- United States

- /

- Marine and Shipping

- /

- NYSE:ZIM

Is ZIM Integrated Shipping Services (NYSE:ZIM) A Risky Investment?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) does use debt in its business. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for ZIM Integrated Shipping Services

What Is ZIM Integrated Shipping Services's Net Debt?

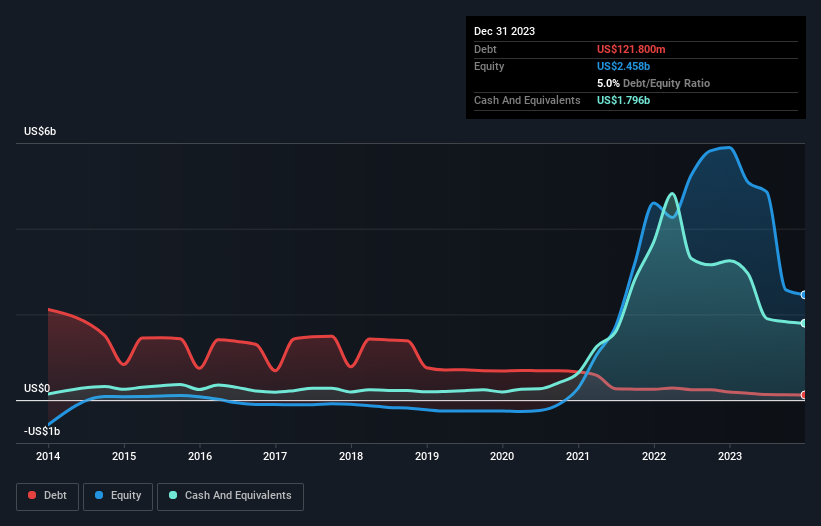

As you can see below, ZIM Integrated Shipping Services had US$121.8m of debt at December 2023, down from US$188.0m a year prior. But on the other hand it also has US$1.80b in cash, leading to a US$1.67b net cash position.

A Look At ZIM Integrated Shipping Services' Liabilities

The latest balance sheet data shows that ZIM Integrated Shipping Services had liabilities of US$2.52b due within a year, and liabilities of US$3.37b falling due after that. On the other hand, it had cash of US$1.80b and US$562.5m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$3.53b.

This deficit casts a shadow over the US$1.59b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, ZIM Integrated Shipping Services would likely require a major re-capitalisation if it had to pay its creditors today. Given that ZIM Integrated Shipping Services has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if ZIM Integrated Shipping Services can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, ZIM Integrated Shipping Services made a loss at the EBIT level, and saw its revenue drop to US$5.2b, which is a fall of 59%. That makes us nervous, to say the least.

So How Risky Is ZIM Integrated Shipping Services?

Although ZIM Integrated Shipping Services had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of US$904m. So taking that on face value, and considering the net cash situation, we don't think that the stock is too risky in the near term. Given the lack of transparency around future revenue (and cashflow), we're nervous about this one, until it makes its first big sales. To us, it is a high risk play. For riskier companies like ZIM Integrated Shipping Services I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if ZIM Integrated Shipping Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ZIM

ZIM Integrated Shipping Services

Provides container shipping and related services in Israel and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success