- United States

- /

- Logistics

- /

- NYSE:UPS

Does the Recent 14% Surge Make UPS a Bargain in 2025?

Reviewed by Bailey Pemberton

- Wondering if United Parcel Service is a bargain or overpriced right now? You are not alone, as plenty of investors are debating what UPS is really worth these days.

- UPS stock has surged 10.5% in the past week and 14.3% over the last month. However, it is still down more than 22% year to date and 23.5% over the last year.

- Recent headlines reveal that increased demand for shipping, ongoing supply chain improvements, and strategic moves in logistics have the market re-examining UPS' potential. Industry news about parcel volume trends and e-commerce partnerships is contributing to the conversation about future growth and risk shifts.

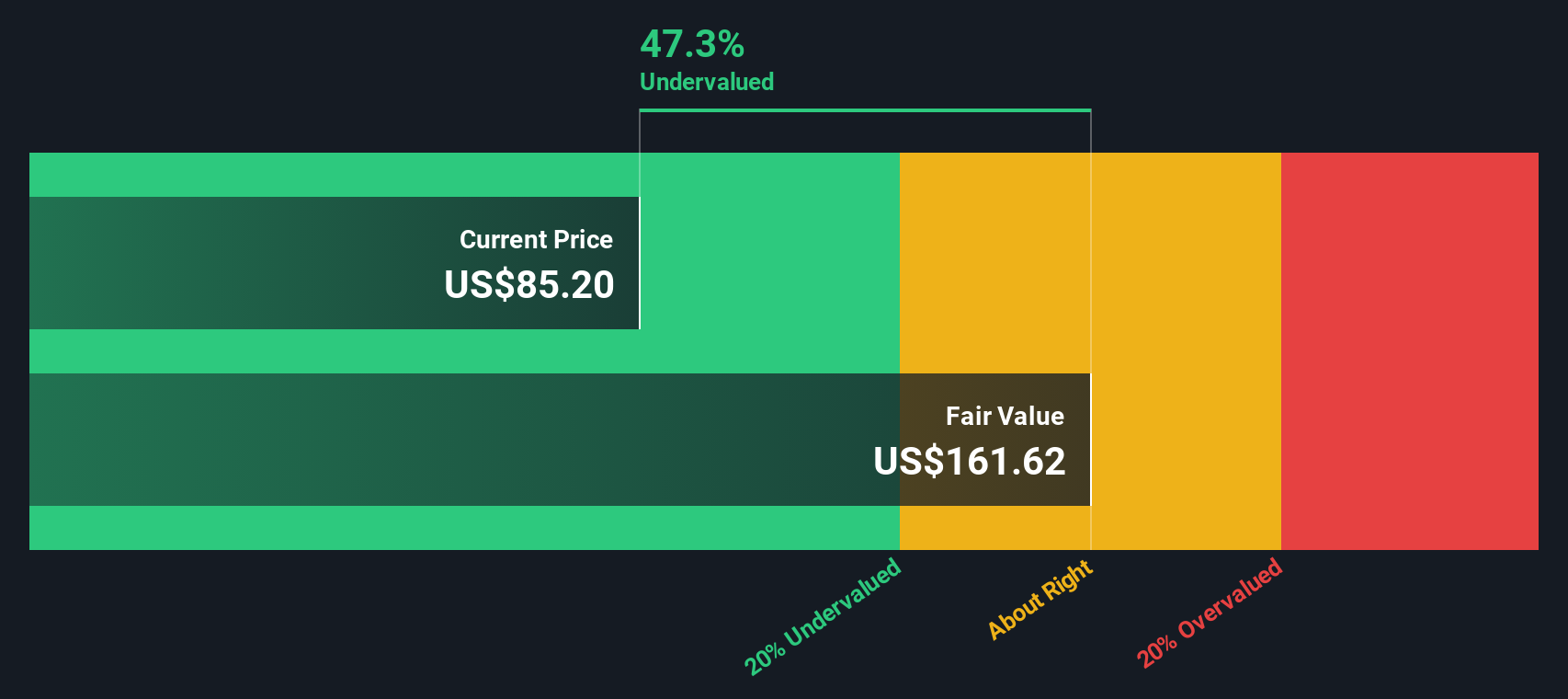

- Our independent checks show UPS is undervalued in 5 out of 6 areas, giving it a current valuation score of 5/6. We will discuss traditional valuation techniques next, but do not miss the final section for a less obvious, more in-depth look at what fair value really means for United Parcel Service.

Find out why United Parcel Service's -23.5% return over the last year is lagging behind its peers.

Approach 1: United Parcel Service Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future cash flows and discounting them back to today's dollars. It helps investors understand what a company is really worth based on its ability to generate cash over time.

For United Parcel Service, the DCF approach uses recent Free Cash Flow data of $3.71 billion, combined with projections from analysts and extrapolations for future years. Analysts provide up to five years of estimates, while projections further into the future are made using reasonable assumptions by Simply Wall St. According to these models, UPS's Free Cash Flow could reach as high as $6.24 billion by 2029.

After applying this modeling, the intrinsic value suggested by the DCF method is $141.09 per share. This is higher than the company’s market pricing, implying the stock trades at a 31.7% discount to its calculated fair value. In other words, the DCF view points to UPS stock being undervalued based on cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests United Parcel Service is undervalued by 31.7%. Track this in your watchlist or portfolio, or discover 832 more undervalued stocks based on cash flows.

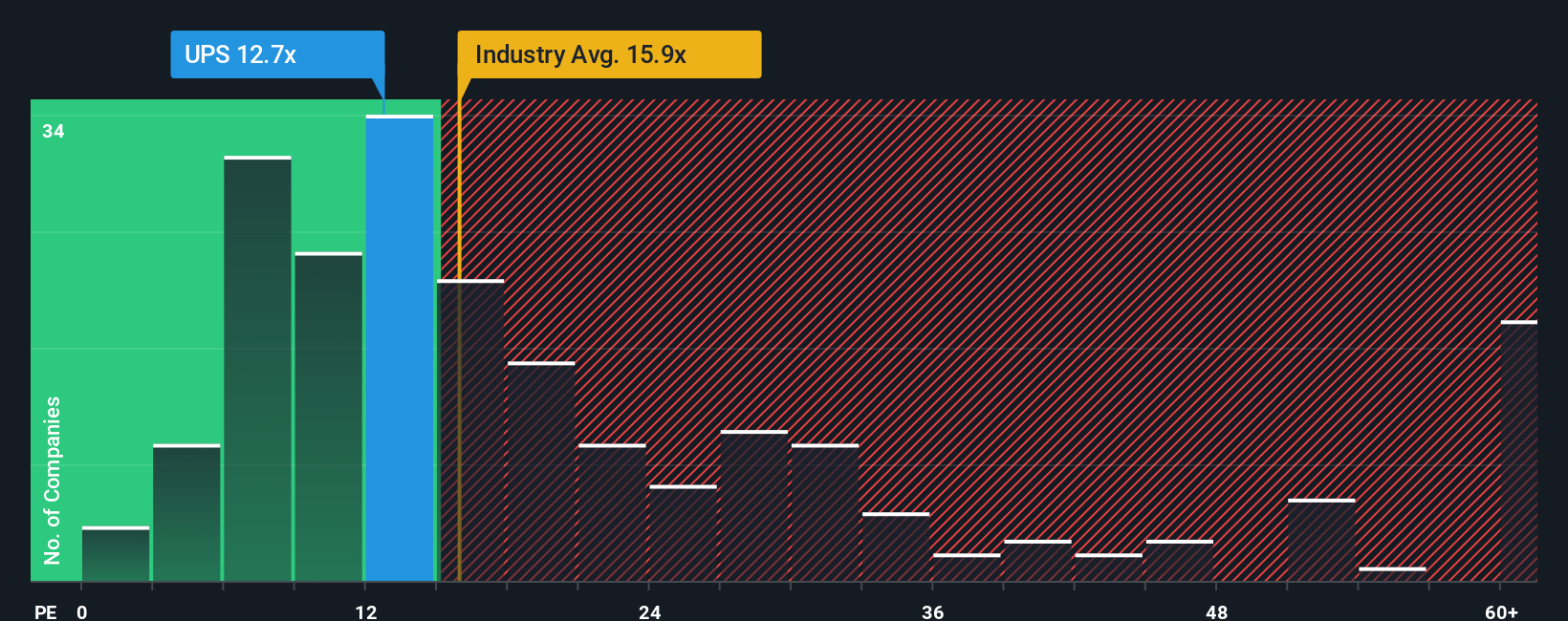

Approach 2: United Parcel Service Price vs Earnings

The Price-to-Earnings (PE) ratio is a favored way to value companies like United Parcel Service that are consistently profitable. This multiple allows investors to quickly gauge how much they are paying for each dollar of current earnings. The PE ratio is particularly useful when steady profits are expected to continue.

Growth prospects, stability, and riskiness all play key roles in determining what a “normal” or “fair” PE ratio should be. Companies with faster earnings growth or lower risk usually deserve a higher PE, while those with weaker prospects or greater uncertainty tend to command lower multiples from the market.

Currently, United Parcel Service trades at a PE ratio of 14.9x. For context, the logistics industry average is 16.0x, and UPS's peers carry an average PE of 19.1x. Simply Wall St’s proprietary “Fair Ratio” for UPS, which incorporates its earnings growth outlook, profitability, risk profile, industry, and market cap, is calculated at 18.0x. Unlike a basic industry or peer comparison, the Fair Ratio provides a more tailored benchmark by directly factoring in the elements that drive company value and justify a premium or discount.

When comparing UPS’s PE of 14.9x to its Fair Ratio of 18.0x, the stock appears to be undervalued relative to what would be justified given its business fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

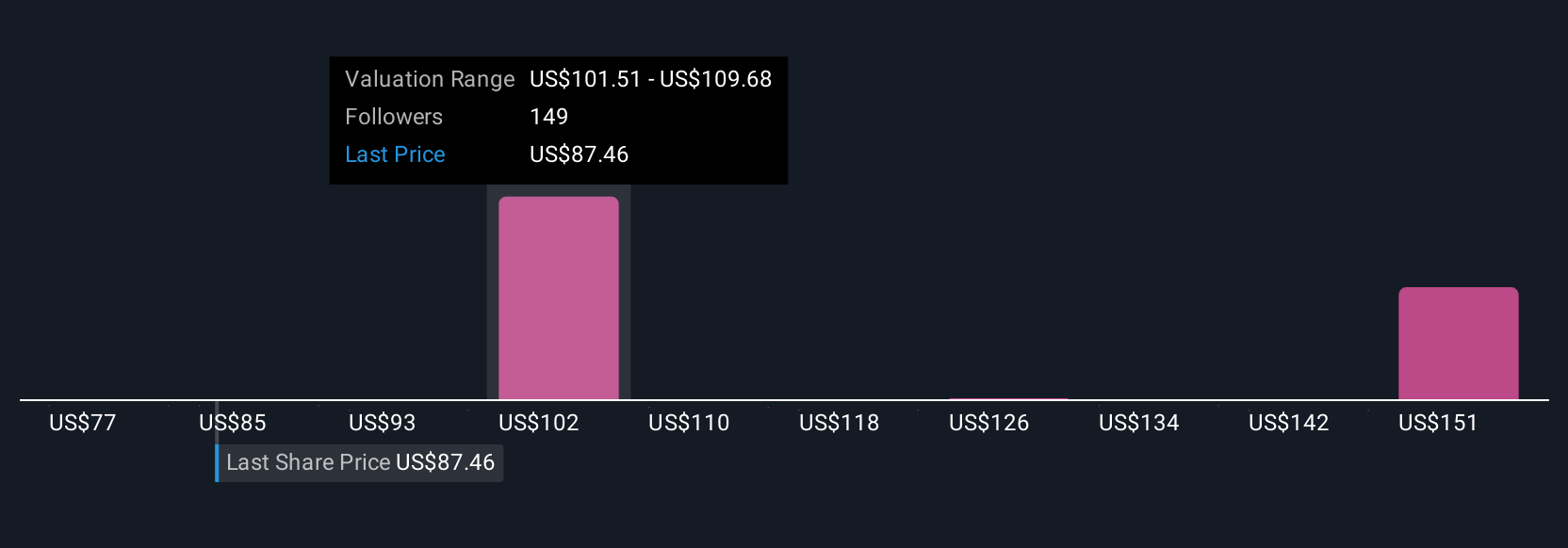

Upgrade Your Decision Making: Choose your United Parcel Service Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is an investor's personalized story that explains how they see a company's future, tying together assumptions about growth, profit margins and risk to a clear estimate of fair value. Instead of relying on generic price targets or industry ratios, Narratives empower you to link United Parcel Service's story, such as its cost-cutting initiatives or new logistics partnerships, directly to a financial forecast and a fair value you believe in.

Narratives are a powerful, easy-to-use feature available to everyone in the Simply Wall St Community, where millions of investors share and compare their perspectives. Each Narrative transparently outlines the assumptions behind the numbers, so you can quickly see how different outlooks turn into different buy or sell decisions, depending on how the current price compares to the estimated fair value.

Importantly, Narratives respond to real-world events and automatically update as new financials or news come in, ensuring your view on United Parcel Service evolves in real time. For example, some users see fair value as high as $132.37 due to bullish assumptions on profit margin and automation, while others see $75.00 based on more cautious revenue projections and cost risks.

For United Parcel Service, here are previews of two leading United Parcel Service Narratives:

🐂 United Parcel Service Bull Case

Fair Value: $132.37

Current price is approximately 27.2% below this fair value.

Revenue Growth Forecast: 2.3%

- Rapid automation and strategic cost-cutting are expected to expand margins and cash flow. Growth may outpace current consensus.

- Expansion in healthcare logistics and global trade lanes, supported by digital investments, contributes to diversified long-term growth.

- Bullish analysts note that substantial upside is possible if UPS sustains margin improvements while managing competitive and regulatory risks.

🐻 United Parcel Service Bear Case

Fair Value: $95.21

Current price is approximately 1.3% above this fair value.

Revenue Growth Forecast: 1.8%

- Cautious outlook due to sustainability concerns, higher costs, and ongoing internal pressures such as labor and shareholder issues.

- Major cost-cutting and automation initiatives are necessary but carry execution risk and have resulted in financial strain, including increased debt.

- Recent partnerships and efficiency efforts may offer some support, but declining earnings and revenue trends remain a significant concern.

Do you think there's more to the story for United Parcel Service? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UPS

United Parcel Service

A package delivery and logistics provider, offers transportation and delivery services.

Undervalued with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives