- United States

- /

- Transportation

- /

- NYSE:UBER

Uber (UBER): Assessing Valuation Following Strong Earnings Growth and Strategic Expansion Moves

Reviewed by Simply Wall St

Uber Technologies (UBER) just released its third-quarter earnings, and investors are taking note. The company reported sizable year-over-year increases in both sales and net income, reflecting broader momentum for its business.

This boost comes alongside a string of new partnerships, including collaborations with Toast, Kroger, and NVIDIA. Each deal points to Uber's drive to grow beyond ride-sharing by tapping opportunities in food delivery, autonomous vehicles, and retail commerce.

See our latest analysis for Uber Technologies.

Uber’s share price has cooled recently, dipping 7.3% over the past month, but the big picture remains strong. Momentum is building, with a 46.8% year-to-date share price return and a three-year total shareholder return exceeding 240%. Strategic partnerships and a push into new business lines are giving investors reasons to keep an eye out for further gains.

If Uber’s growth and innovation have you thinking broader, it might be time to broaden your search and discover fast growing stocks with high insider ownership

But with shares already up sharply this year and analysts projecting significant future growth, is there still hidden value waiting to be unlocked? Or has Uber’s rising stock price already accounted for the company’s next chapter?

Most Popular Narrative: 23.7% Overvalued

According to YasserSakuragi, Uber's most closely-watched fair value estimate sits well below the latest closing price, highlighting a tough hurdle for upside. The narrative anchors its case in major improvements to profitability and ambitious revenue targets, yet signals caution on current market enthusiasm.

Profitability: Achieved sustainable profitability with $1.78B net income vs $654M loss year ago

Cash Generation: Exceptional FCF of $6.9B in 2024, $2.3B in Q1 2025

Want to know what drives such a steep discount in fair value? This narrative hinges on big earnings leaps and bold profit margin targets, but there is a surprising forecast twist buried in the details. Discover which core financial projections shape this valuation outlook.

Result: Fair Value of $75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, upside surprises in international growth or rapid adoption of new tech could quickly shift earnings expectations and challenge today’s cautious outlook.

Find out about the key risks to this Uber Technologies narrative.

Another View: Multiples Tell a Different Story

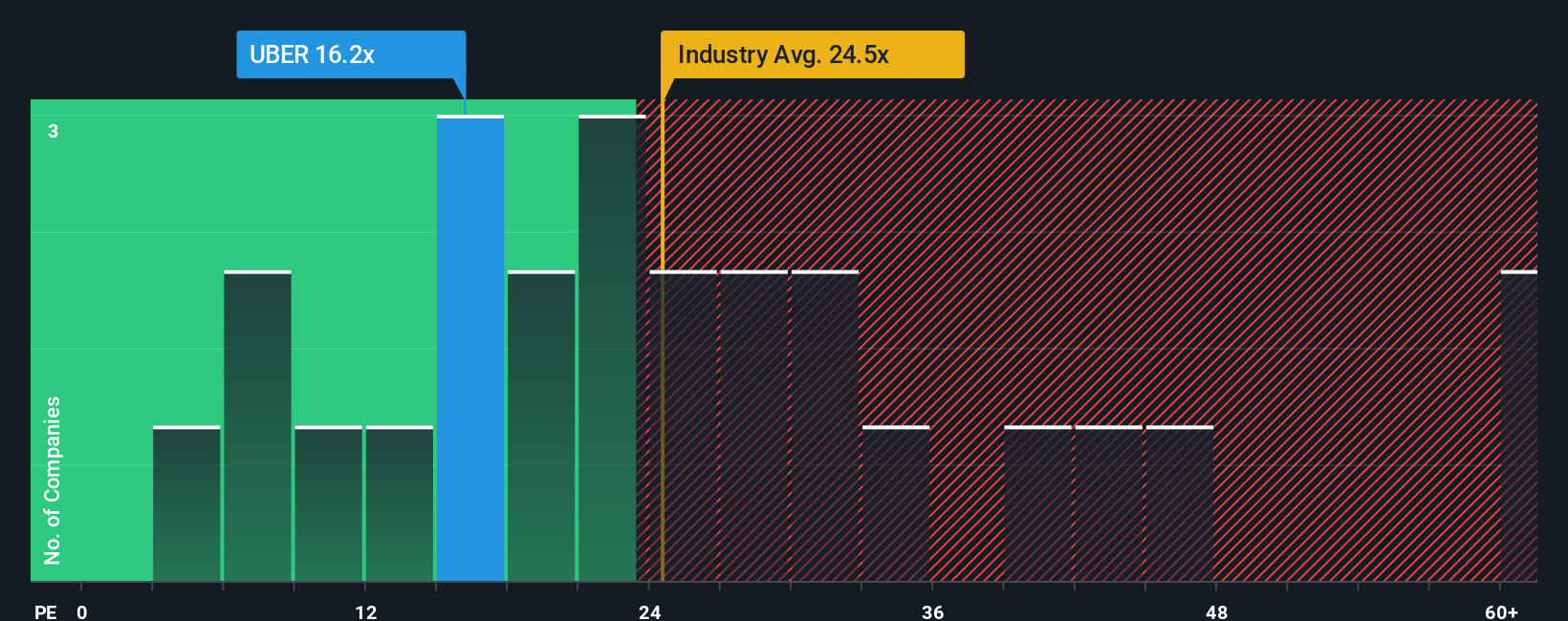

While the user narrative points to overvaluation, another lens suggests the opposite. Comparing Uber’s price-to-earnings ratio of 11.6x to industry peers averaging 27.6x and a fair ratio of 13.5x paints Uber as attractively valued relative to both competitors and what the market might eventually expect. Does this disconnect offer an overlooked chance, or is there risk in these expectations not playing out?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Uber Technologies Narrative

If these perspectives don't match your own, or you’d rather reach your own conclusions, crafting a personalized thesis takes just a few minutes. Do it your way.

A great starting point for your Uber Technologies research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investing goes beyond a single stock, and now is the time to target opportunities that others might overlook. Choose your next move with one of these powerful tools:

- Capture firsthand the potential behind blockchain innovation and digital asset trends with these 81 cryptocurrency and blockchain stocks.

- Boost your income portfolio and spot companies offering attractive yields by checking out these 20 dividend stocks with yields > 3%.

- Target forward-thinking healthcare trends by tapping into top players in artificial intelligence with these 33 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives