- United States

- /

- Marine and Shipping

- /

- NYSE:KEX

Will Strong Q3 Earnings and Upbeat Guidance Reshape Kirby's (KEX) Marine Transportation Narrative?

Reviewed by Sasha Jovanovic

- Earlier this week, Kirby Corporation reported third-quarter 2025 earnings that exceeded analyst expectations and provided positive revenue guidance for its Inland and Coastal operations, while Executive Vice President Amy D. Husted exercised options and sold 10,413 shares for US$1.1 million on November 21, 2025.

- An interesting aspect of this news is the analyst optimism around Kirby's marine transportation segments, driven by improving revenue and margin outlooks in both Inland and Coastal operations.

- We'll explore how Kirby's stronger earnings results and improved revenue guidance shape the context for its investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Kirby Investment Narrative Recap

To be a Kirby shareholder, you need confidence in the company's ability to sustain strong marine transportation demand, secure robust barge utilization, and manage costs, particularly as higher margins and better revenue guidance are driving near-term optimism. The recent Q3 earnings beat reinforces the revenue catalyst, but does not materially reduce the most pressing risk: the potential impact of a softening chemical market and broader macroeconomic volatility on Kirby's core inland business.

Among the recent developments, Kirby’s ongoing share buyback program stands out as most relevant. The company repurchased over 1.8 million shares this past quarter, signaling management’s confidence in its capital allocation discipline, which supports the investment catalyst of optimizing shareholder value amid positive earnings momentum.

However, despite this positive momentum, investors must also consider how persistent inflation and rising labor costs could weigh on margins if pricing power fades, especially as ...

Read the full narrative on Kirby (it's free!)

Kirby's narrative projects $3.9 billion revenue and $445.6 million earnings by 2028. This requires 6.1% yearly revenue growth and a $142.6 million earnings increase from $303.0 million currently.

Uncover how Kirby's forecasts yield a $125.33 fair value, a 11% upside to its current price.

Exploring Other Perspectives

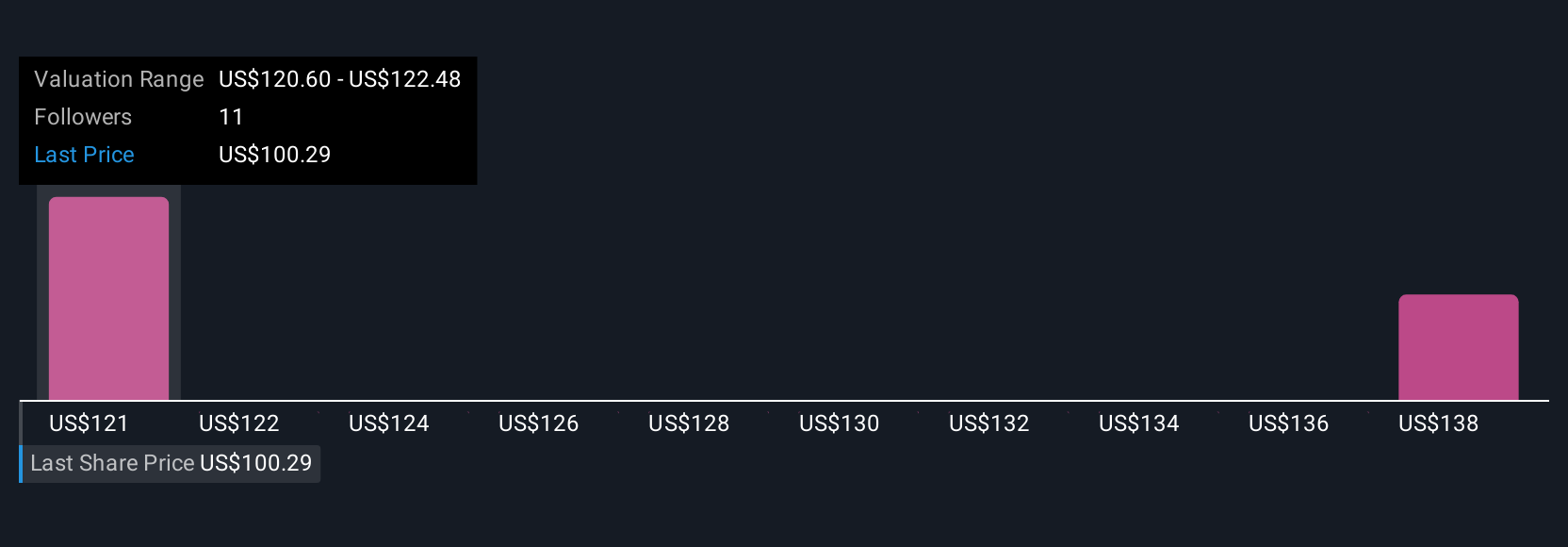

Private investors in the Simply Wall St Community provided two fair value estimates ranging from US$36.84 to US$125.33 per share. As optimism on Kirby’s marine operations grows, this range underlines just how much opinions can vary on the company’s ability to overcome cost challenges and deliver earnings growth.

Explore 2 other fair value estimates on Kirby - why the stock might be worth less than half the current price!

Build Your Own Kirby Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kirby research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Kirby research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kirby's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kirby might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEX

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success