- United States

- /

- Airlines

- /

- NYSE:LUV

A Fresh Look at Southwest Airlines (LUV) Valuation as Shares Rebound in the Travel Sector

Reviewed by Simply Wall St

Southwest Airlines (LUV) shares climbed nearly 2% in the last trading session, drawing attention as investors weighed its recent performance against a shifting travel sector. The stock's rebound is sparking fresh conversations about underlying fundamentals and outlook.

See our latest analysis for Southwest Airlines.

Southwest’s total shareholder return is up 11.9% over the past year, reflecting some resilience even as its share price has trended slightly lower year to date and over recent months. After a choppy stretch for airline stocks, the latest session’s pop hints at improving sentiment as investors look for signs of renewed momentum and value in the sector.

If news in travel stocks has you looking further afield, now is a great moment to broaden your search and discover See the full list for free.

With earnings rebounding but shares still lagging their historical highs, investors are now left to wonder if Southwest is truly undervalued, or if the market is already factoring in all of its next steps for growth.

Most Popular Narrative: 4.6% Undervalued

With Southwest Airlines closing at $32.20 and the most followed narrative suggesting fair value is $33.76, intrigue builds around whether the stock's recent momentum is grounded in robust fundamentals or optimistic projections.

Planned introduction of premium and assigned seating, along with basic economy offerings, can enhance revenue yield through differentiated pricing strategies catering to varied consumer preferences. This could potentially boost net margins and overall earnings.

Want to find out which profit levers and pricing strategies drive this edge? The real story hides in forecasts for future earnings strength and a shift in how Southwest is expected to compete. Miss the details and you might overlook how key revenue upgrades are shaping this fair value call.

Result: Fair Value of $33.76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing macroeconomic uncertainty and rising competition could challenge Southwest’s recovery. These factors may potentially alter the airline’s revenue outlook in the quarters ahead.

Find out about the key risks to this Southwest Airlines narrative.

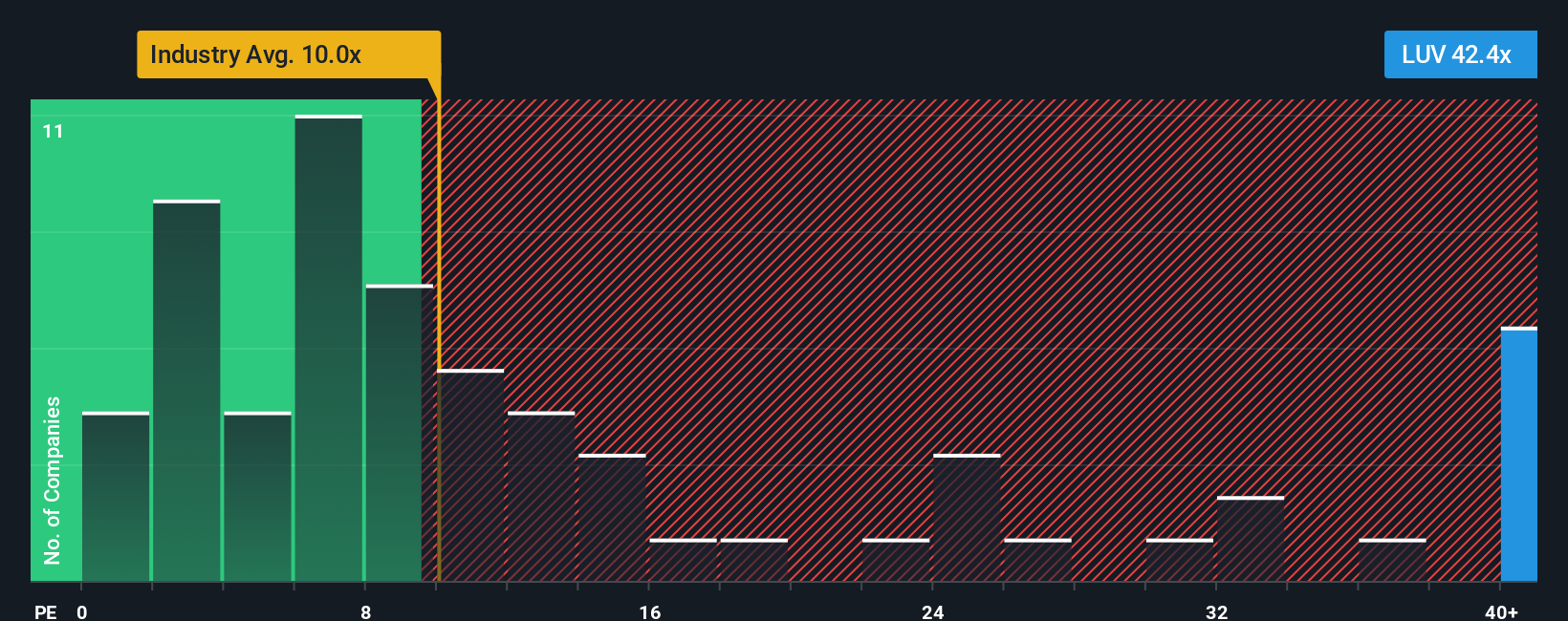

Another View: Multiples Pose a Challenge

Looking at Southwest’s valuation through the lens of its price-to-earnings ratio creates a more cautious picture. At 44.1x, Southwest trades at a steep premium compared to both the industry average (8.8x) and the fair ratio of 29.1x. That gap signals the market might be overestimating its recovery, or at least pricing in optimism not supported by current results. Should investors be wary of paying a high price for potential growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Southwest Airlines Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own view in just a few quick steps. Do it your way

A great starting point for your Southwest Airlines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Stay sharp and get ahead. Simply Wall St’s Screener shows you opportunities many investors are missing. Take action now before the most exciting ideas get snapped up.

- Spot undervalued companies with healthy balance sheets by tapping into these 877 undervalued stocks based on cash flows, and never miss a great value opportunity again.

- Grow your portfolio’s passive income by finding these 17 dividend stocks with yields > 3% with yields over 3% that stand out for solid cash returns.

- Ride the AI revolution by seeking out potential leaders within these 27 AI penny stocks before their breakthroughs hit the headlines.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUV

Southwest Airlines

Operates as a passenger airline company that provides scheduled air transportation services in the United States and near-international markets.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives