- United States

- /

- Logistics

- /

- NYSE:UPS

Has UPS (UPS) Unlocked Sustainable Growth or Just Short-Term Savings Through Its New Efficiency Drive?

Reviewed by Sasha Jovanovic

- Recently, United Parcel Service (UPS) reported third-quarter results exceeding analyst expectations, highlighting ongoing cost-saving measures such as workforce reductions and facility consolidations, while reaffirming guidance for the holiday season and operational shifts toward higher-margin segments.

- An interesting development is UPS's substantial progress on its multi-year network reconfiguration and efficiency initiatives, which have already yielded billions in cost savings and a major workforce reduction in 2025.

- To assess the impact on UPS's investment case, we'll explore how deep cost savings and the shift away from Amazon deliveries affect future growth assumptions.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

United Parcel Service Investment Narrative Recap

To be a UPS shareholder today, you would have to believe the company’s ambitious shift away from lower-margin Amazon volumes and its massive cost-saving program can drive profitability, even as near-term revenue and margin pressures persist. The latest earnings beat and reinforced holiday guidance are encouraging, but the planned Amazon volume reductions remain the biggest risk to revenue in the short term, and this news does not materially change that outlook for now.

Among the latest company disclosures, UPS’s confirmation of its US$5.5 billion dividend for 2025 stands out. This sizeable ongoing distribution, subject to board approval, is especially meaningful as UPS works through its largest-ever network reconfiguration and pursues higher-margin business. Whether UPS’s dividend policy remains sustainable alongside these changes ties directly into the core catalysts and risks that matter most right now.

However, investors should also be aware that...

Read the full narrative on United Parcel Service (it's free!)

United Parcel Service's outlook projects $94.5 billion in revenue and $7.1 billion in earnings by 2028. This is based on a 1.5% annual revenue growth rate and an earnings increase of $1.4 billion from current earnings of $5.7 billion.

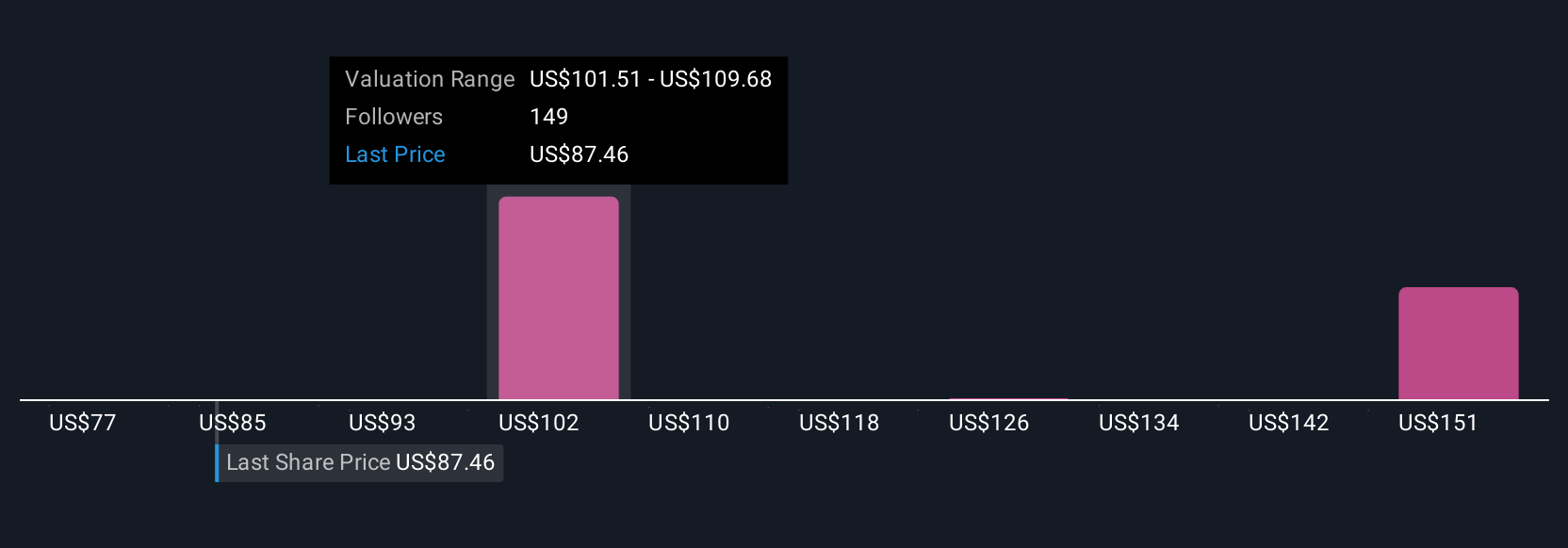

Uncover how United Parcel Service's forecasts yield a $100.50 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Some top analysts have been far more optimistic about UPS, previously forecasting revenues of US$96.7 billion and profits climbing to US$8.0 billion by 2028. While baseline expectations focus on cost cuts and efficiency, these bullish views see automation and new trade lanes as keys to faster margin and revenue growth. Analyst opinions can differ widely, so it’s worth weighing how the latest results may influence these sharply contrasting outlooks.

Explore 24 other fair value estimates on United Parcel Service - why the stock might be worth as much as 46% more than the current price!

Build Your Own United Parcel Service Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Parcel Service research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free United Parcel Service research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Parcel Service's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UPS

United Parcel Service

A package delivery and logistics provider, offers transportation and delivery services.

Undervalued with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives