- United States

- /

- Marine and Shipping

- /

- NYSE:MATX

Does Matson's (MATX) Lower Outlook and Innovation Push Signal a Shift in Strategic Priorities?

Reviewed by Sasha Jovanovic

- Matson, Inc. recently reported third quarter results showing year-over-year declines in sales, revenue, and net income, while also providing guidance for a further 30% lower operating income in the upcoming quarter and completing a multi-year share buyback totaling over US$1.18 billion.

- Separately, Matson announced it became the first container shipping company to deploy advanced whale detection technology developed with the Woods Hole Oceanographic Institution, reflecting an investment in environmental stewardship and operational safety.

- We'll examine how Matson's cautious earnings outlook and commitment to innovation may alter its investment narrative moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

Matson Investment Narrative Recap

For investors to own Matson, I think you have to believe in the long-term resilience of the company’s core shipping lanes in the Pacific and its ability to adapt to shifting global trade, even as short-term uncertainties mount. The company’s latest results, including a projected 30% drop in Q4 operating income, keep volatility and persistent demand headwinds in focus, but do not drastically alter the importance of demand stabilization and freight rate recovery as the key near-term catalyst. The most pressing risk remains sustained weakness in transpacific volumes, particularly in China-related routes, which could dampen both earnings and sentiment if not reversed soon.

Among recent announcements, Matson’s rollout of advanced whale detection technology with the Woods Hole Oceanographic Institution stands out. While not directly tied to quarterly earnings, this move signals an investment in operational efficiency and environmental safety that could support its premium service positioning, especially if regulatory pressures or customer expectations in protected markets rise further. But while innovation offers a potential edge, investors should weigh it against immediate concerns about freight demand and profit margins.

By contrast, investors should be aware that persistent uncertainty in global trade and tariff changes could...

Read the full narrative on Matson (it's free!)

Matson's outlook projects $3.4 billion in revenue and $289.2 million in earnings by 2028. This is based on a forecast annual revenue decline of 0.3% and a decrease in earnings of $204.9 million from current earnings of $494.1 million.

Uncover how Matson's forecasts yield a $144.00 fair value, a 35% upside to its current price.

Exploring Other Perspectives

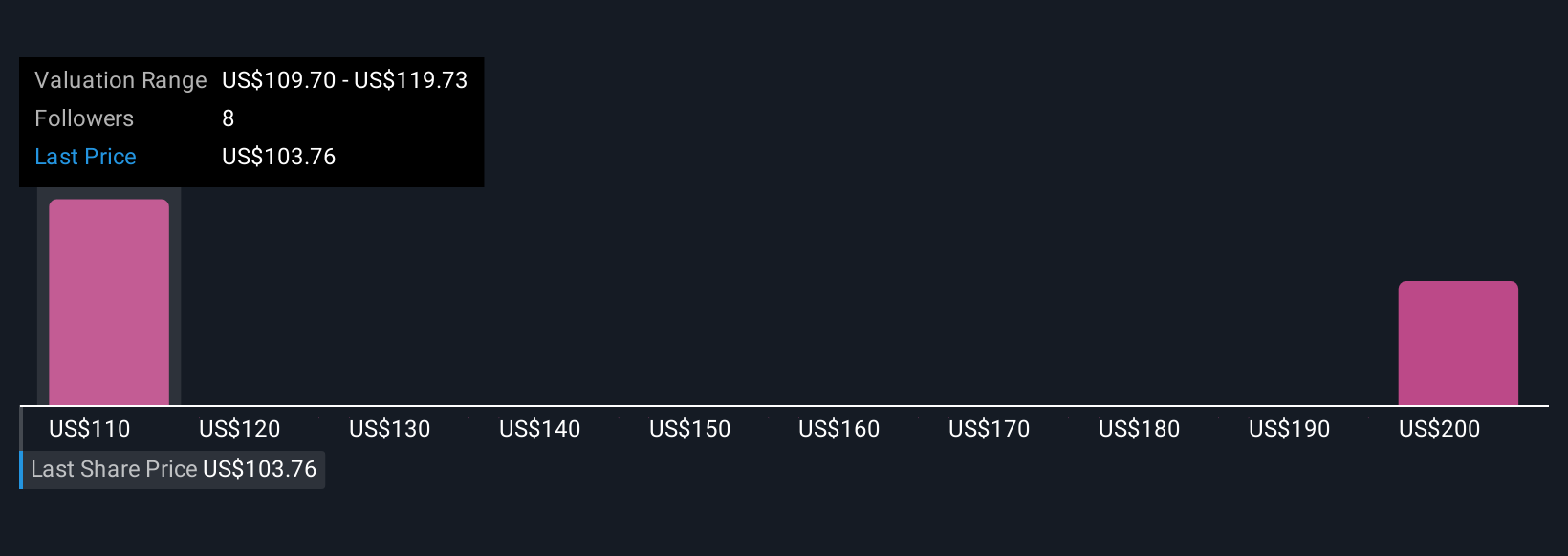

The Simply Wall St Community has posted eight distinct fair value estimates for Matson, stretching from US$92 to US$210 per share. With global freight volumes and earnings guidance both under pressure, your own assessment of the company's earnings stability could shift your outlook significantly, explore how other investors see it.

Explore 8 other fair value estimates on Matson - why the stock might be worth as much as 97% more than the current price!

Build Your Own Matson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Matson research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Matson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Matson's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MATX

Matson

Engages in the provision of ocean transportation and logistics services.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives