- United States

- /

- Transportation

- /

- OTCPK:DIDI.Y

Assessing DiDi (OTCPK:DIDI.Y) Valuation Following Abu Dhabi Autonomous Driving Collaboration and Expansion into Smart Mobility

Reviewed by Simply Wall St

DiDi Global (OTCPK:DIDI.Y) is making headlines as its autonomous driving division partners with the Abu Dhabi Investment Office to develop autonomous driving technology in the Middle East. This collaboration signals a fresh push toward smart mobility innovation.

See our latest analysis for DiDi Global.

DiDi Global’s momentum is catching attention, with its recent autonomous driving partnership adding to a year marked by a solid 16.5% share price return so far and a robust 17.2% total shareholder return over the past twelve months. The company’s longer-term trajectory is also notable, as its three-year total shareholder return stands at an impressive 126%. This suggests that optimism around DiDi’s growth prospects and resilience is building.

If you’re interested in the future of smart mobility and innovation, now is the perfect time to discover See the full list for free.

With shares still trading at a significant discount to analyst price targets and DiDi showing strong growth metrics, the question remains: does the current market undervalue its potential, or is all that future promise already reflected in the price?

Price-to-Sales of 0.8x: Is it justified?

With DiDi Global trading at a price-to-sales ratio of just 0.8x and a last close price of $5.51, the stock looks attractively valued compared to its peers and sector averages.

The price-to-sales (P/S) ratio reflects how much investors are willing to pay for each dollar of sales. A lower ratio can suggest the market is undervaluing a company's revenue potential. For fast-evolving businesses like DiDi Global, this multiple offers a cleaner lens than profit metrics, especially during periods of unprofitability.

DiDi's P/S ratio not only compares favorably to the US Transportation industry average of 1.1x and the peer group average of 3.2x, but also stands below the company's own estimated fair P/S ratio of 1.4x. This level may indicate potential for a catch-up move if the market's perception of DiDi's growth prospects improves.

Explore the SWS fair ratio for DiDi Global

Result: Price-to-Sales of 0.8x (UNDERVALUED)

However, DiDi’s rapid revenue growth is paired with persistent net losses. As a result, any setbacks in execution or regulatory changes could challenge this optimistic outlook.

Find out about the key risks to this DiDi Global narrative.

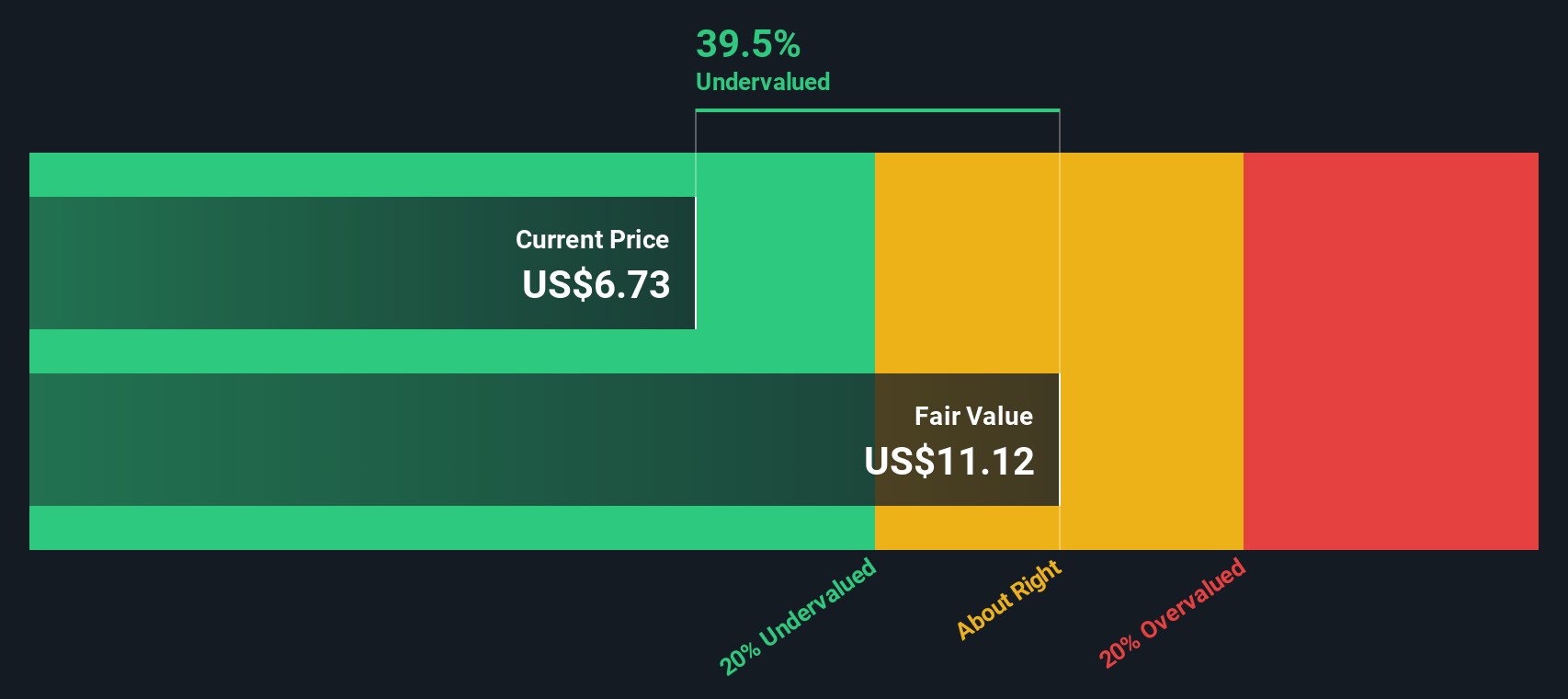

Another View: SWS DCF Model Signals Deeper Value

While the price-to-sales ratio suggests DiDi Global looks undervalued by market standards, our DCF model goes even further. It estimates DiDi’s fair value at $15.61 per share, which is significantly higher than its current price of $5.51. Is the market overlooking the bigger picture or just pricing in risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DiDi Global for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 868 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DiDi Global Narrative

If you have a different perspective or want to dig into the numbers yourself, you can shape your own DiDi Global story quickly and easily. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding DiDi Global.

Looking for More Investment Ideas?

Take your investing to the next level with strategies that zero in on real opportunities. The right tools can reveal stocks with game-changing potential. Don't let these ideas pass you by.

- Capture growth by tracking these 868 undervalued stocks based on cash flows poised for a breakout based on strong cash flows and overlooked fundamentals.

- Tap into tomorrow’s digital winners by following these 27 AI penny stocks that are harnessing artificial intelligence for rapid expansion and market disruption.

- Maximize your income strategy by checking out these 15 dividend stocks with yields > 3% offering substantial yields and the stability serious investors need.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:DIDI.Y

DiDi Global

Operates a mobility technology platform that provides various mobility and other services in the People's Republic of China, Brazil, Mexico, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives