- United States

- /

- Marine and Shipping

- /

- NYSE:ZIM

Will ZIM’s (ZIM) AI Logistics Partnership Reshape Its Edge in Digital Supply Chain Solutions?

Reviewed by Sasha Jovanovic

- We Store Frozen, a leading Texas cold storage and logistics provider, recently announced a partnership with Zimark, the technology unit of ZIM Integrated Shipping Services, to introduce AI-powered smart pallet tracking and automation across all its facilities.

- This move highlights ZIM's increasing focus on digital logistics solutions in the traditionally manual cold storage industry, following a successful pilot that led to wider adoption of the technology.

- We'll explore how ZIM's expansion into AI-driven logistics, through this collaboration, could shift its investment narrative and competitive positioning.

Find companies with promising cash flow potential yet trading below their fair value.

ZIM Integrated Shipping Services Investment Narrative Recap

To be a shareholder in ZIM Integrated Shipping Services today, you need to believe that its push into digital logistics and investments in operational efficiency can outpace industry headwinds, including volatile trade routes and ongoing overcapacity risks. The recent news of ZIMark’s AI-driven partnership with We Store Frozen adds visibility to ZIM’s digital initiatives but does not appear to materially shift near-term catalysts, such as sensitivity to Transpacific rates, or reduce the pressing risk posed by weakened, volatile earnings and industry overcapacity.

Of recent announcements, ZIM’s August 2025 regulatory challenges, specifically Turkish port restrictions on Israel-linked vessels, are most relevant in the context of new digital partnerships, reflecting the company’s ongoing efforts to stabilize operations and pivot beyond exposed trade lanes. Both events highlight the ongoing tension between ZIM’s attempts to modernize and the operational setbacks it continues to face.

However, investors should also keep in mind that while digital initiatives may help efficiency, the risk of industry overcapacity remains especially acute as...

Read the full narrative on ZIM Integrated Shipping Services (it's free!)

ZIM Integrated Shipping Services is projected to generate $4.9 billion in revenue and $61.6 million in earnings by 2028. This outlook reflects a 16.8% annual revenue decline and a decrease of $1.94 billion in earnings from the current $2.0 billion.

Uncover how ZIM Integrated Shipping Services' forecasts yield a $13.26 fair value, a 11% downside to its current price.

Exploring Other Perspectives

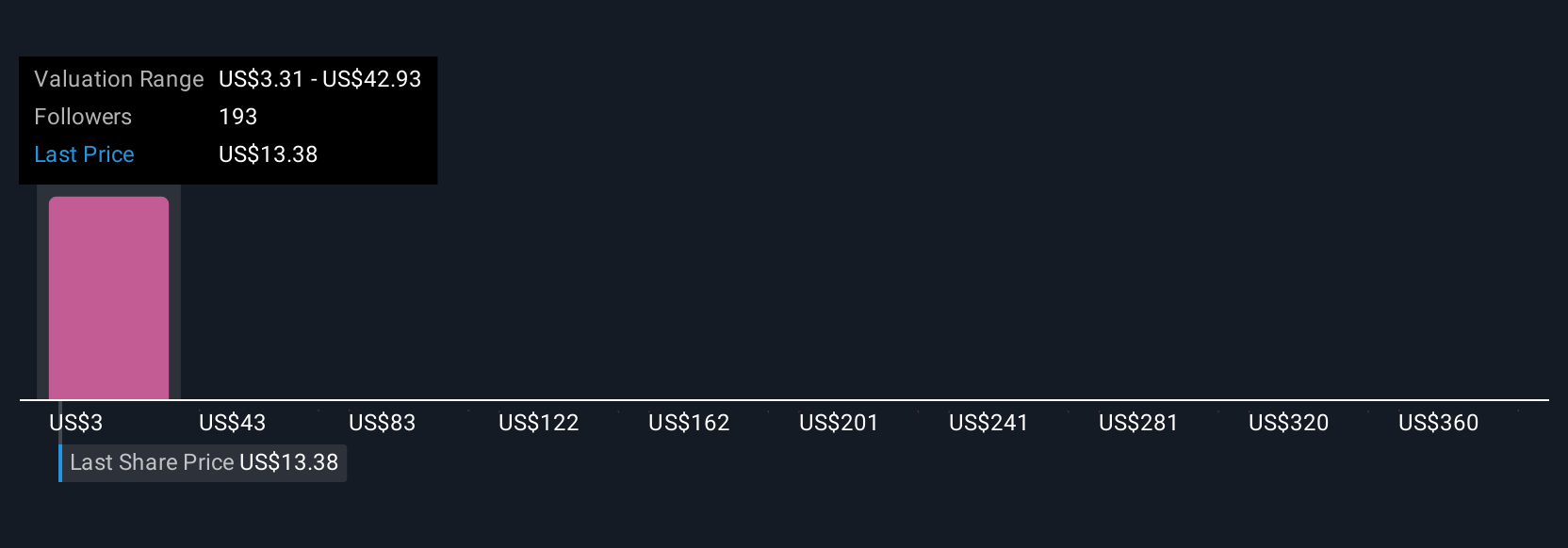

Fair value estimates from 33 Simply Wall St Community members span from US$3.24 to US$452.35 per share. While many expect digital efficiencies to support margin expansion, current industry overcapacity poses tough questions for future returns, consider all.

Explore 33 other fair value estimates on ZIM Integrated Shipping Services - why the stock might be a potential multi-bagger!

Build Your Own ZIM Integrated Shipping Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ZIM Integrated Shipping Services research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ZIM Integrated Shipping Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ZIM Integrated Shipping Services' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZIM Integrated Shipping Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZIM

ZIM Integrated Shipping Services

Provides container shipping and related services in Israel and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives