numbers yourself, crafting your own narrative takes just a few minutes. Do it your way

A great starting point for your American Electric Power Company research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Now’s your chance to jump on new opportunities before the crowd. Don’t let strong trends pass you by; use these curated routes to spot potential winners for your portfolio.

- Uncover impressive value plays with real upside by browsing these 923 undervalued stocks based on cash flows and pick stocks that could transform your portfolio returns.

- Tap into the future of healthcare by checking out these 30 healthcare AI stocks focused on innovative companies harnessing artificial intelligence to reshape the industry.

- Capitalize on bold growth trends in digital assets. Explore these 81 cryptocurrency and blockchain stocks for emerging leaders shaking up the cryptocurrency and blockchain space.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AEP

American Electric Power Company

An electric public utility holding company, engages in the generation, transmission, and distribution of electricity for sale to retail and wholesale customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026