- United States

- /

- Airlines

- /

- NYSE:LUV

Why Southwest Airlines (LUV) Is Up 6.1% After Launching New Hawaii Route and Onboard Upgrades

Reviewed by Sasha Jovanovic

- Southwest Airlines has announced it will begin daily nonstop service between Ontario International Airport and Honolulu in June 2026, while also introducing new onboard amenities like assigned and premium seating, free Wi-Fi for loyalty program members, and in-seat power on its Boeing 737 MAX 8 fleet.

- This move will double available seats on the Ontario-Honolulu route and marks a significant enhancement for Los Angeles-area travelers, reflecting Southwest's continued focus on expanding its California and Hawaii offerings.

- We'll examine how Southwest's new Hawaii route and onboard enhancements may shift its investment narrative and growth prospects.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Southwest Airlines Investment Narrative Recap

For shareholders of Southwest Airlines, the long-term case centers on the airline’s ability to expand its network, manage costs, and differentiate through passenger experience upgrades. Southwest’s move to double seats on the Ontario-Honolulu route and introduce premium onboard features are important operational milestones, but they may not directly address the ongoing uncertainty in leisure travel demand, which remains the most significant short-term catalyst, and risk, for the stock. These enhancements will likely strengthen Southwest's market position in the West Coast–Hawaii corridor, but unless leisure booking trends show improvement, their overall impact could be limited. Of recent company developments, the announcement of a quarterly cash dividend of US$0.18 per share stands out. This payout reflects stability in capital returns amid expansion, though dividend sustainability could face pressure if economic headwinds persist or operational costs rise unexpectedly. Yet, unlike the excitement around new routes, there are critical operational and demand risks investors should be aware of...

Read the full narrative on Southwest Airlines (it's free!)

Southwest Airlines' outlook anticipates $32.6 billion in revenue and $1.9 billion in earnings by 2028. Achieving this would require a 5.9% annual revenue growth rate and an increase in earnings of about $1.5 billion from the current $392.0 million.

Uncover how Southwest Airlines' forecasts yield a $34.23 fair value, in line with its current price.

Exploring Other Perspectives

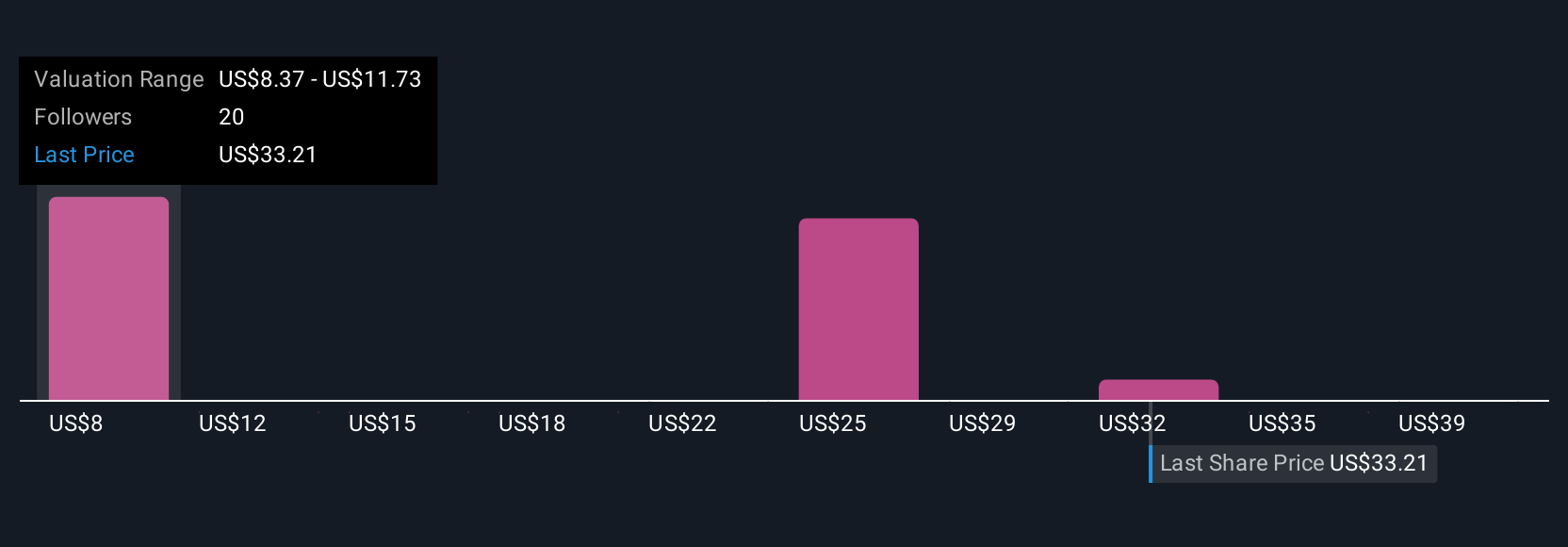

Simply Wall St Community members provided seven fair value estimates for Southwest Airlines, ranging from US$8.11 to US$45.91. While several see upside in new route launches, uncertainty in leisure travel demand remains a central theme suggesting careful monitoring of earnings potential is wise.

Explore 7 other fair value estimates on Southwest Airlines - why the stock might be worth less than half the current price!

Build Your Own Southwest Airlines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Southwest Airlines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Southwest Airlines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Southwest Airlines' overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUV

Southwest Airlines

Operates as a passenger airline company that provides scheduled air transportation services in the United States and near-international markets.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026