- United States

- /

- Airlines

- /

- NYSE:LUV

Will Flight Reductions Challenge Southwest Airlines' (LUV) Operational Edge Amid New Partnership Push?

Reviewed by Sasha Jovanovic

- Southwest Airlines faced significant operational disruptions earlier this month, leading the major U.S. carriers in canceled flights at its Dallas Love Field hub following FAA-mandated flight cuts tied to the ongoing government shutdown.

- This disruption occurred as the airline recently expanded its international partnerships, including a new agreement between Philippine Airlines and Southwest to connect transoceanic travelers through major U.S. gateways.

- We'll explore how the recent FAA-mandated flight reductions could weigh on Southwest's margin outlook and operational efficiency narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Southwest Airlines Investment Narrative Recap

For shareholders, the long-term vision rests on Southwest Airlines' ability to restore operational efficiency and capitalize on loyalty, distribution, and network expansion to drive margin recovery. The recent FAA-mandated flight cuts represent a short-term risk to this narrative, with implications for near-term earnings pressure and cost structure. However, this disruption does not appear to fundamentally alter the biggest catalyst, new initiatives around premium and assigned seating that remain underway, but it magnifies the operational risk around schedule stability for now.

Among recent announcements, the new partnership with Philippine Airlines stands out. It brings expanded Pacific connectivity through key U.S. gateways, aligning with Southwest's drive to reach new customer segments, a critical short-term catalyst as the airline works to offset demand challenges and margin compression. This increased international exposure could help diversify revenue streams but will still depend on stabilized domestic operations to reach its full potential.

By contrast, investors should be aware that operational disruptions from mandated flight cuts could have ripple effects on…

Read the full narrative on Southwest Airlines (it's free!)

Southwest Airlines’ outlook forecasts $32.6 billion in revenue and $1.9 billion in earnings by 2028. Achieving this projection would require 5.9% annual revenue growth and an increase in earnings of $1.5 billion from the current $392 million.

Uncover how Southwest Airlines' forecasts yield a $34.07 fair value, in line with its current price.

Exploring Other Perspectives

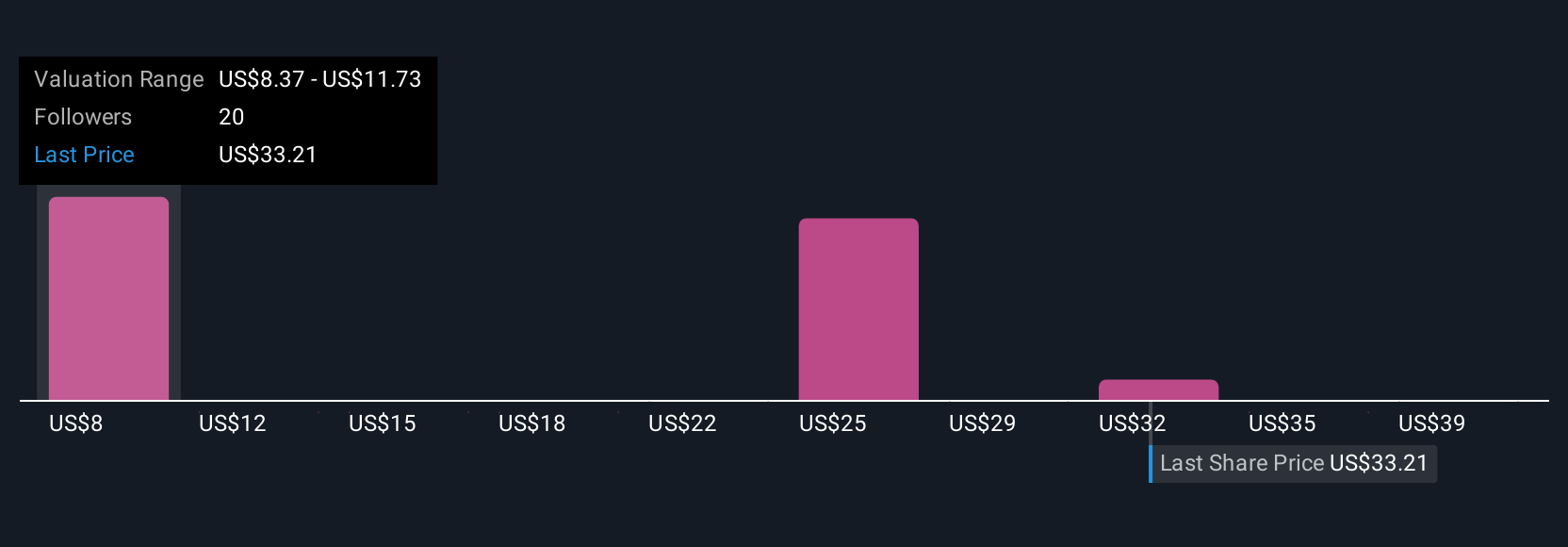

Seven members of the Simply Wall St Community assign fair values ranging from US$8.06 to US$45.91 per share. With this broad spectrum of views, consider how recent volatility in flight operations could further weigh on revenue predictability and near-term earnings potential.

Explore 7 other fair value estimates on Southwest Airlines - why the stock might be worth less than half the current price!

Build Your Own Southwest Airlines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southwest Airlines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Southwest Airlines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southwest Airlines' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUV

Southwest Airlines

Operates as a passenger airline company that provides scheduled air transportation services in the United States and near-international markets.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives