- United States

- /

- Transportation

- /

- OTCPK:DIDI.Y

Does DiDi Global's (DIDI.Y) Third Quarter Rebound Mark a Turning Point in Profitability Strategy?

Reviewed by Sasha Jovanovic

- DiDi Global Inc. reported third quarter 2025 earnings on November 26, 2025, with sales rising to CNY 58.59 billion and net income reaching CNY 1.46 billion, both up from the same period last year.

- While third quarter net income and sales improved, the company’s year-to-date net income remains lower than the comparable period in the prior year.

- We’ll examine how the rebound in third quarter net income shapes DiDi Global’s broader investment narrative amid shifting annual results.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

What Is DiDi Global's Investment Narrative?

To be a shareholder in DiDi Global, you have to believe in the company’s ability to drive profitable growth in a fiercely competitive mobility sector, despite ongoing volatility in its bottom line. The latest earnings reveal a rebound in third quarter net income and record sales, yet net income for the year remains behind last year’s pace, suggesting that one strong quarter doesn’t erase the challenging picture of uneven profitability. With revenue growth continuing but profit recovery emerging only recently, short-term catalysts hinge on DiDi’s ability to turn operational improvements into lasting gains, further supported by past share buybacks and expanding partnerships. That said, this mixed profit trajectory may shift some attention from previous risks around regulatory challenges and margin pressure toward DiDi’s capacity for meaningful earnings acceleration. The recent results signal improved momentum but highlight the company’s need for sustained consistency across future quarters.

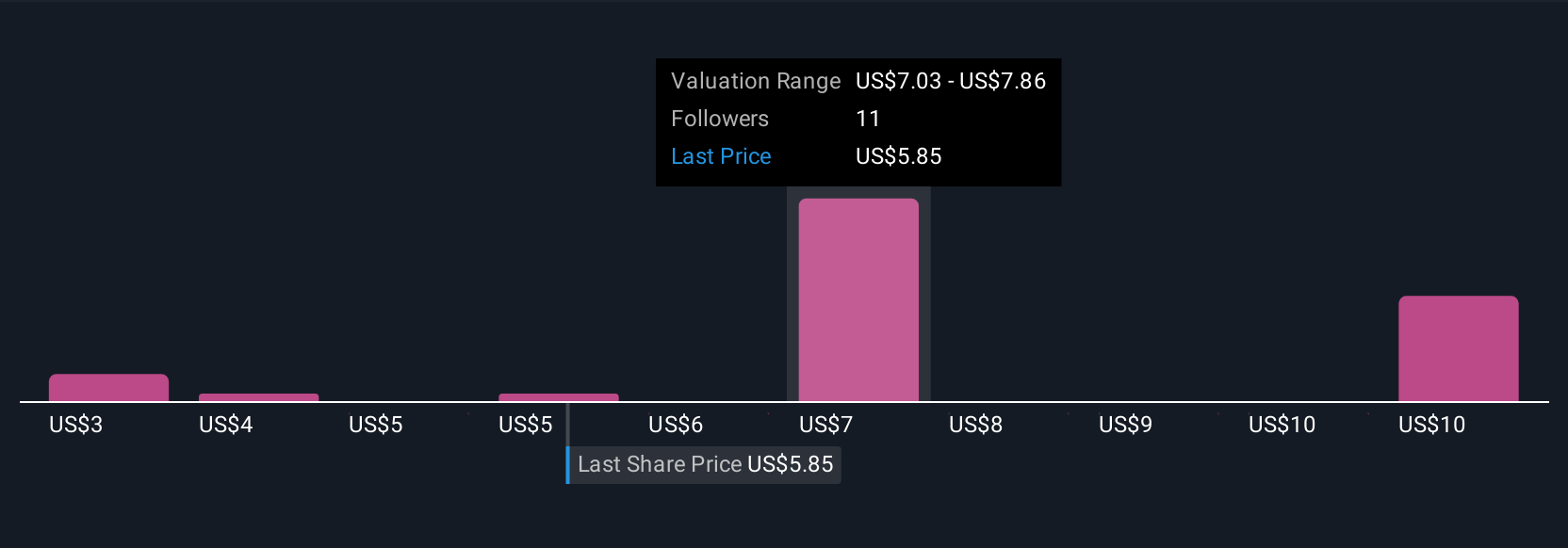

On the other hand, regulatory shifts remain a significant variable that investors should not ignore. DiDi Global's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 4 other fair value estimates on DiDi Global - why the stock might be worth 48% less than the current price!

Build Your Own DiDi Global Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DiDi Global research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free DiDi Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DiDi Global's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:DIDI.Y

DiDi Global

Operates a mobility technology platform that provides various mobility and other services in the People's Republic of China, Brazil, Mexico, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success