- United States

- /

- Airlines

- /

- NYSE:JOBY

Does New Saudi and Dubai Partnerships Signal a Global Breakout Moment for Joby Aviation (JOBY)?

Reviewed by Sasha Jovanovic

- Red Sea Global and The Helicopter Company have announced a memorandum of understanding for Joby Aviation to conduct pre-commercial air taxi flights in Saudi Arabia, with plans for evaluation flights in the first half of 2026 and expanded partnerships announced in Dubai and Kazakhstan.

- This series of new international collaborations highlights Joby Aviation's growing influence in the eVTOL sector as it strengthens regulatory engagement and exclusive agreements across several high-profile markets.

- We'll examine how these partnerships and the deepening regulatory cooperation in the Middle East shape Joby Aviation's investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Joby Aviation's Investment Narrative?

To be a shareholder in Joby Aviation, one has to believe in the company's ability to translate global regulatory wins and high-profile partnerships into real commercial momentum, despite ongoing losses and cash burn. The latest memorandum of understanding with Red Sea Global and The Helicopter Company in Saudi Arabia expands Joby’s geographic reach, but it does not materially change the core short-term catalyst: achieving full regulatory certification and launching commercial services. This remains the single biggest hurdle, as operational milestones in new markets rely on successful certification and the path to profitability still appears distant. The recent financial filings and continued dilution risks also remind investors that funding growth comes at a cost. While partnerships in the Middle East show Joby's growing influence, execution and regulatory approval are still the critical benchmarks investors are watching most closely.

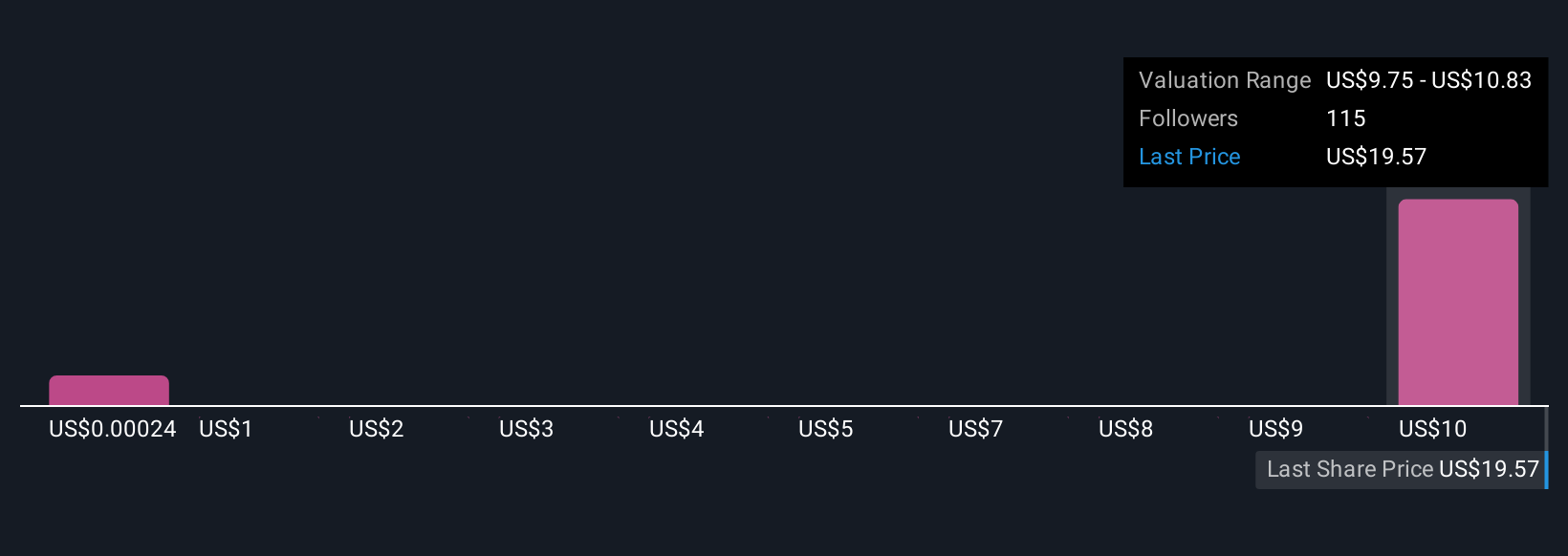

But the scale of further funding needs isn’t the only factor investors should be watching. In light of our recent valuation report, it seems possible that Joby Aviation is trading beyond its estimated value.Exploring Other Perspectives

Explore 13 other fair value estimates on Joby Aviation - why the stock might be worth as much as $12.50!

Build Your Own Joby Aviation Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Joby Aviation research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Joby Aviation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Joby Aviation's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JOBY

Joby Aviation

A vertically integrated air mobility company, engages in building an electric vertical takeoff and landing aircraft optimized to deliver air transportation as a service in the United States and Dubai.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success