- United States

- /

- Airlines

- /

- NYSE:LUV

Southwest Airlines (LUV): Assessing Valuation After Flight Cuts and FAA Disruptions at Dallas Love Field

Reviewed by Simply Wall St

Southwest Airlines (LUV) has been at the center of attention after the FAA required airlines to cut flights at Dallas Love Field because of the ongoing government shutdown, which has led to hundreds of cancellations. Investors are examining what these disruptions might mean for the company’s outlook.

See our latest analysis for Southwest Airlines.

Share price momentum at Southwest Airlines has been choppy, with recent government shutdown-related disruptions sparking caution among investors. Even though new international partnerships and a key investor relations hire signal long-term ambition, the stock’s total return over the past year is just 4.2%, while five-year performance remains deep in the red. This highlights lingering market skepticism about a swift turnaround.

If these headline swings in the airline industry have you curious about other fast movers, this could be the ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With ongoing turbulence both operationally and in the share price, the big question now is whether investors are looking at an overlooked value play or if the current market price already reflects Southwest’s true prospects for future growth.

Most Popular Narrative: 3% Undervalued

With Southwest Airlines closing at $33.04 and the narrative fair value set at $34.07, the current price sits just below the consensus estimate. The market is watching closely to see if the assumptions behind this small premium will play out for shareholders.

Planned introduction of premium and assigned seating, along with basic economy offerings, can enhance revenue yield through differentiated pricing strategies catering to varied consumer preferences. This may potentially boost net margins and overall earnings.

What makes this valuation tick? The future price tag leans on upgraded margins, bold new revenue streams, and a profit surge that could signal a turnaround story. Curious to see which analyst projections, some more aggressive than others, drive this optimistic fair value? Find out what could send the stock higher if these moves deliver as expected.

Result: Fair Value of $34.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing macroeconomic uncertainty and possible delays in aircraft deliveries could quickly undermine these optimistic earnings and margin forecasts for Southwest Airlines.

Find out about the key risks to this Southwest Airlines narrative.

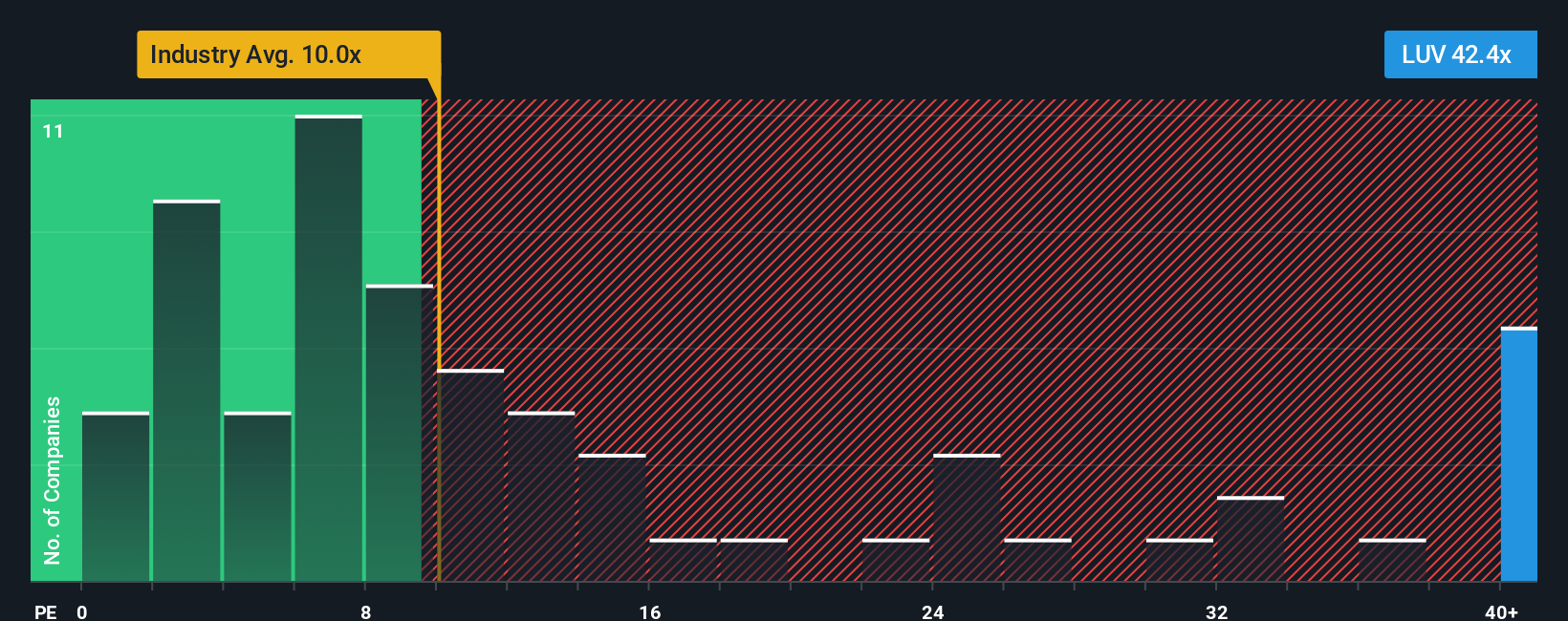

Another View: How Do Valuation Multiples Stack Up?

While the earlier analysis suggests Southwest may have room to run, looking at its price-to-earnings ratio tells a different story. Southwest currently trades at 45.1x earnings, which is much higher than the industry average of 9.2x, its peers at 10.1x, and even the fair ratio of 28.1x. This large gap means investors are paying a significant premium for the stock, which could raise concerns if future growth does not materialize as expected. Is the market too optimistic, or is there something unique justifying this elevated price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Southwest Airlines Narrative

If you want a different perspective or enjoy digging into the numbers yourself, it only takes a few minutes to shape your own view on Southwest Airlines. So why not Do it your way?

A great starting point for your Southwest Airlines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Investment Picks?

Expand your portfolio and stay ahead of the crowd by checking out other high-potential companies and sectors using Simply Wall Street’s tailored screeners.

- Tap into massive yield potential with these 15 dividend stocks with yields > 3%, where you can find companies delivering consistent income and growth opportunities with yields above 3%.

- Spot undervalued gems positioned for strong rebounds by using these 868 undervalued stocks based on cash flows and ensure you never miss out on quality at the right price.

- Ride the AI innovation wave for outsized gains and discover which transformative businesses are making headlines with these 27 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUV

Southwest Airlines

Operates as a passenger airline company that provides scheduled air transportation services in the United States and near-international markets.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives