- United States

- /

- Transportation

- /

- OTCPK:DIDI.Y

How DiDi’s Middle East Autonomous Driving Partnership May Shape the Investment Narrative for DIDI.Y

Reviewed by Sasha Jovanovic

- The Abu Dhabi Investment Office recently announced a collaboration with DiDi Autonomous Driving, a subsidiary of DiDi Global, to accelerate autonomous transport technologies in the Middle East, with DiDi joining Abu Dhabi’s Smart and Autonomous Vehicle Industries (SAVI) cluster.

- This marks DiDi Autonomous Driving’s first step into the Middle East, with a focus on technology innovation, AI talent development, and ecosystem building for smart mobility in the region.

- We'll explore how DiDi’s entry into the Middle East through this high-profile partnership shapes its investment narrative and global ambitions.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is DiDi Global's Investment Narrative?

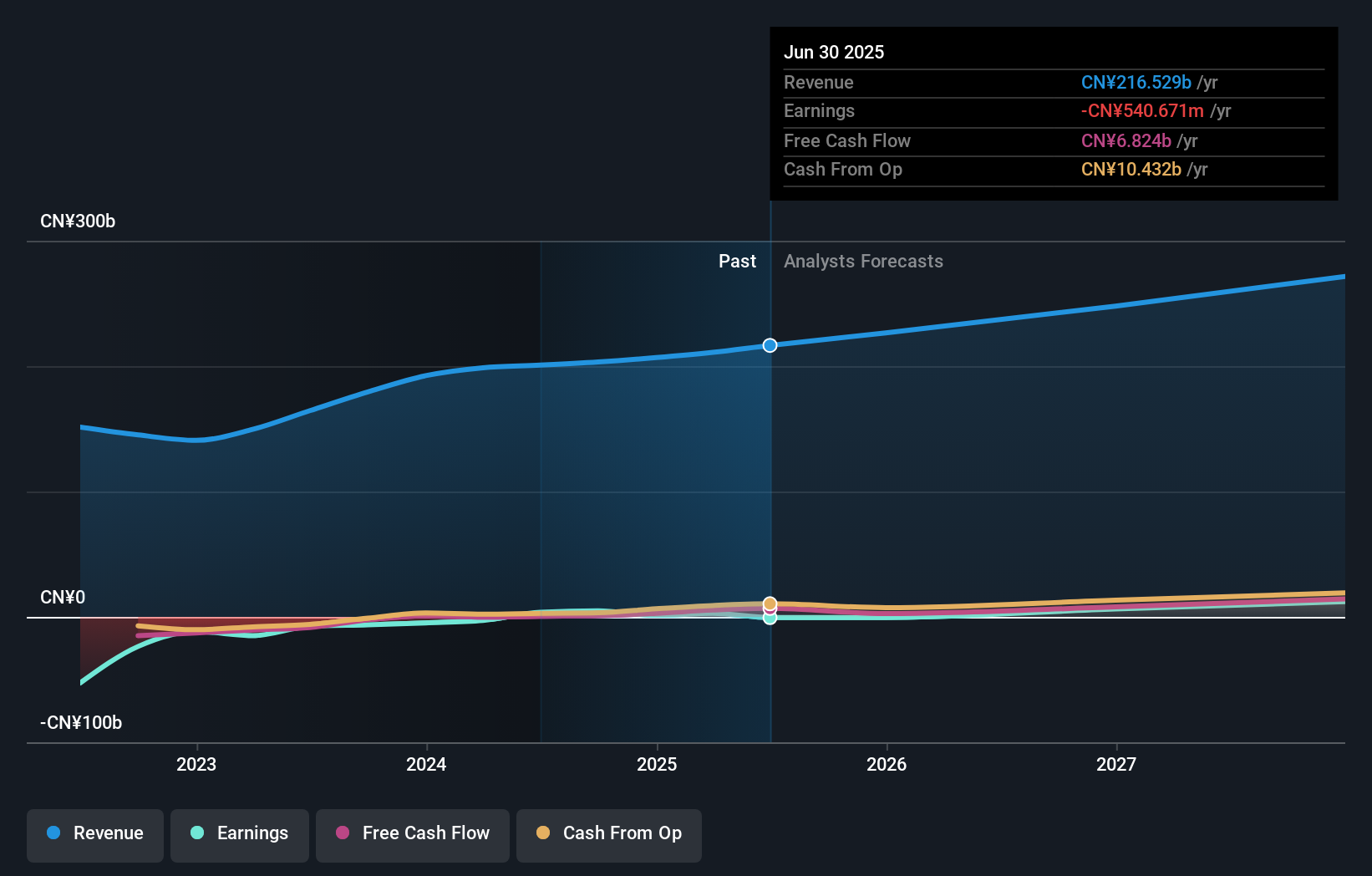

To be a shareholder in DiDi Global, you have to believe in the company’s ability to turn rapid international expansion and technology investments into sustained profitability, despite the uneven earnings profile seen in recent quarters. The new partnership with the Abu Dhabi Investment Office, launching DiDi’s autonomous driving tech in the Middle East, may strengthen the long-term growth story by opening up a high-potential market and deepening the company’s mobility ecosystem. Short-term catalysts like share buybacks, ongoing cost controls, and gradual margin improvement could potentially get a boost if this international move pays off faster than expected, although recent share price declines suggest the market has yet to price in any positive surprises. At the same time, DiDi still faces key risks: profitability remains elusive, board independence is a concern, and there is uncertainty around the actual timeline for monetizing autonomous driving advancements. While DiDi screens as undervalued on several metrics, the main test is execution and whether these overseas bets finally tip the company into consistent profits or prolong losses.

On the other hand, risks around board independence remain as a potential concern for investors.

Exploring Other Perspectives

Explore 4 other fair value estimates on DiDi Global - why the stock might be worth 45% less than the current price!

Build Your Own DiDi Global Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DiDi Global research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free DiDi Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DiDi Global's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:DIDI.Y

DiDi Global

Operates a mobility technology platform that provides various mobility and other services in the People's Republic of China, Brazil, Mexico, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives