- United States

- /

- Transportation

- /

- NYSE:UBER

Uber (UBER): Evaluating Valuation After Bold Entry Into Robotaxi and New Strategic Partnerships

Uber Technologies (UBER) just made headlines by partnering with Lucid Group to invest in a next-generation robotaxi initiative that could put 20,000 electric vehicles on the road over the next six years. This is more than just another tech announcement; it is a clear signal that Uber is doubling down on autonomous and electric mobility. For investors weighing up the possibilities, this move says a lot about where Uber’s management sees growth beyond the traditional ride-hailing business and hints at major shifts in both how the company operates and how markets might value it in the future.

This announcement comes shortly after several high-profile business moves, including Uber's new partnership with Best Buy to bring consumer electronics onto the Uber Eats platform and a recent fixed-income offering. Over the past year, Uber's share price has surged almost 35%, outpacing much of the market, as the company reported improved profitability and shed noncore divisions. With nearly 50% year-to-date gains and renewed momentum, the market’s enthusiasm appears fueled by the company's expanding reach and operational discipline.

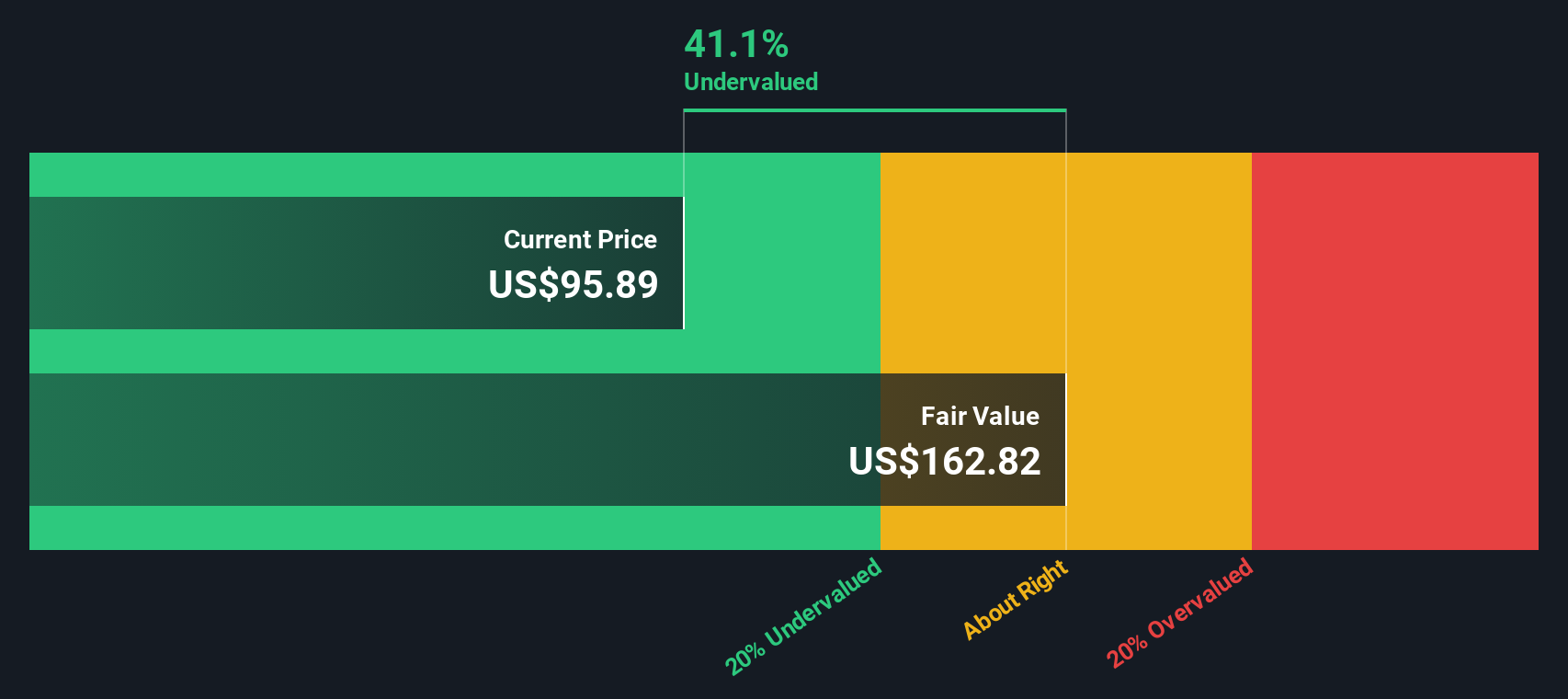

With this wave of strategic news and a strong performance in the share price, investors may consider whether Uber is now attractively priced or if the market is already factoring in significant growth for the future.

Most Popular Narrative: 29% Overvalued

According to the most popular narrative, Uber is currently viewed as overvalued, with its market price trading well above what is justified by underlying company assumptions and discount rates.

Uber has several key products and services that could significantly impact its sales and earnings. Ride-Hailing Services remain Uber’s core revenue generator. The company continues to innovate and expand its ride-hailing services globally.

What is really powering this aggressive price target? A closer look hints at ambitious projections for both top-line growth and future profitability. Curious which business segments are expected to bring in the biggest rewards, and which key financial ratios are forecasting a tech-style premium for Uber? Unlock the full narrative for the surprising details shaping this bold valuation thesis.

Result: Fair Value of $72.92 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, operational challenges such as driver dissatisfaction and heightened regulatory scrutiny could still dampen Uber’s ambitious growth story.

Find out about the key risks to this Uber Technologies narrative.Another View: A Different Take on Value

Looking through the lens of our SWS DCF model, Uber's shares tell a very different story. This method values future cash flows, and the outcome challenges the overvalued narrative from traditional ratios. Could the market be missing something, or is optimism running too hot?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Uber Technologies Narrative

If the perspectives above do not align with your views or you prefer hands-on analysis, it only takes a few minutes to create and test your own thesis. Do it your way.

A great starting point for your Uber Technologies research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Now is the perfect time to find your next big winner. The market is full of fresh opportunities that you do not want to overlook. Use the powerful Simply Wall Street Screener and let your curiosity lead you to new possibilities across dynamic sectors and innovative trends.

- Capture income potential by reviewing companies with reliable payouts using our dividend stocks with yields > 3% for yields above 3%.

- Spot tomorrow’s AI breakthroughs by browsing AI penny stocks, featuring forward-thinking technology leaders changing the game.

- Uncover great value by targeting undervalued stocks based on cash flows, which focuses on cash flows and highlights stocks that could be flying under the radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

This strategic transformation of TTE? Significant re-rating potential

Q3 Outlook modestly optimistic

Okamoto Machine Tool Works focus on profitability

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.