- United States

- /

- Marine and Shipping

- /

- NYSE:ZIM

Assessing ZIM Stock After 37% Monthly Surge and Shifting Global Trade Patterns

Reviewed by Bailey Pemberton

- Wondering if ZIM Integrated Shipping Services is a value play or a value trap? You are not alone, especially with everything happening in the shipping sector lately.

- The stock has seen some dramatic swings, shooting up 17.6% in the past week and 37.3% over the last month. However, it is still down 15.5% year-to-date, which indicates the market is quickly re-assessing its risk and growth profile.

- Recent headlines have focused on shifting global trade patterns and ongoing supply chain changes. These factors have kept investors and analysts closely watching the company. Such macro developments are fueling speculation about ZIM's future prospects in a still-volatile shipping landscape.

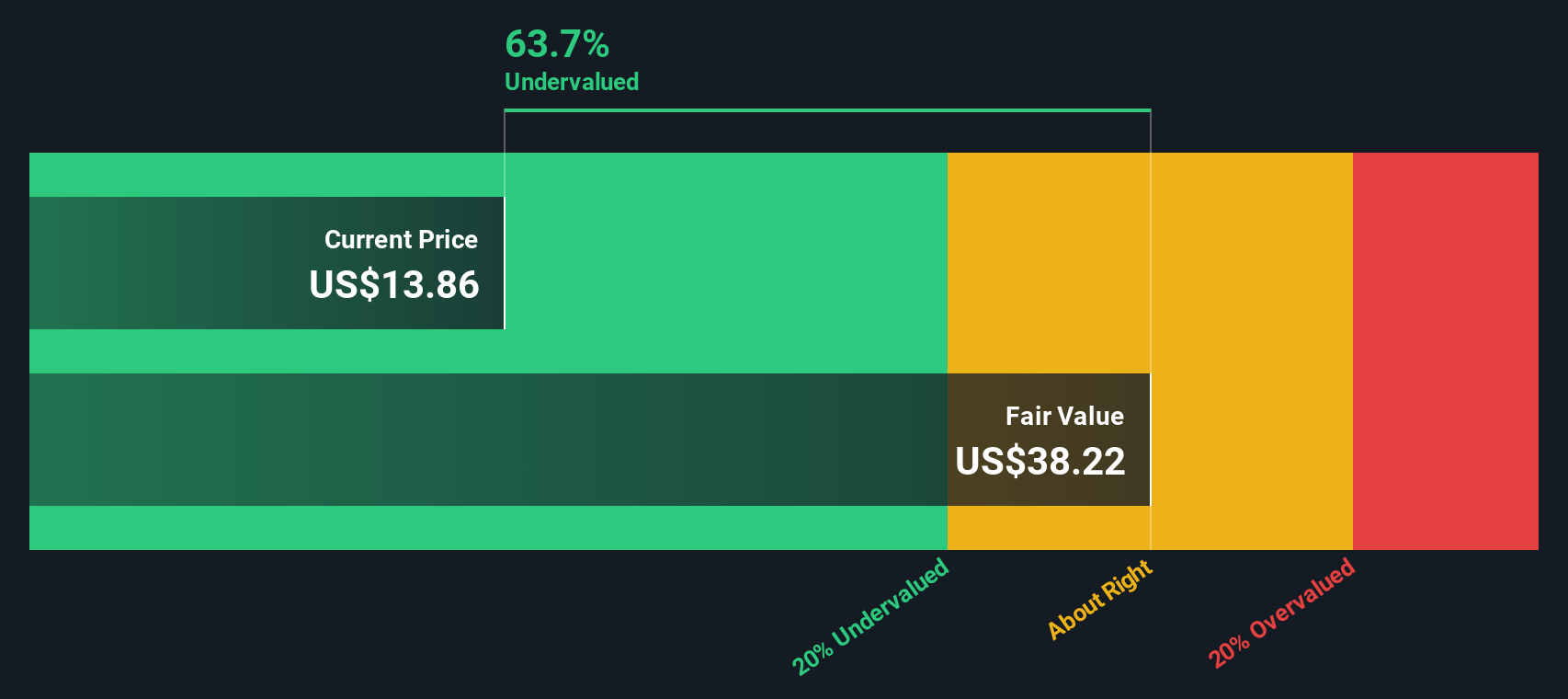

- ZIM currently scores a 4 out of 6 on our valuation checks, signaling that it appears undervalued on several key measures. Up next, we will break down how these scores are calculated, but stay tuned as we will also show you an even more insightful way to think about value before we wrap up.

Approach 1: ZIM Integrated Shipping Services Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model works by projecting a company's expected future cash flows and then discounting those amounts back to their present value. This provides investors with an estimate of a business’s true worth today. This approach aims to capture both current performance and longer-term prospects.

For ZIM Integrated Shipping Services, the most recent trailing twelve months of Free Cash Flow totals approximately $2.89 billion. Analyst forecasts extend out five years. After this period, Simply Wall St extrapolates the figures to cover up to a decade. By 2027, projected annual Free Cash Flow is expected to be $719 million. The ten-year outlook suggests a gradual decline to around $718 million by 2035, according to these estimates.

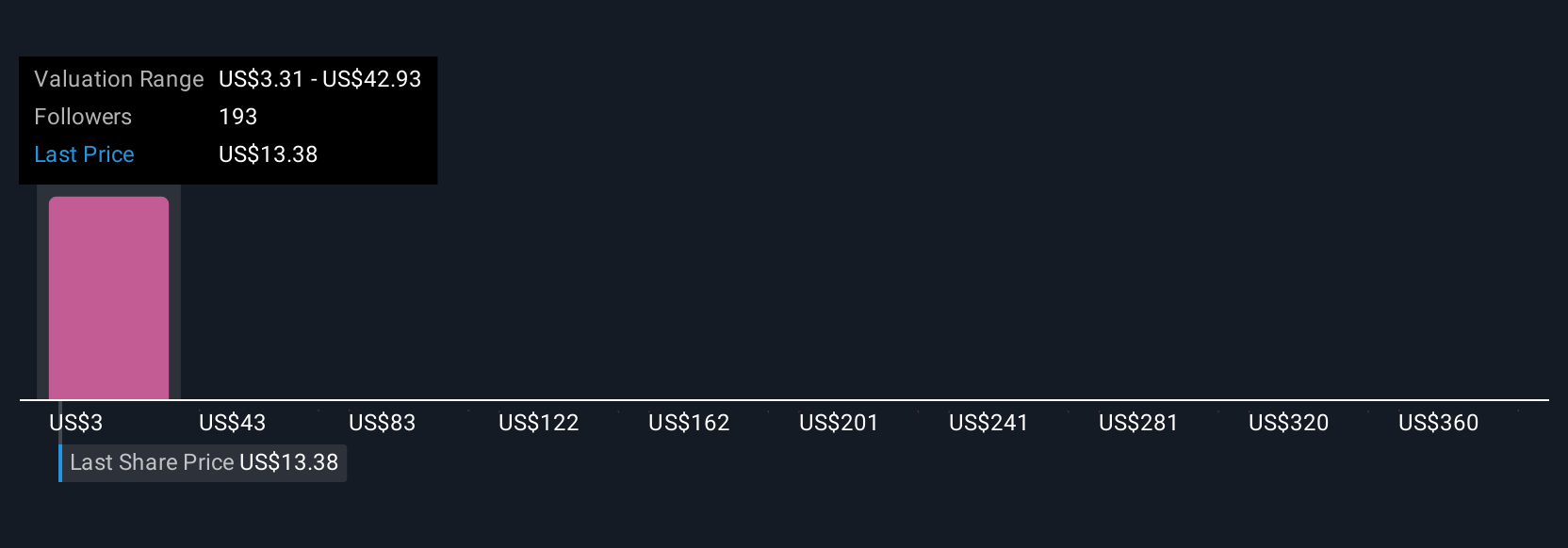

The DCF analysis estimates ZIM's intrinsic value at $42.93 per share. With the DCF implying the stock is 54.1% undervalued compared to its current trading price, this model suggests a significant gap between market price and underlying value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ZIM Integrated Shipping Services is undervalued by 54.1%. Track this in your watchlist or portfolio, or discover 925 more undervalued stocks based on cash flows.

Approach 2: ZIM Integrated Shipping Services Price vs Earnings

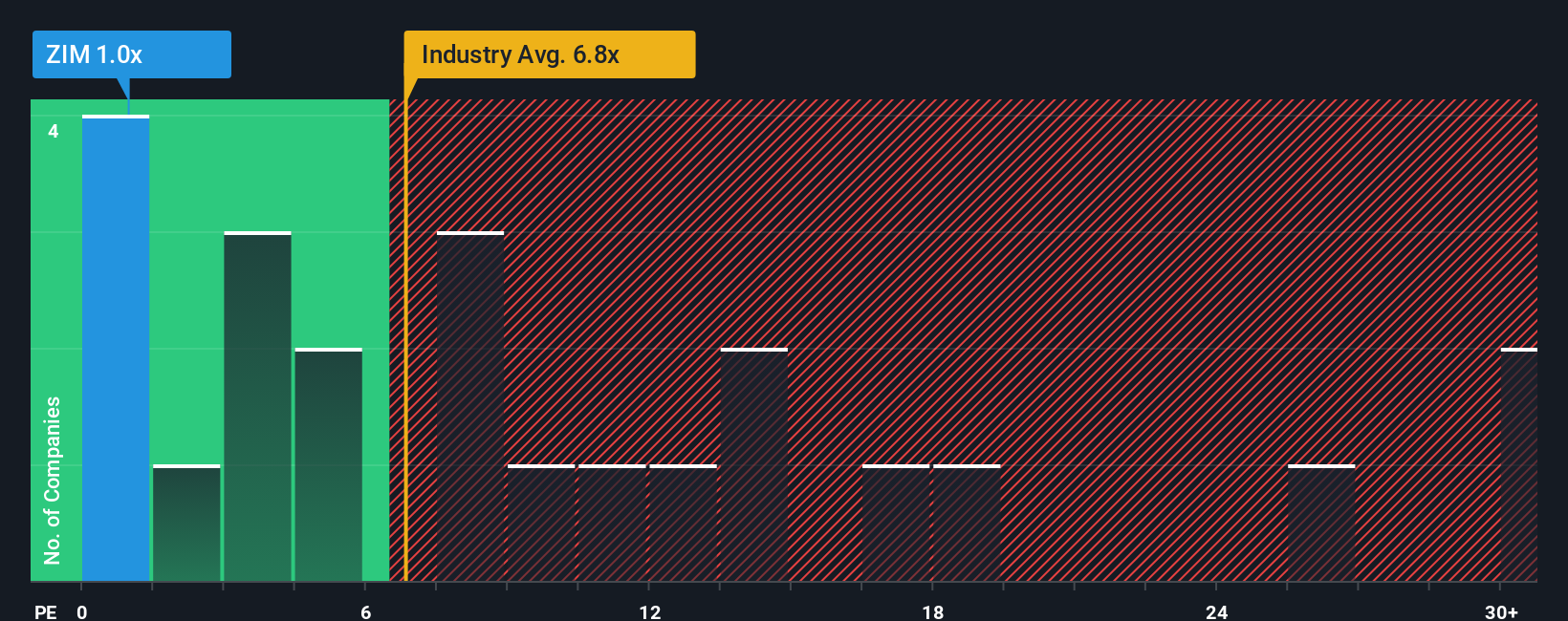

The Price-to-Earnings (PE) ratio is a foundational metric for valuing profitable companies, as it directly relates a company’s market price to its current earnings per share. For companies like ZIM Integrated Shipping Services with positive and measurable profits, the PE ratio offers investors an intuitive way to gauge what the market is willing to pay for a dollar of earnings today.

In general, companies growing quickly or seen as lower risk will be rewarded with higher PE ratios. This reflects optimism about future profits and stability. Slower growth and higher risk typically result in lower PE multiples. The “right” or fair PE depends not only on industry standards but also on the unique attributes and outlook for each company.

Currently, ZIM’s PE ratio stands at just 2.4x, markedly below both the industry average of 9.7x and its shipping sector peers at 13.6x. While these comparisons offer useful context, Simply Wall St introduces the “Fair Ratio,” an advanced benchmark tailored to account for factors such as company-specific growth forecasts, profit margins, risk, and market cap, alongside the industry and sector backdrop. In this case, ZIM’s Fair Ratio is calculated at 0.8x, showing a more nuanced view than broad peer or industry averages.

Since ZIM’s actual PE of 2.4x sits well above its Fair Ratio of 0.8x, this suggests the stock is trading at a premium to its fundamentals, even though it appears cheap versus industry averages. This analysis highlights why the Fair Ratio provides a more realistic and relevant valuation benchmark for investors.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1432 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ZIM Integrated Shipping Services Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply a story you build around a company’s future. It reflects where you think revenue, profits, and margins are heading, and what fair value you believe is justified. By connecting this story to hard numbers and forecasts, Narratives let you see how your view of ZIM Integrated Shipping Services translates financially. This makes it easy to compare your expectations with others and the current share price.

On Simply Wall St's Community page, millions of investors use Narratives to clarify when a stock like ZIM might be undervalued or overvalued relative to its fundamentals, all within an accessible, interactive tool. Narratives are dynamic and automatically update as events or earnings reports come in, so your perspective stays relevant with the latest information. For example, some ZIM investors believe major risks from heavy reliance on volatile China-U.S. trade will drive drastic earnings declines and set fair value as low as $9.80 per share. Others anticipate margin resilience and fleet modernization supporting a much higher fair value of $19.00.

This range of Narratives illustrates how the right approach to valuation goes beyond simple metrics. It invites you to invest with context, confidence, and your own unique thesis.

Do you think there's more to the story for ZIM Integrated Shipping Services? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZIM Integrated Shipping Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZIM

ZIM Integrated Shipping Services

Provides container shipping and related services in Israel and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success