- United States

- /

- Marine and Shipping

- /

- NYSE:NMM

Navios Maritime Partners (NYSE:NMM): Assessing Valuation Following Fleet Sales, New Deliveries, and Long-Term Charters

Reviewed by Kshitija Bhandaru

Navios Maritime Partners (NYSE:NMM) just completed a flurry of transactions, including the sale of two dry bulk vessels, the pending sale of a tanker, and the delivery of a new product tanker that is now on long-term charter. Investors are paying close attention as these deals increase contracted revenue and highlight the company’s approach to fleet management and cash flow stability.

See our latest analysis for Navios Maritime Partners.

Alongside these operational shakeups, Navios Maritime Partners’ share price has shown signs of renewed momentum, up 11.7% over the last 90 days. However, the one-year total shareholder return remains deep in negative territory at -22.2%. Still, its 3-year and 5-year total returns of 78.6% and 644% respectively put the company’s longer-term outperformance into perspective. This suggests that market sentiment ebbs and flows with shifting fleet strategy and cash flow outlook.

If you’re looking for more investment ideas beyond shipping and want to broaden your search, now is the perfect time to discover fast growing stocks with high insider ownership

With the latest fleet updates and rebound in share price, the main question for investors is clear: Is Navios Maritime Partners undervalued after recent moves, or has the market already priced in the company’s future growth trajectory?

Most Popular Narrative: 31.6% Undervalued

With Navios Maritime Partners' fair value pegged at $66.50, which is well above the last close of $45.47, the most followed narrative suggests the stock could have significant upside. This perspective considers whether the market has priced in future earnings power and how strategic changes could impact long-term value.

“Ongoing fleet renewal, with significant investment in newer, more energy-efficient vessels, positions Navios to capitalize on tightening environmental regulations, resulting in lower operating costs and allowing for premium charter rates, thereby supporting improved net margins and competitive advantage over peers with older fleets.”

The numbers behind this narrative are anything but ordinary. The implied upside is not just anchored by recent fleet news; it is built on ambitious targets for revenue growth and profit margins. Want to know what financial drivers make that fair value possible? The blueprint might surprise you. Dig into the full narrative for details.

Result: Fair Value of $66.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, weaker freight markets or sector overcapacity could undermine earnings growth. These factors present real challenges to the bullish case for Navios Maritime Partners.

Find out about the key risks to this Navios Maritime Partners narrative.

Another View: What Does the SWS DCF Model Say?

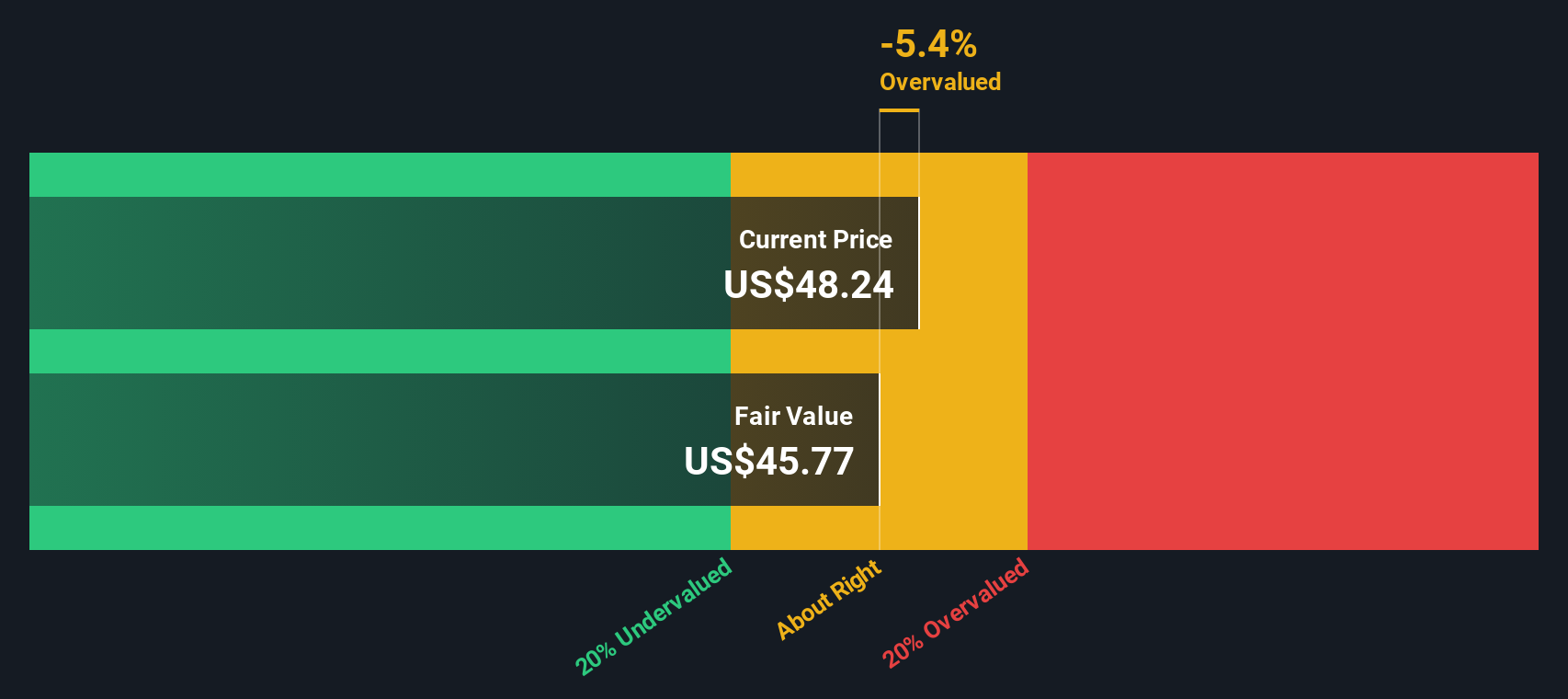

While analyst targets suggest Navios Maritime Partners could be undervalued, our SWS DCF model offers a different perspective. Based on its cash flow projections and a 14.1% discount rate, the DCF estimate comes in just below the current share price. This implies the stock may not be as discounted as it first appears.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Navios Maritime Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Navios Maritime Partners Narrative

If you have a different take or want to dive into the data on your own terms, try building your own perspective. It takes less than three minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Navios Maritime Partners.

Looking for More Investment Ideas?

Smart moves start with knowing where the real opportunities are. Level up your strategy and be first to spot trends that others will wish they hadn't missed.

- Unlock steady cash flow potential by scanning these 18 dividend stocks with yields > 3% offering yields above 3%. This approach is suitable for income-seeking investors searching for market-beating payouts.

- Capitalize on rapid tech shifts by targeting these 24 AI penny stocks that are changing the game with artificial intelligence innovations in every sector.

- Get ahead of Wall Street by zeroing in on these 878 undervalued stocks based on cash flows based on solid fundamentals and attractive price-to-cash flow valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navios Maritime Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NMM

Navios Maritime Partners

Owns and operates dry cargo vessels in Asia, Europe, North America, and Australia.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives