- United States

- /

- Transportation

- /

- NYSE:SNDR

Schneider National (SNDR): Margins Tick Higher, Challenging Bearish Profitability Narratives

Reviewed by Simply Wall St

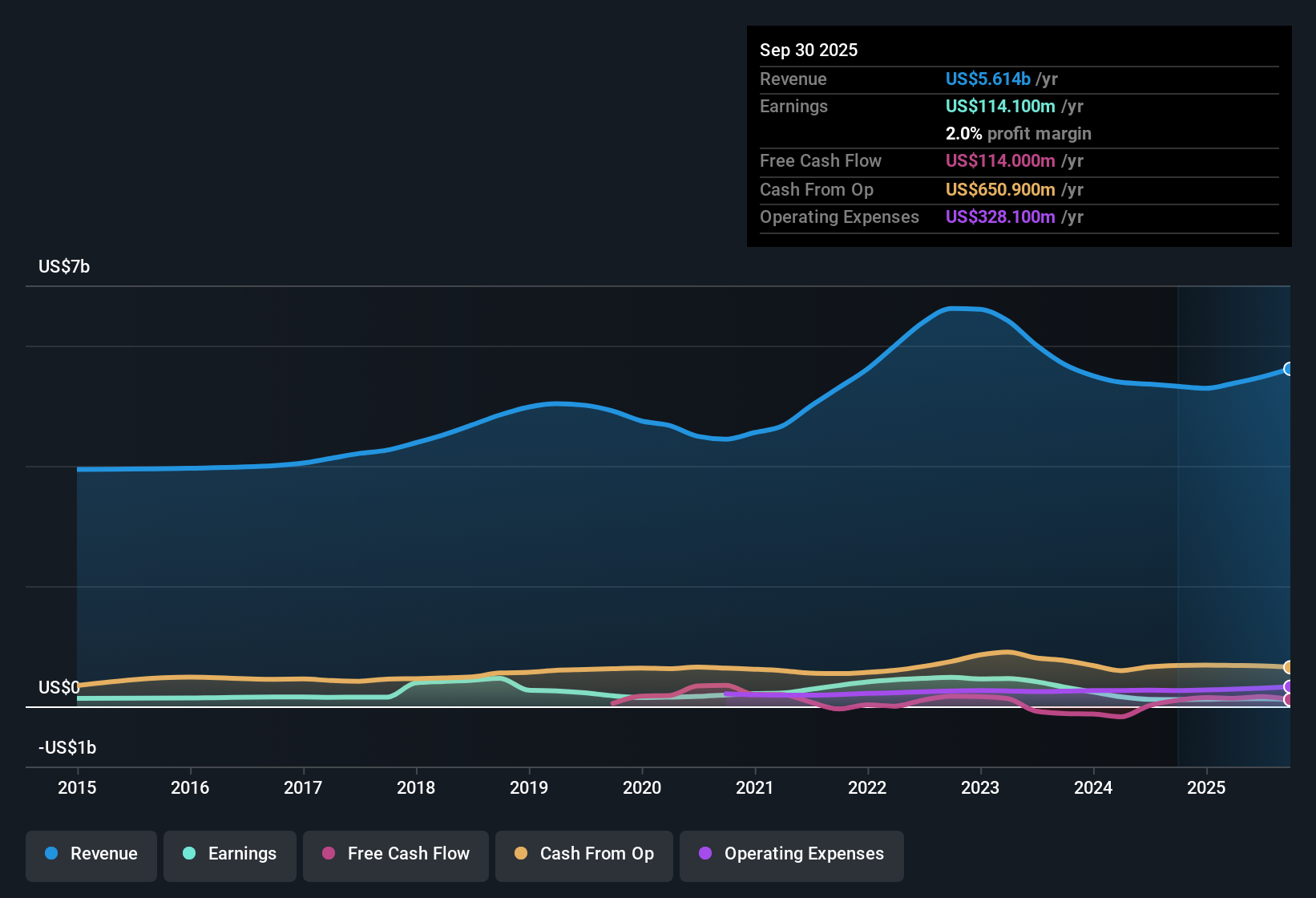

Schneider National (SNDR) reported a year-over-year net profit margin of 2.3%, up from 2.2% last year, alongside 7.3% earnings growth. This performance stands in stark contrast to its average annual earnings decline of 14.4% over the previous five years. Looking ahead, revenue is forecast to grow at 4.9% per year, trailing the broader US market's 10.3%. The company's Price-to-Earnings ratio of 28.3x remains above both its industry and peer averages. Investors are weighing a modest improvement in profitability against relatively high valuation, with the outlook shaped by moderate revenue prospects and newly stabilizing margins.

See our full analysis for Schneider National.Next, we will put these headline results up against the prevailing narratives on Simply Wall St, highlighting where the numbers confirm common views and where expectations might need to shift.

See what the community is saying about Schneider National

Margin Expansion Outpaces Forecasts

- Analysts now expect Schneider National's profit margins to rise from the current 2.3% to 5.2% over the next three years. This would almost double margin levels if achieved.

- According to the analysts' consensus view, the company’s continued investment in technology and cost reduction initiatives is expected to protect margins even as costs rise. Specific factors include:

- Enhanced operational efficiency and digital freight platforms are projected to drive sustainable margin gains as volumes recover.

- Ongoing cost inflation and regulatory demands remain barriers, with earnings resilience highly dependent on expense control.

Consensus narrative points to better cash flow prospects if these margin targets are hit despite sector headwinds. 📊 Read the full Schneider National Consensus Narrative.

Revenue Growth Trails Industry Pace

- Schneider National is forecast to grow revenue at 4.9% per year, underperforming the broader US market's 10.3% annual rate and signaling only modest top-line acceleration.

- Analysts' consensus highlights that while the expansion of intermodal and dedicated logistics offerings diversifies revenue streams,

- Persistent market pressure from rising costs and shifting shipper preferences may cap revenue gains below peer averages.

- Strategic rail partnerships and e-commerce trends create opportunities. However, growth could lag unless volume trends improve.

Valuation Sits Between Discounted Cash Flow and Peer Multiples

- Schneider National trades below its DCF fair value of $22.08 at a current share price of $20.25. Its price-to-earnings ratio of 28.3x remains above the peer average of 24.9x and the US Transportation industry’s 25.8x.

- Analysts' consensus view argues that sustained earning improvements and visible recurring revenues support a higher valuation, but:

- A future PE ratio of 17.9x, based on analysts’ 2028 profit estimates, would imply significant multiple contraction even if earnings targets are met.

- The ongoing valuation premium signals optimism for margin resilience. However, it leaves little room for error if costs outpace forecasted benefits.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Schneider National on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the results? Share your view and shape your own narrative, all in just a few minutes. Do it your way

A great starting point for your Schneider National research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Schneider National’s below-market revenue growth and need for margin resilience highlight inconsistent top-line expansion and uncertainty around future earnings stability.

If steady performance matters to you, use our stable growth stocks screener (2112 results) tool to target companies that consistently deliver reliable revenue and earnings growth, cycle after cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SNDR

Schneider National

Provides multimodal surface transportation and logistics solutions in the United States, Canada, and Mexico.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives