- United States

- /

- Logistics

- /

- NYSE:UPS

Is There an Opportunity in UPS Shares After Supply Chain Innovation Headlines?

Reviewed by Bailey Pemberton

- Ever wondered if United Parcel Service might actually be undervalued at today's prices? Let's dig into whether the numbers suggest you've found a bargain hiding in plain sight.

- Although the stock saw a modest 0.5% gain over the last week, the past year has been tough, with UPS shares down over 26% and year-to-date performance showing a 23.6% drop.

- Recent headlines have spotlighted supply chain innovations across the logistics sector and increased competition, as UPS expands new delivery partnerships and adapts to shifting e-commerce demand. Broader industry trends have also stirred up both optimism and caution among investors.

- Right now, UPS scores a 5 out of 6 on our undervaluation checks, making it one of the more intriguing large-caps to watch. Next, we will break down each valuation approach. Stick around, because we will also share the way savvy investors look beyond just the standard numbers.

Find out why United Parcel Service's -26.4% return over the last year is lagging behind its peers.

Approach 1: United Parcel Service Discounted Cash Flow (DCF) Analysis

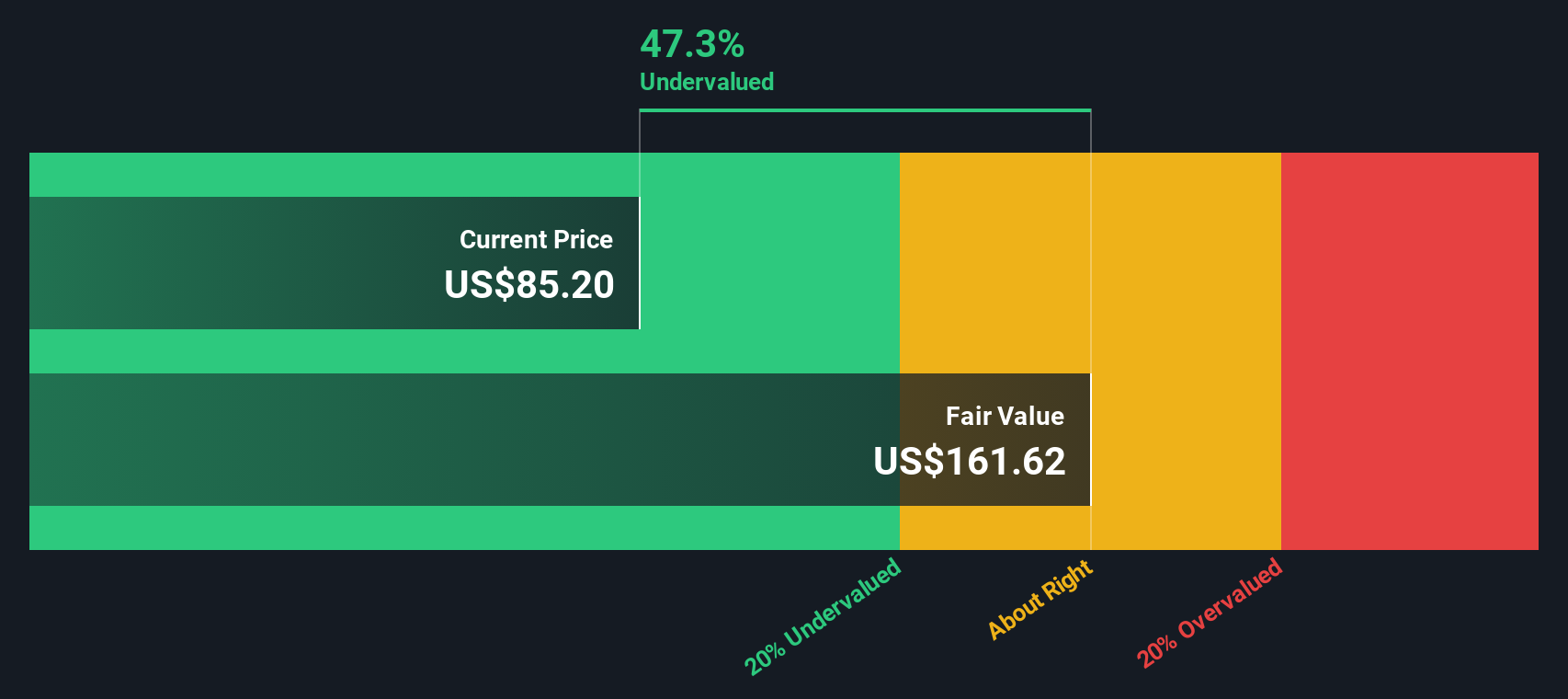

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its future cash flows and then discounting them back to today's dollars. This gives investors an idea of what the business is fundamentally worth.

For United Parcel Service, current Free Cash Flow sits at $3.7 billion. Analysts forecast significant growth over the next few years. By the end of 2029, Free Cash Flow is projected to reach approximately $6.2 billion. While analyst estimates typically cover only the first five years, further forecasts are extrapolated to capture potential long-term trends.

Based on these cash flow projections using the 2 Stage Free Cash Flow to Equity approach, the DCF model calculates an intrinsic value of $135.78 per share. Given that this figure suggests the stock is trading at a 30.3% discount to its estimated intrinsic value, UPS appears significantly undervalued at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests United Parcel Service is undervalued by 30.3%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: United Parcel Service Price vs Earnings

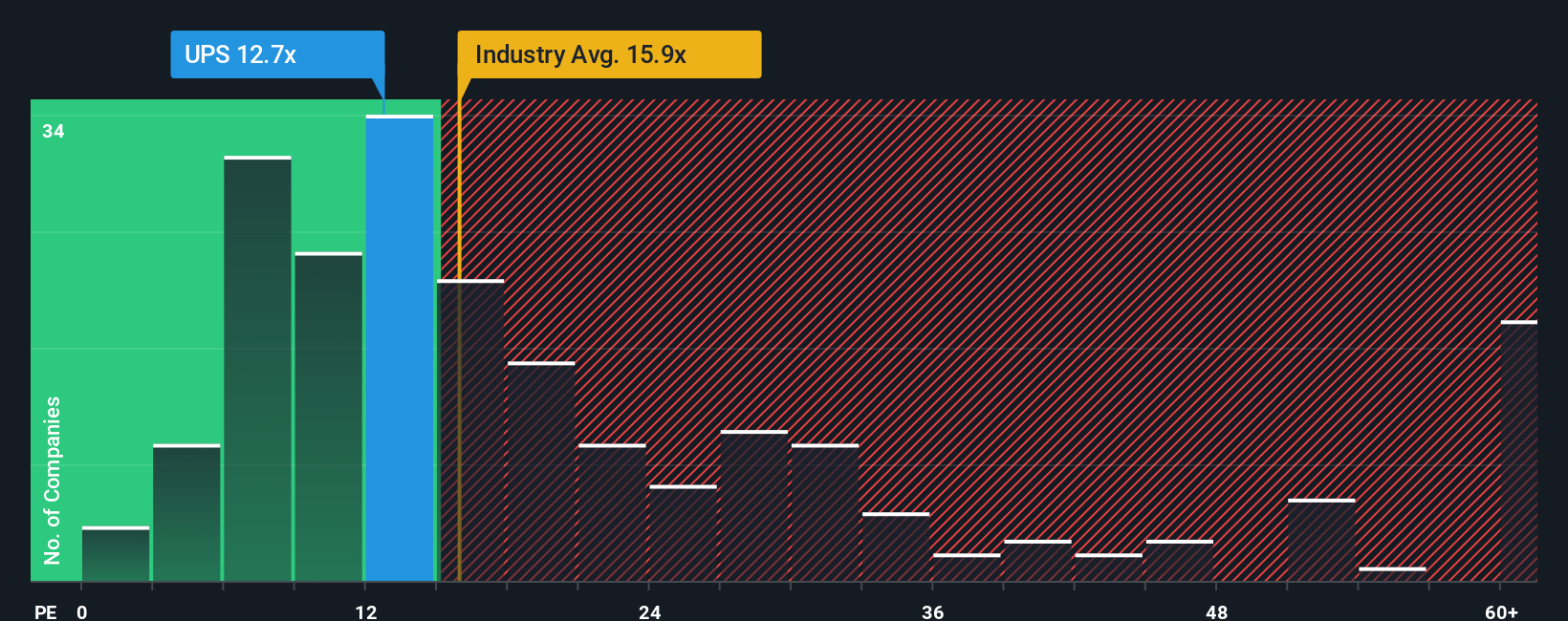

The price-to-earnings (PE) ratio is a widely used valuation method for profitable companies like United Parcel Service. It reflects how much investors are willing to pay for a dollar of earnings, making it especially informative when a company has steady profits. A higher PE can indicate expectations for future growth or a lower perceived risk, while a lower PE may signal the opposite.

United Parcel Service currently trades at a PE ratio of 14.6x. This is below the average PE for its industry, which is 15.9x, and also below the average of key peers, which stands at 20.1x. Such a discount might catch the eye, but comparing straightforward PE ratios does not always tell the full story. Growth prospects, profit margins, company size, and risk can all mean that what looks cheap at first glance might not be so in reality.

That is why Simply Wall St uses a proprietary “Fair Ratio” for valuation. For United Parcel Service, this Fair Ratio is calculated to be 18.7x. Unlike basic peer or industry comparisons, the Fair Ratio accounts for the company’s unique mix of earnings growth, business risks, profit margins, industry sector, and market capitalization. This produces a more tailored and relevant benchmark for what the stock’s multiple should be today.

Since United Parcel Service’s current PE of 14.6x is meaningfully below its Fair Ratio of 18.7x, the valuation appears attractive based on earnings. This suggests the stock could offer value for investors at its current price.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1434 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your United Parcel Service Narrative

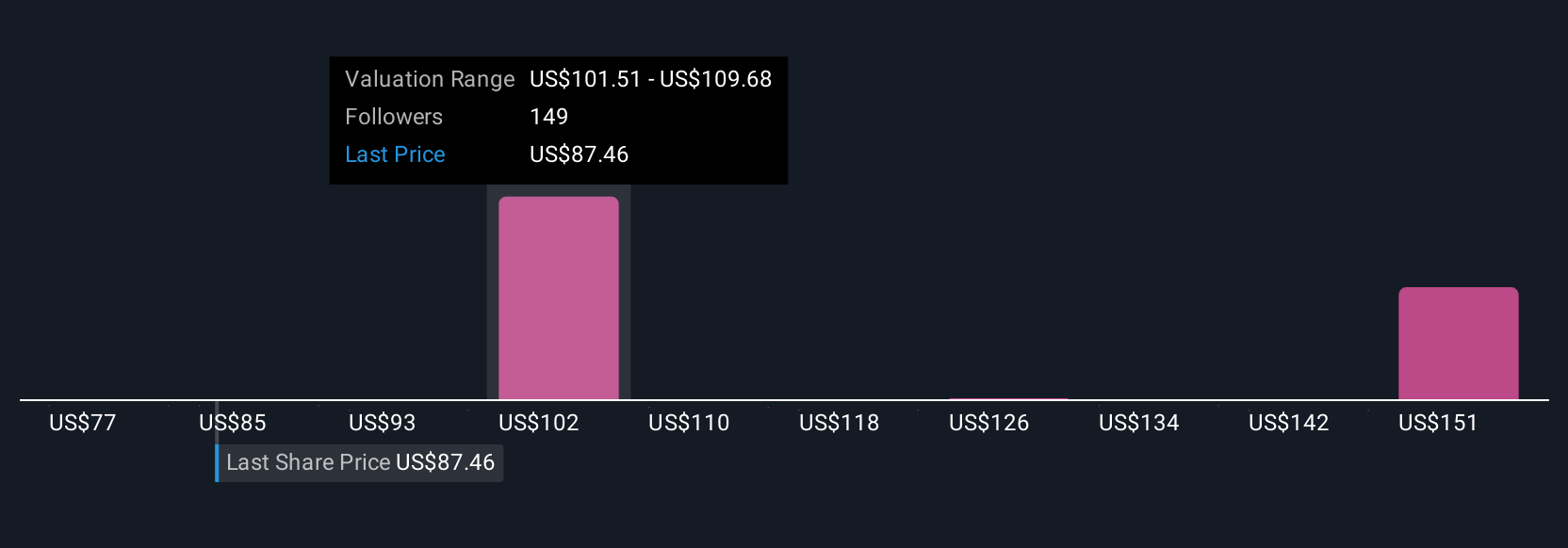

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives, an intuitive new approach that empowers you to bring your perspective to investing.

A Narrative combines your story about a company with your projections for future revenue, earnings, and margins, linking the company’s strategy and business environment directly to forecasted financial results and a calculated fair value.

This framework transforms investing from just comparing ratios to building a clear, actionable roadmap, where your view of the company's future meets the numbers behind its price.

On Simply Wall St's Community page, Narratives are easy for anyone to create, update, and discuss, letting millions of investors track their views in real-time as news or earnings updates arrive. You never have to start from scratch when new information drops.

With Narratives, you can decide when to buy or sell by comparing Fair Value (what you think the stock is worth based on your storyline and assumptions) to the current market Price, and instantly sense-check your outlook against the crowd.

For example, some investors see UPS as worth $133 a share based on rapid automation and robust margin growth, while others assign a fair value as low as $75, reflecting caution around cost pressures and profit risks.

Do you think there's more to the story for United Parcel Service? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UPS

United Parcel Service

A package delivery and logistics provider, offers transportation and delivery services.

Undervalued with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives