- United States

- /

- Logistics

- /

- NYSE:EXPD

How Investors Are Reacting To Expeditors International (EXPD) Earnings Momentum and Export Compliance Focus

Reviewed by Sasha Jovanovic

- Expeditors International recently hosted a discussion led by its exports compliance specialist and trade compliance manager on the basics of exporting out of the U.S.

- This comes as analyst coverage highlights a rising consensus earnings estimate and recognition of Expeditors International’s outperformance within the Transportation sector this year.

- We’ll explore how Expeditors International’s improving earnings outlook reshapes its investment story for current and prospective investors.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Expeditors International of Washington's Investment Narrative?

To have conviction in Expeditors International, you’ll want to believe in the resilience of global logistics and the company’s ability to stay agile amid changing trade environments. Recent strength in earnings estimates and sector outperformance points to positive momentum, with the company’s ongoing cash returns (through dividends and share buybacks) supporting a shareholder-centric approach. The latest export compliance discussion shows Expeditors’ focus on regulatory best practices, but this event isn’t likely to move the needle for near-term business catalysts or change the primary risks, which continue to center on economic cycles, margin pressures, and sector valuation given the premium multiple. The company’s solid year-to-date return, board independence, and experienced management present positives, yet the forecast for slower growth and a relatively rich valuation remain areas for watchfulness.

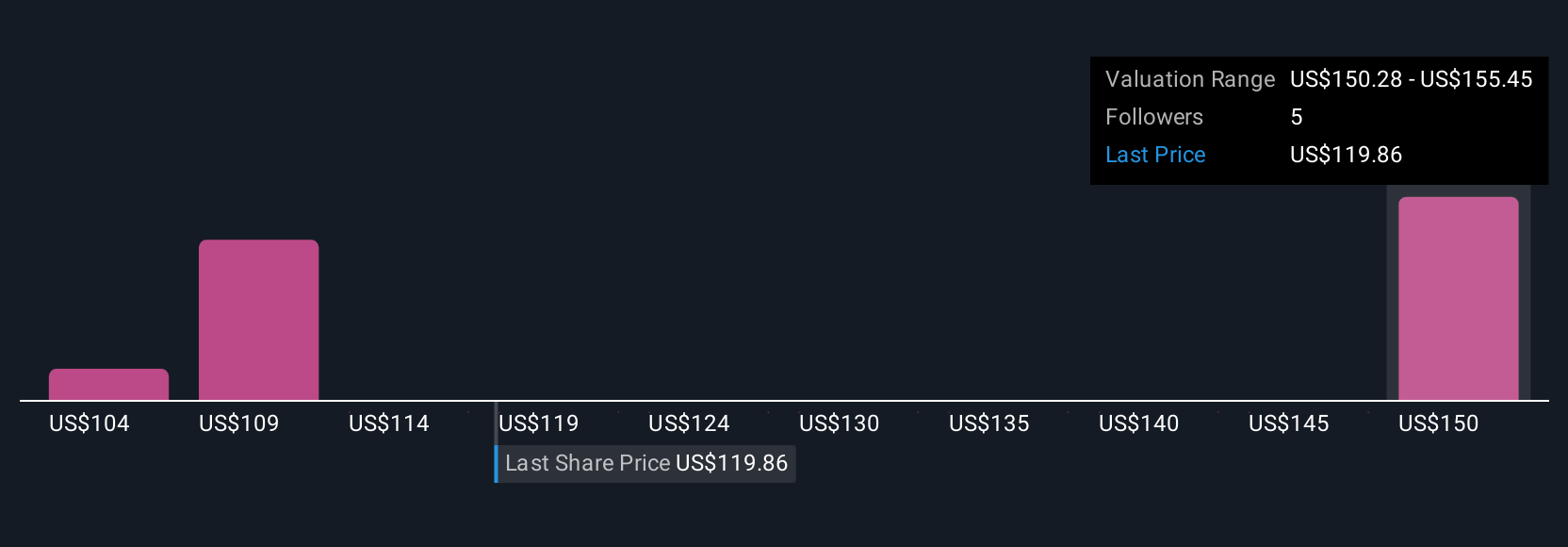

But under the surface, the premium valuation compared to peers is something investors should watch. Expeditors International of Washington's shares have been on the rise but are still potentially undervalued by 22%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on Expeditors International of Washington - why the stock might be worth as much as 28% more than the current price!

Build Your Own Expeditors International of Washington Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Expeditors International of Washington research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Expeditors International of Washington research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Expeditors International of Washington's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expeditors International of Washington might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EXPD

Expeditors International of Washington

Provides logistics services in the Americas, North Asia, South Asia, Europe, and MAIR.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026