- United States

- /

- Transportation

- /

- NYSE:UBER

Could Uber’s (UBER) Abu Dhabi Robotaxi Launch Reveal a Shift in Its Autonomous Strategy?

Reviewed by Sasha Jovanovic

- WeRide and Uber Technologies recently launched Level 4 fully driverless robotaxi operations in Abu Dhabi, marking the first such deployment in the Middle East and the first city outside the US to host fully autonomous rides on the Uber platform.

- This milestone not only expands Uber's autonomous footprint internationally, but also signals accelerating industry adoption of self-driving mobility solutions through regulatory support and ongoing operational partnerships.

- We'll explore how Uber's first fully autonomous robotaxi launch outside the US could reshape its investment narrative and long-term outlook.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Uber Technologies Investment Narrative Recap

To own Uber Technologies as a shareholder, you need to believe in its ambition to lead global mobility through scale, technology, and ecosystem integration, particularly in autonomous vehicles, delivery, and on-demand services. The launch of fully driverless robotaxis in Abu Dhabi strengthens Uber’s AV credentials, but the most important short-term catalyst remains achieving profitable scale in autonomous fleets; the key risk is that execution missteps or slower-than-expected AV adoption could prolong unprofitable operations. The new service marks global progress for Uber, though its impact on near-term financials is not material yet.

Among the company’s recent announcements, the partnership with Starship Technologies to deploy Level 4 autonomous sidewalk robots in the UK and beyond directly relates to Uber’s broader AV strategy. Both the Abu Dhabi robotaxi launch and this new delivery initiative highlight Uber's multi-modal approach and reinforce the company’s bet that automation will drive efficiency and long-term margin expansion.

Yet, as Uber pushes further into autonomy, investors should also be alert to ongoing pressure from capital intensity and uncertain scaling timelines for AV operations if...

Read the full narrative on Uber Technologies (it's free!)

Uber Technologies' narrative projects $71.2 billion revenue and $9.7 billion earnings by 2028. This requires 14.6% yearly revenue growth and a $2.9 billion decrease in earnings from $12.6 billion currently.

Uncover how Uber Technologies' forecasts yield a $110.55 fair value, a 32% upside to its current price.

Exploring Other Perspectives

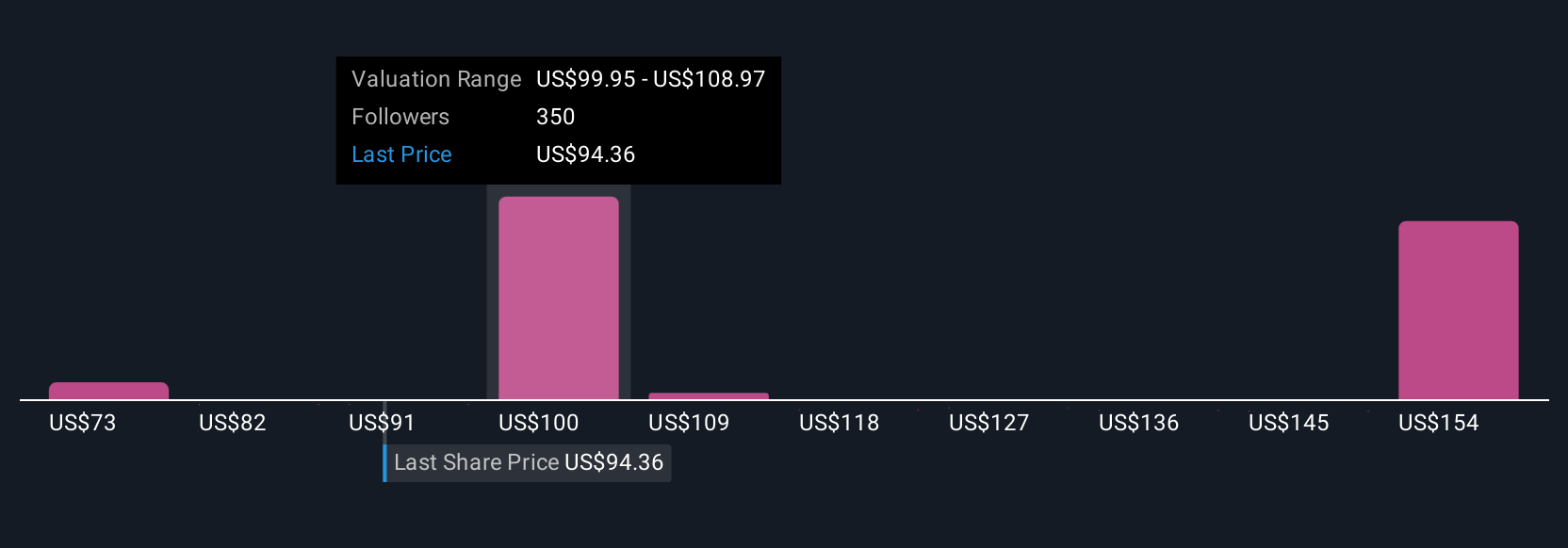

Fifty-seven members of the Simply Wall St Community estimate Uber’s fair value from US$75 up to US$168, with many pricing scenarios in between. With so much variation, it’s clear opinions differ, especially as Uber’s capital-heavy bet on driverless technology could enhance returns, or extend cash burn if commercial gains take longer to emerge.

Explore 57 other fair value estimates on Uber Technologies - why the stock might be worth over 2x more than the current price!

Build Your Own Uber Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Uber Technologies research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Uber Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Uber Technologies' overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UBER

Uber Technologies

Develops and operates proprietary technology applications in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success