- United States

- /

- Transportation

- /

- NYSE:UBER

How Uber’s 52.8% Rally and Expansion Shape Its 2025 Valuation Prospects

Reviewed by Bailey Pemberton

- Wondering if Uber Technologies has finally crossed into true value territory? You are not alone, with investors everywhere eyeing this stock’s next move.

- Uber’s shares have delivered a remarkable 52.8% gain so far this year and are up an impressive 31.7% over the past twelve months, highlighting both its growth story and shifting sentiment.

- Recent headlines have spotlighted Uber’s expansion into new markets and ongoing innovations in its mobility and delivery segments, catching the attention of both retail and institutional investors. These developments have been cited as drivers behind the company’s surging share price and newfound attention from analysts.

- With a valuation score of 5 out of 6 underscoring just how attractive the stock looks by conventional checks, we are set to dig into how the market is really valuing Uber before exploring an even broader perspective that could matter most for investors.

Approach 1: Uber Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future free cash flows and discounting them back to today's dollars. This method helps clarify what Uber Technologies could be worth based on its actual ability to generate cash in the coming years.

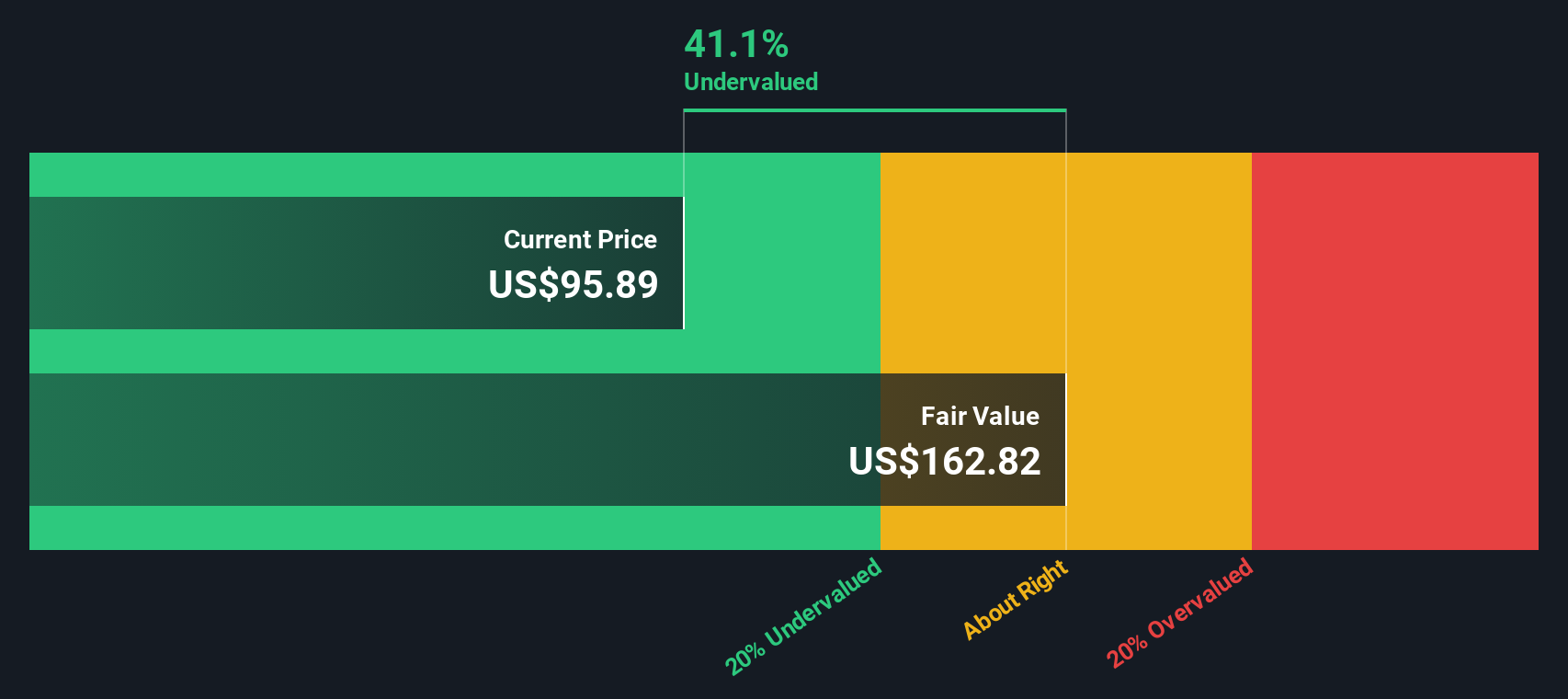

Currently, Uber is generating Free Cash Flow of $8.49 Billion. Analyst estimates suggest this figure will continue to rise, projecting Free Cash Flow of $16.84 Billion by 2029. While analysts typically look only five years ahead, projections beyond that are extrapolated by Simply Wall St. This growth outlook is based on a 2 Stage Free Cash Flow to Equity model, specifically tailored to Uber’s financial lifecycle.

The results of this model point to an intrinsic value of $170.51 per share, significantly above recent trading levels. In fact, the DCF suggests that Uber shares are trading at a 43.4% discount. This means the stock appears substantially undervalued according to these projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Uber Technologies is undervalued by 43.4%. Track this in your watchlist or portfolio, or discover 832 more undervalued stocks based on cash flows.

Approach 2: Uber Technologies Price vs Earnings

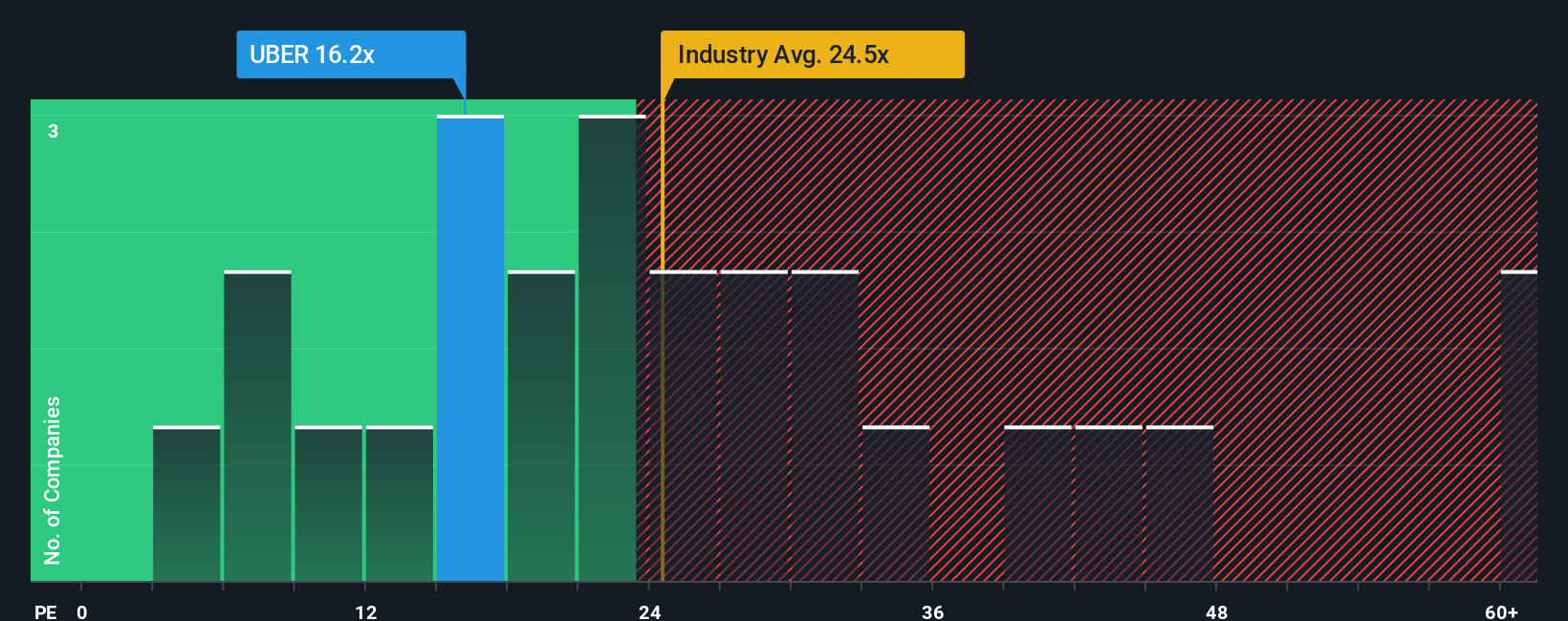

The Price-to-Earnings (PE) ratio is a widely used valuation multiple for profitable companies like Uber Technologies. It quickly illustrates how much investors are willing to pay for each dollar of earnings today. This metric is especially relevant for firms with consistent bottom-line profits, as it sheds light on the market’s expectations for continued growth and profitability.

Determining whether a PE ratio is “normal” or “fair” depends on several factors. Companies expected to grow rapidly or those perceived as lower risk can often justify higher PE ratios. In contrast, slower-growing or riskier businesses typically trade at lower PE multiples.

Currently, Uber trades at a PE ratio of 15.94x. This is well below the average PE of 26.95x across the Transportation industry and even further below the peer group average of 38.34x. However, benchmarks like these do not account for company-specific factors that may warrant a higher or lower PE.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio, calculated at 16.94x for Uber, reflects a tailored benchmark based on Uber’s own earnings growth, profit margin, risks, industry factors, and market cap. Unlike raw comparisons to industry or peers, this method gives a more nuanced and individualized assessment for investors.

Comparing Uber’s actual PE ratio (15.94x) to the Fair Ratio (16.94x), the two figures are extremely close. This suggests that Uber’s shares are trading at very reasonable levels based on its earnings, growth potential, and risk profile.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Uber Technologies Narrative

Earlier we mentioned a better way to understand valuation, so let's introduce you to Narratives, a dynamic approach that connects your personal perspective on a company's future to real financial forecasts and an estimated fair value.

A Narrative is simply the story you believe about Uber Technologies: what the next few years hold, how revenues, earnings, and margins may shift, and why. Narratives let you move beyond the surface of valuation ratios by linking your expectations for Uber's business, such as expansion into new markets or risks from competition, directly with projected numbers for revenue, profit, and share price.

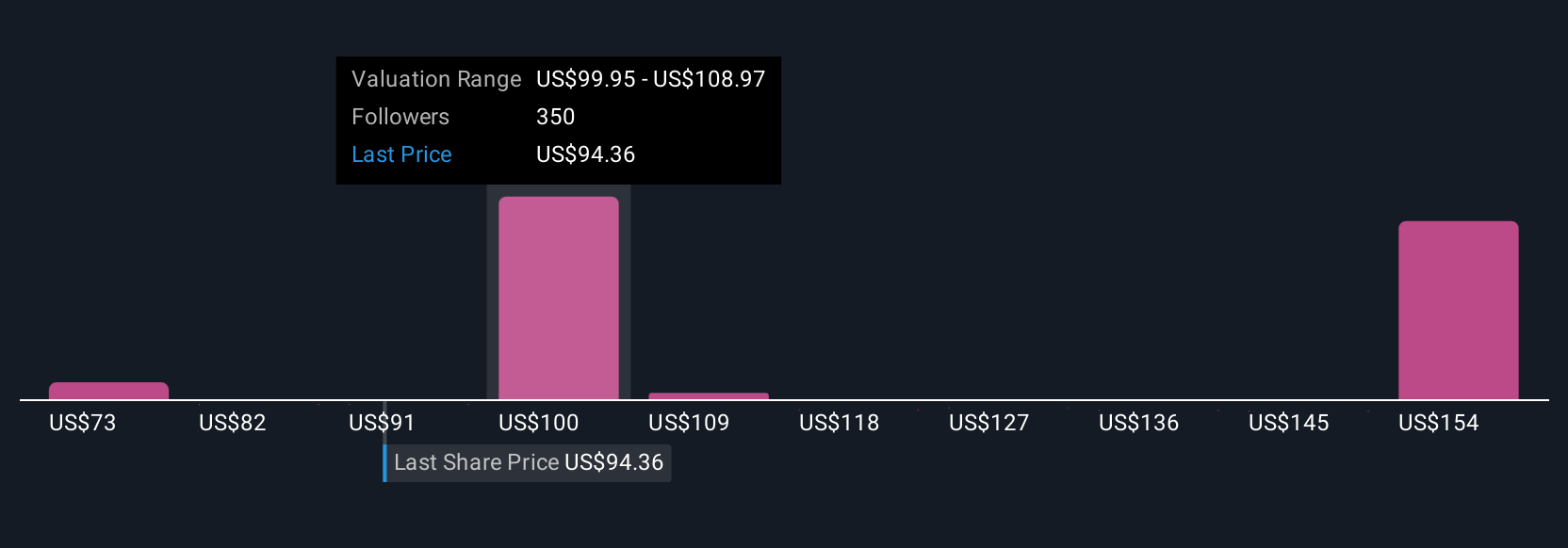

This process makes investing much more approachable and is easily done on Simply Wall St's Community page, where millions of investors already share and compare their Narratives. Narratives help you decide whether to buy or sell by showing how your own fair value estimate stacks up against the latest market price.

Importantly, your Narrative updates automatically when new results or major news hits, so your decisions stay current. For example, some investors today see Uber's fair value as high as $108.88 per share, pointing to robust growth and tech leadership, while others calculate a more cautious fair value around $75, reflecting margin and competition risks. Your Narrative helps clarify which belief drives your decision.

For Uber Technologies, we'll make it really easy for you with previews of two leading Uber Technologies Narratives:

- 🐂 Uber Technologies Bull Case

Fair Value: $108.88

Undervalued by: 11.36%

Expected Revenue Growth: 14.71%

- Robust revenue growth driven by user expansion, cross-platform initiatives, and targeted promotions is deepening customer engagement and retention.

- Strategic investments in autonomous vehicles, electrification, and high-margin services aim to boost long-term profitability and maintain a competitive edge.

- Analysts project Uber can sustain industry leadership and higher market share, though risks remain around regulatory pressures and capital intensity.

- 🐻 Uber Technologies Bear Case

Fair Value: $75.00

Overvalued by: 28.67%

Expected Revenue Growth: 4.2%

- Uber displays strong recent profitability and cash flow, but the current market price is seen as significantly above intrinsic value, with limited margin of safety.

- The bear case expects moderate long-term growth, projecting that future gains, especially from autonomous vehicles, may already be priced in.

- Sustainable value would require a much lower entry price, with this narrative suggesting an attractive range of $65 to $75 per share.

Do you think there's more to the story for Uber Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives