- United States

- /

- Transportation

- /

- OTCPK:DIDI.Y

DiDi Global (DIDI.Y) Is Down 6.7% After Swinging to Loss Despite Higher Q2 2025 Revenues

Reviewed by Simply Wall St

- DiDi Global Inc. recently reported its second quarter 2025 results, posting sales of CNY 56.40 billion, up from CNY 50.86 billion a year earlier, but reported a net loss of CNY 2.49 billion versus net income the previous year.

- This marks a reversal from profitability to loss, highlighting a significant operational shift for the company despite increasing revenues.

- We’ll explore how the company's return to net losses, despite higher sales, shapes DiDi Global’s investment narrative moving forward.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

What Is DiDi Global's Investment Narrative?

To believe in DiDi Global as a shareholder right now, you’d need to see its long-term prospects as intact despite fresh concerns from the latest quarterly report. The swing from net income of CNY 854 million last year to a net loss of CNY 2.49 billion this quarter, even as sales rose to CNY 56.40 billion, increases scrutiny on management’s cost control and execution after a period of recovering profitability. This reversal could sharpen focus on short-term catalysts like operational turnaround or cost efficiency, as recent share buybacks and the XPENG partnership remain potential positives. However, risks have intensified: continued losses, especially after a brief return to profit, now make financial consistency a bigger issue than before and may affect confidence about DiDi’s ability to deliver on growth and its plans for a Hong Kong listing. The story going forward may hinge on how quickly management can restore margins and reassure investors. But volatility after a rapid reversal to losses is something investors need to pay close attention to.

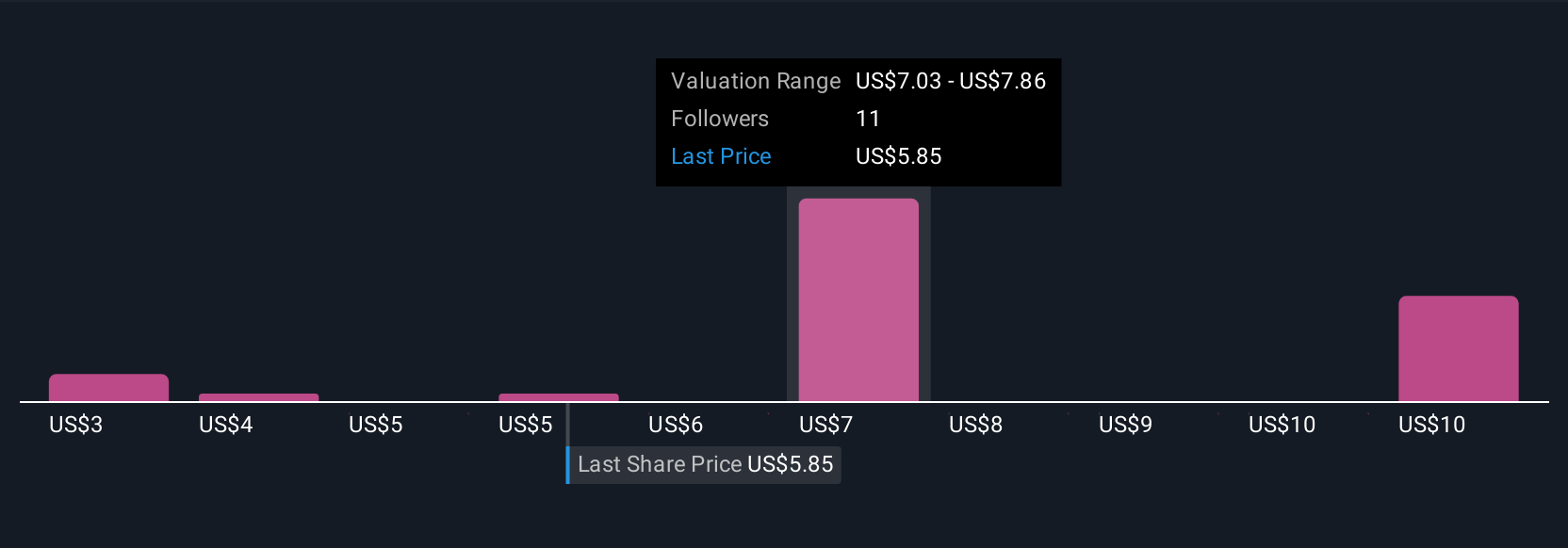

Despite retreating, DiDi Global's shares might still be trading 46% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 6 other fair value estimates on DiDi Global - why the stock might be worth less than half the current price!

Build Your Own DiDi Global Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DiDi Global research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DiDi Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DiDi Global's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 22 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:DIDI.Y

DiDi Global

Operates a mobility technology platform that provides various mobility and other services in the People's Republic of China, Brazil, Mexico, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives