- United States

- /

- Marine and Shipping

- /

- NYSE:ZIM

Should You Reassess ZIM After Recent 18% Rally and Industry Rate Volatility News?

Reviewed by Bailey Pemberton

- Wondering if ZIM Integrated Shipping Services is a diamond in the rough or just another shipping stock? You are not alone, especially with value investors always on the hunt for a good deal.

- The stock has had quite a ride recently. It jumped 18.0% over the last month and 8.8% in the last week, yet remains down 31.3% year-to-date, hinting at shifts in sentiment and opportunities below the surface.

- Recent news has focused on industry-wide shipping rate volatility, as well as ZIM’s strategic partnerships and fleet expansion plans. These developments are sparking debate about the company’s long-term positioning and are helping shape how the market is pricing both growth potential and short-term risks.

- On raw numbers alone, ZIM scores a 4 out of 6 on our valuation checks, suggesting it looks undervalued by some measures but not all. Next, we will dig into what goes into these valuation approaches and, at the end of this article, reveal a smarter way to size up whether ZIM is truly a value opportunity.

Approach 1: ZIM Integrated Shipping Services Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a business by projecting its future cash flows and discounting them back to today’s dollars. This helps investors determine what a company is intrinsically worth, rather than relying on current market sentiment.

For ZIM Integrated Shipping Services, the most recent trailing twelve month Free Cash Flow stands at $3.75 billion. Analyst forecasts provide estimates for up to five years, after which Simply Wall St extrapolates projections. These suggest Free Cash Flow could reach around $718 million by 2035. This downward trajectory points to normalization after several high-earning years, and future cash flows are discounted to reflect their present value.

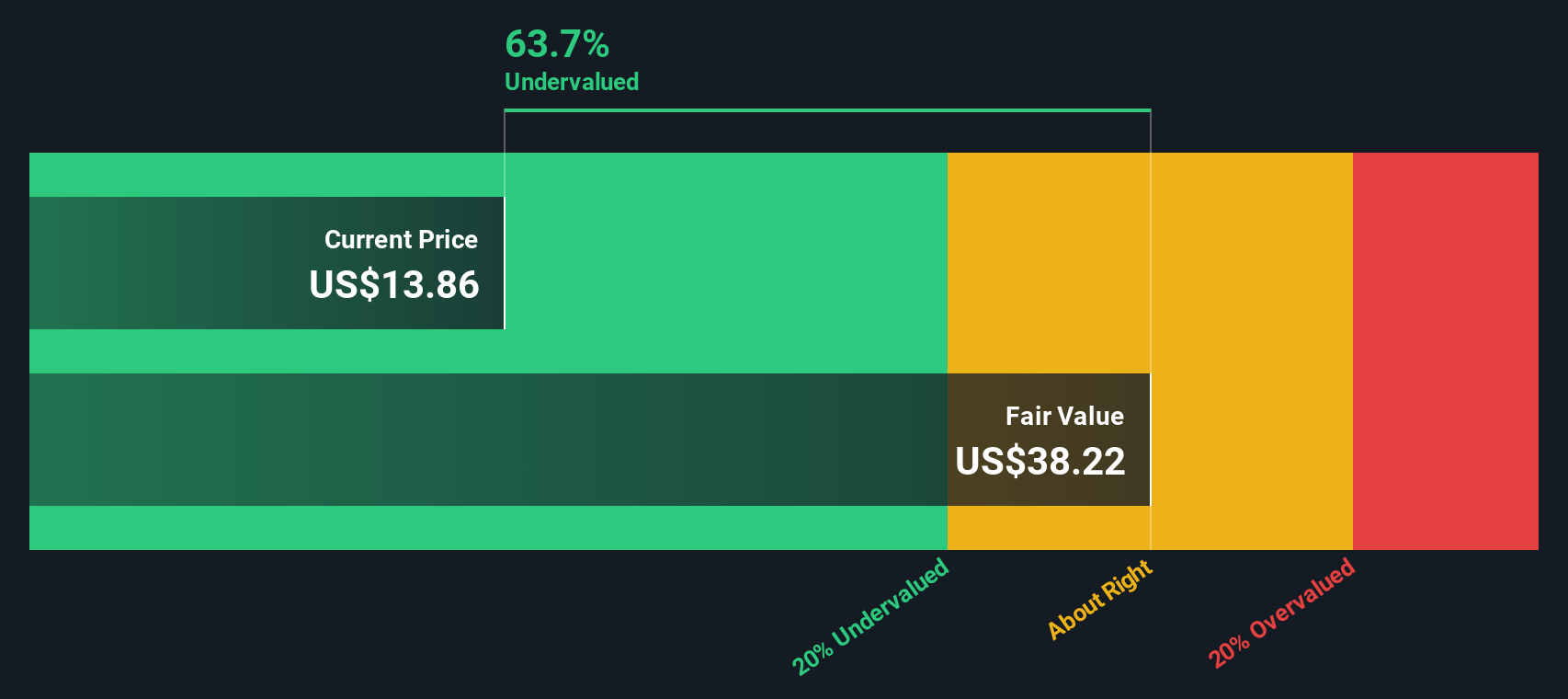

Based on all these projections, the model estimates ZIM’s intrinsic value at $38.48 per share. At current share prices, this equates to a 58.4% discount, indicating the market is pricing the stock well below its estimated fair value.

According to the DCF approach, ZIM Integrated Shipping Services is significantly undervalued, reflecting market caution or a potential opportunity for investors seeking value buys.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ZIM Integrated Shipping Services is undervalued by 58.4%. Track this in your watchlist or portfolio, or discover 878 more undervalued stocks based on cash flows.

Approach 2: ZIM Integrated Shipping Services Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used way to value consistently profitable companies, since it directly relates a company’s share price to its per-share earnings. For investors, the PE ratio helps illustrate how much the market is willing to pay for a dollar of a company’s historical or projected profits.

"Normal" or fair PE ratios depend on multiple factors, especially earnings growth expectations, risk profile, and industry trends. Generally, higher growth and lower risk support higher PE multiples. Cyclical or volatile businesses typically demand a discount.

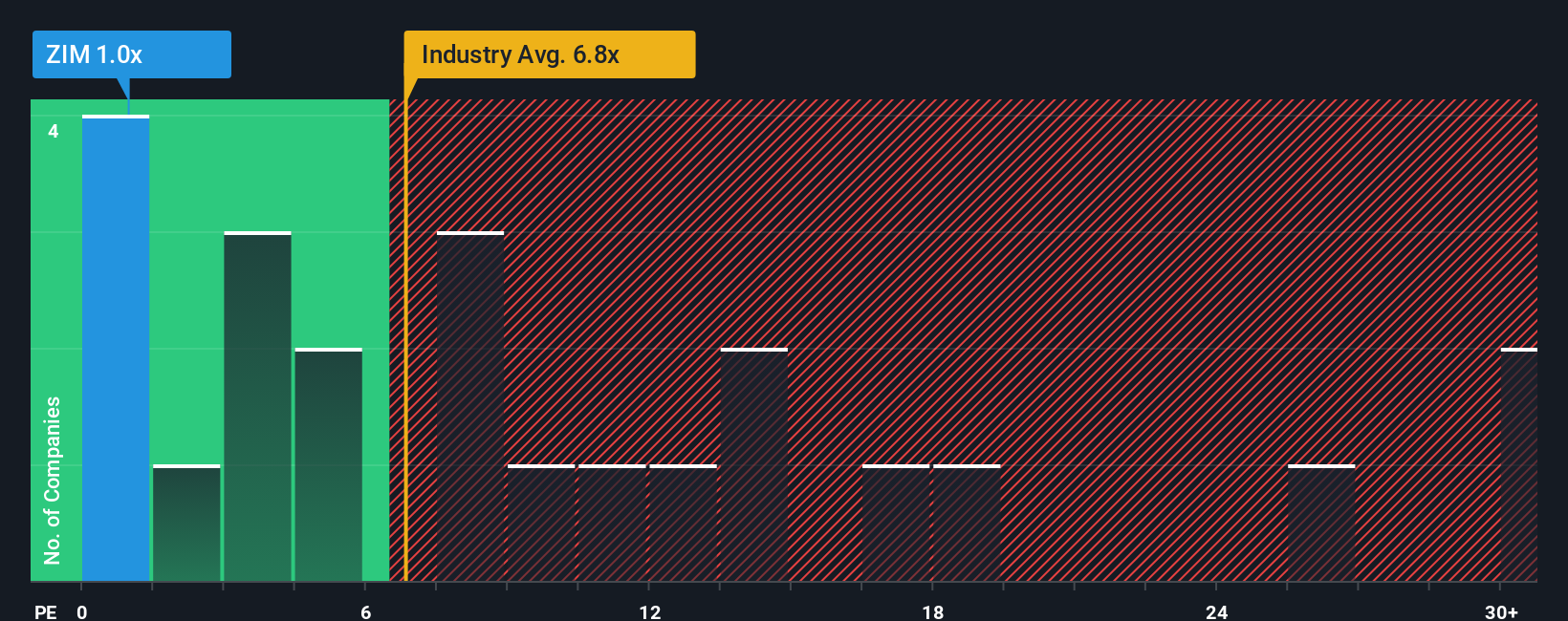

Right now, ZIM Integrated Shipping Services trades at a PE ratio of just 1.0x, which is dramatically lower than both the shipping industry average of 9.6x and its peer group at 8.5x. That makes ZIM look cheap compared to its sector and the broader market.

However, rather than relying solely on industry or peer comparisons, Simply Wall St’s proprietary “Fair Ratio” takes it further by weighing crucial company-specific factors, such as profit margins, historical and expected growth, risk, size, and industry nuances. This approach provides a more accurate picture, rather than just using broad benchmarks that may not reflect ZIM’s actual operating environment.

ZIM’s Fair PE Ratio is estimated to be 0.7x. Since its actual PE ratio of 1.0x is slightly above this figure, it suggests the stock is trading roughly in line with what would be justified, given all relevant factors.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose Your ZIM Integrated Shipping Services Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal investment story, a way to connect your perspective on ZIM Integrated Shipping Services with its numbers by outlining what you believe about its future revenue, earnings, and profit margins, and what you think the shares are worth based on that story.

Narratives bridge the company's qualitative story (what you think will drive its business) with a quantified forecast and a resulting fair value. This allows you to see exactly how your assumptions compare with reality. With Simply Wall St’s Narratives tool, available on the Community page and trusted by millions of investors, anyone can quickly build and adjust their own viewpoint, whether cautious, bullish, or anywhere between.

This makes investment decisions clearer. By actively comparing your Narrative’s Fair Value with the current Price, you gain the insight needed to decide when to buy or sell. Plus, Narratives update dynamically whenever major news, earnings reports, or sector events happen, ensuring your analysis evolves in real time.

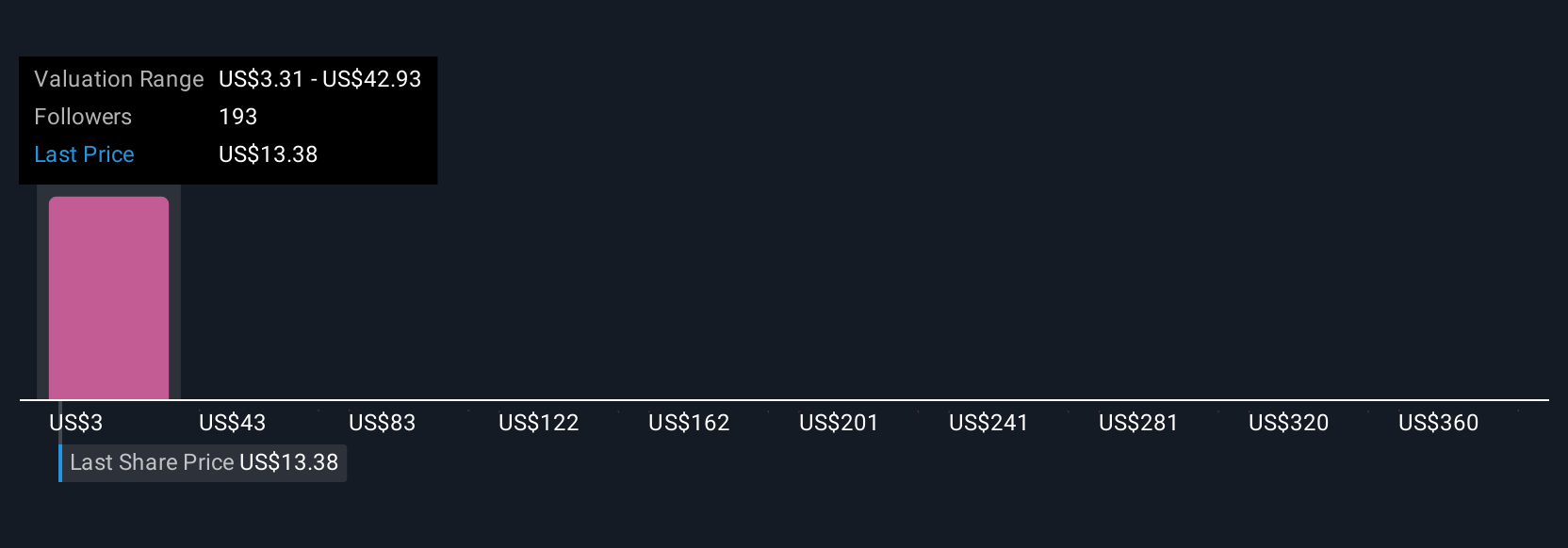

For example, some ZIM Integrated Shipping Services Narratives highlight risks from overcapacity and margin pressure, projecting a fair value as low as $9.80 per share, while others emphasize resilience from fleet modernization and diversification, supporting valuations up to $19.00. Your Narrative can be tailored, making investment analysis more accessible, more personal, and far more actionable.

Do you think there's more to the story for ZIM Integrated Shipping Services? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZIM Integrated Shipping Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZIM

ZIM Integrated Shipping Services

Provides container shipping and related services in Israel and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives