- United States

- /

- Airlines

- /

- NYSE:JOBY

How the First Hybrid-Electric, Autonomous Flight at Joby Aviation (JOBY) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Joby Aviation and L3Harris Technologies recently completed the first flight of Joby’s hybrid-electric, autonomous vertical takeoff and landing demonstrator, targeting both defense and future commercial applications.

- This milestone marks Joby Aviation’s entry into hybrid powertrain technology, expanding its platform beyond all-electric air taxis and opening new opportunities in military logistics and extended-range air mobility.

- Let’s explore how this hybrid demonstrator milestone reshapes Joby Aviation’s investment narrative, particularly through broader defense market access and expanded technology capabilities.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Joby Aviation's Investment Narrative?

To be a shareholder in Joby Aviation right now, you need to have conviction in the company’s ability to pioneer the commercial electric air taxi sector while navigating substantial operating losses and market risk. The recent successful hybrid-electric VTOL demonstrator flight, achieved with L3Harris, injects a new catalyst into the story by positioning Joby for earlier and broader defense market access, alongside their commercial ambitions. While impressive technically, this hybrid milestone doesn't immediately address near-term financial concerns: Joby continues to burn cash and is not expected to reach profitability within three years. Prior catalysts, like FAA certification and launch of passenger service, remain pivotal. However, this defense entry and new technological capability could shift the focus from short-term revenue targets to longer-term potential, which may affect how investors weigh existing risks. Despite this, Joby’s shares did not react materially to the news, which may signal that investors are still heavily focused on execution, certification progress, and the path to profitability.

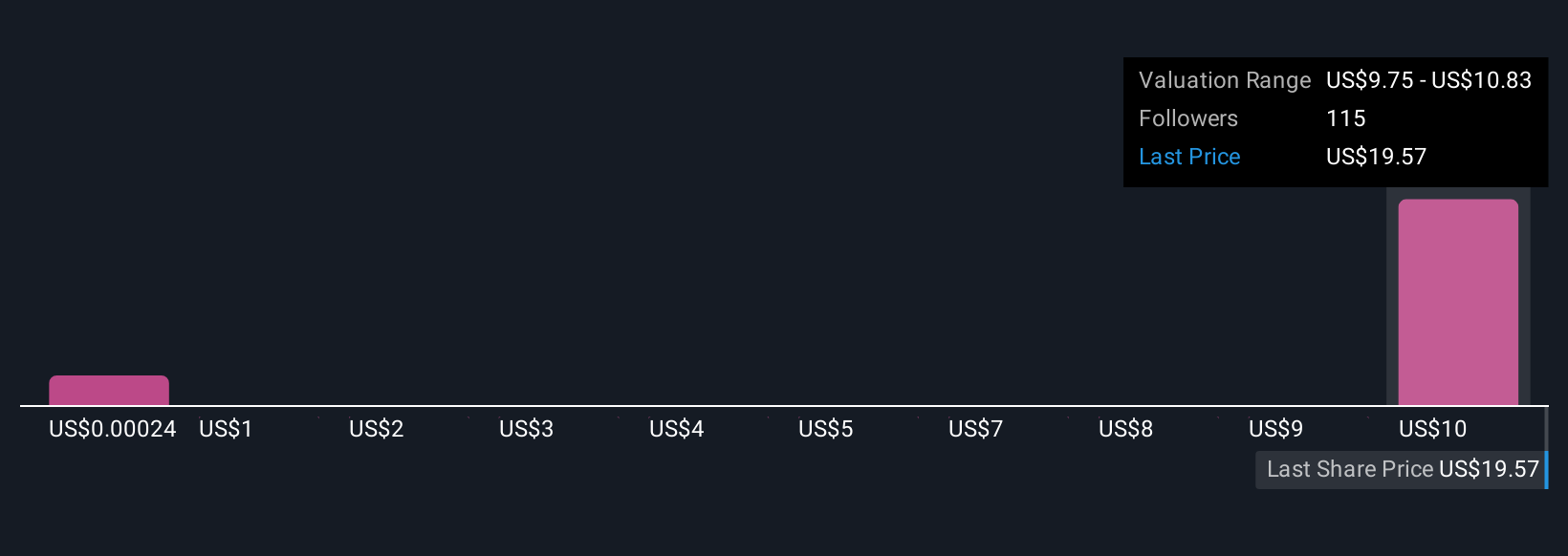

But keep in mind, the scale of Joby's financial losses is something investors should watch closely. The analysis detailed in our Joby Aviation valuation report hints at an inflated share price compared to its estimated value.Exploring Other Perspectives

Explore 13 other fair value estimates on Joby Aviation - why the stock might be worth as much as $12.50!

Build Your Own Joby Aviation Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Joby Aviation research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Joby Aviation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Joby Aviation's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JOBY

Joby Aviation

A vertically integrated air mobility company, engages in building an electric vertical takeoff and landing aircraft optimized to deliver air transportation as a service in the United States and Dubai.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives