- United States

- /

- Marine and Shipping

- /

- NYSE:ZIM

ZIM Integrated Shipping Services (NYSE:ZIM): Evaluating Valuation as Market Grows Cautious Ahead of Earnings Report

Reviewed by Simply Wall St

Investors are treading carefully with ZIM Integrated Shipping Services (NYSE:ZIM) this week, as the company’s upcoming earnings report has prompted a wave of lowered earnings expectations and an unusual increase in put option activity.

See our latest analysis for ZIM Integrated Shipping Services.

While ZIM Integrated Shipping Services has struggled in 2025, with a year-to-date share price return of -31.3%, the past month tells a different story as buyers have pushed the share price up more than 19%. Despite the challenging outlook ahead of earnings, the company still boasts a remarkable 63% total shareholder return over three years, signaling that longer-term investors have seen significant value even through recent volatility.

If this kind of momentum shift has you curious about other opportunities, consider broadening your search to discover fast growing stocks with high insider ownership.

With analyst estimates drifting lower and an uptick in bearish options trading, the stage is set for a pivotal earnings moment. Does this create a hidden value opportunity for buyers, or has the market already accounted for all future risks and rewards?

Most Popular Narrative: 20.8% Overvalued

ZIM Integrated Shipping Services’ most-followed narrative places fair value at $13.26, which stands far below the recent closing price of $16.02. This key disconnect frames the debate around whether the stock’s price reflects realities in shipping markets and company growth.

The company's significant exposure to volatile Transpacific trade leaves earnings highly sensitive to tariff changes and geopolitical shifts. The current overhang of U.S. and China tariffs, unpredictable regulatory moves, and alliance restructurings threaten both volume and rate stability, challenging assumptions that future earnings will be resilient or steadily expanding.

Think rapid swings in global trade are already priced in? The real shocker sits just beneath the headline margin assumptions. Find out which pivotal forecasted figures drive this valuation. There is a twist in the profitability projection you will want to see for yourself.

Result: Fair Value of $13.26 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ZIM’s modernized fleet and expansion into new trade routes could cushion earnings and create upside if global shipping dynamics improve unexpectedly.

Find out about the key risks to this ZIM Integrated Shipping Services narrative.

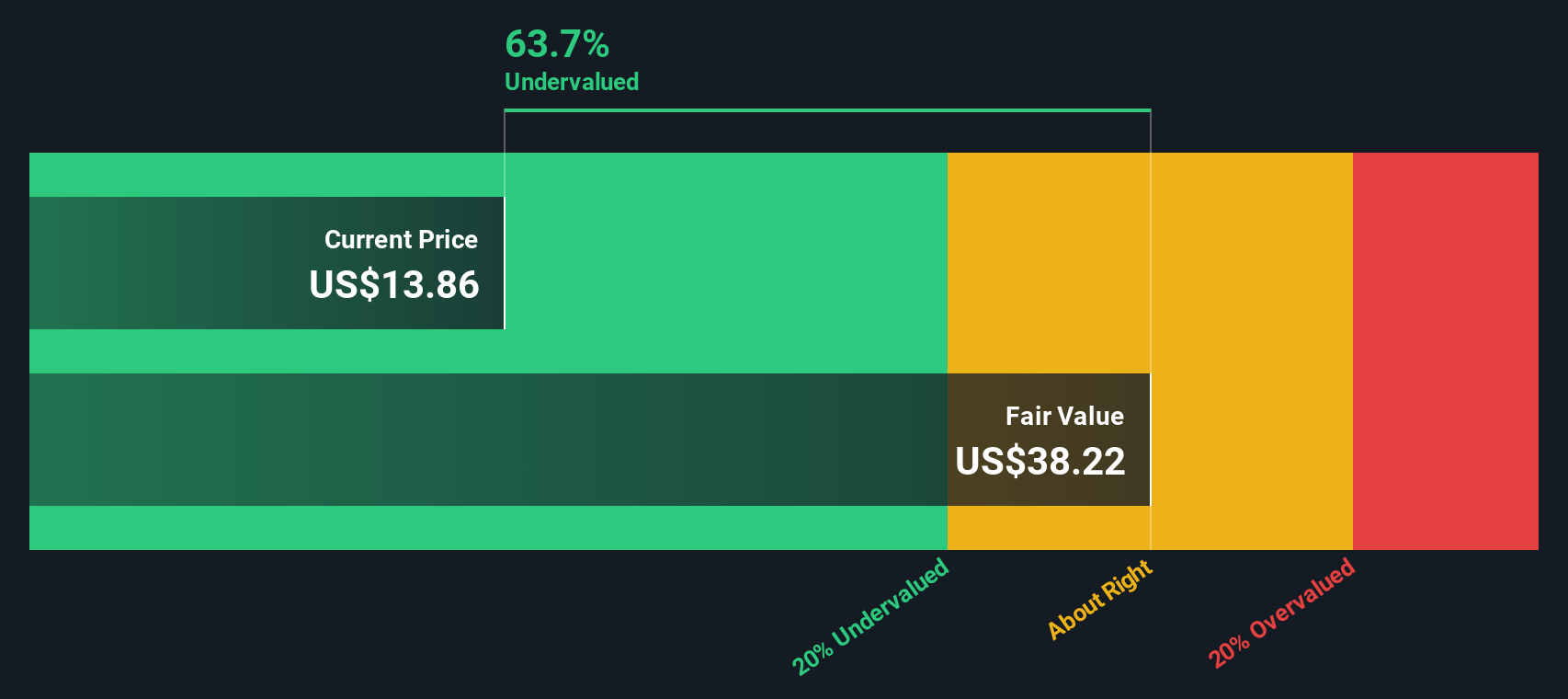

Another View: SWS DCF Model Points Higher

While the narrative approach suggests ZIM is overvalued, the SWS DCF model tells a strikingly different story. According to this method, ZIM's fair value lands at $38.50, significantly above the current share price. Such a wide gap raises the question: are investors missing a deeper opportunity, or is the market right to be cautious given the headwinds?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own ZIM Integrated Shipping Services Narrative

If you see the story differently or want to put your own assumptions to the test, you can easily create a personalized narrative in a matter of minutes with Do it your way.

A great starting point for your ZIM Integrated Shipping Services research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

The best opportunities often hide in plain sight. Ensure you never miss a promising trend by expanding your research beyond ZIM and confidently pursuing your next smart move with these timely screens:

- Unlock high yields by targeting reliable income opportunities with these 16 dividend stocks with yields > 3% offering above-average returns for yield-seeking investors.

- Capitalize on the surge in AI innovation when you browse these 25 AI penny stocks packed with companies shaping automation and smarter tech across industries.

- Jump on strong fundamentals at an attractive price point by reviewing these 886 undervalued stocks based on cash flows that could be poised for outsized returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZIM Integrated Shipping Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZIM

ZIM Integrated Shipping Services

Provides container shipping and related services in Israel and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives