- United States

- /

- Logistics

- /

- NYSE:EXPD

How Investors Are Reacting To Expeditors International (EXPD) Falling Revenue Amid Order Postponements

Reviewed by Sasha Jovanovic

- In recent days, Expeditors International of Washington reported declining revenue and lower earnings per share, primarily attributed to customers postponing their orders.

- This trend reflects a broader slowing in demand for logistics and freight forwarding services, raising concerns about the pace of recovery in the sector.

- We'll explore how the impact of customer order postponements has shifted Expeditors International's investment narrative and operational outlook.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Expeditors International of Washington's Investment Narrative?

To be in Expeditors International of Washington for the long haul, you need to have conviction in the company's ability to steer profitably through periods when global trade flows slow down. The recent report of falling revenue and lower earnings per share, driven by customer order delays, may pose a challenge to some of the near-term drivers such as demand normalization and margin stability. This shift calls into question whether the pace of recovery widely expected in the logistics sector will materialize as soon as previously thought. With a new CEO just settling in and further management changes in play, the focus will likely turn to operational efficiency and cost control, rather than growth or aggressive capital returns. The biggest risk now is that these current demand headwinds prove more persistent, stretching a soft patch into a longer-term earnings challenge. All eyes will be on whether recent order trends are a brief setback or signal a deeper shift in logistics demand. Yet there’s an emerging risk of prolonged softness in customer shipping activity that cannot be ignored.

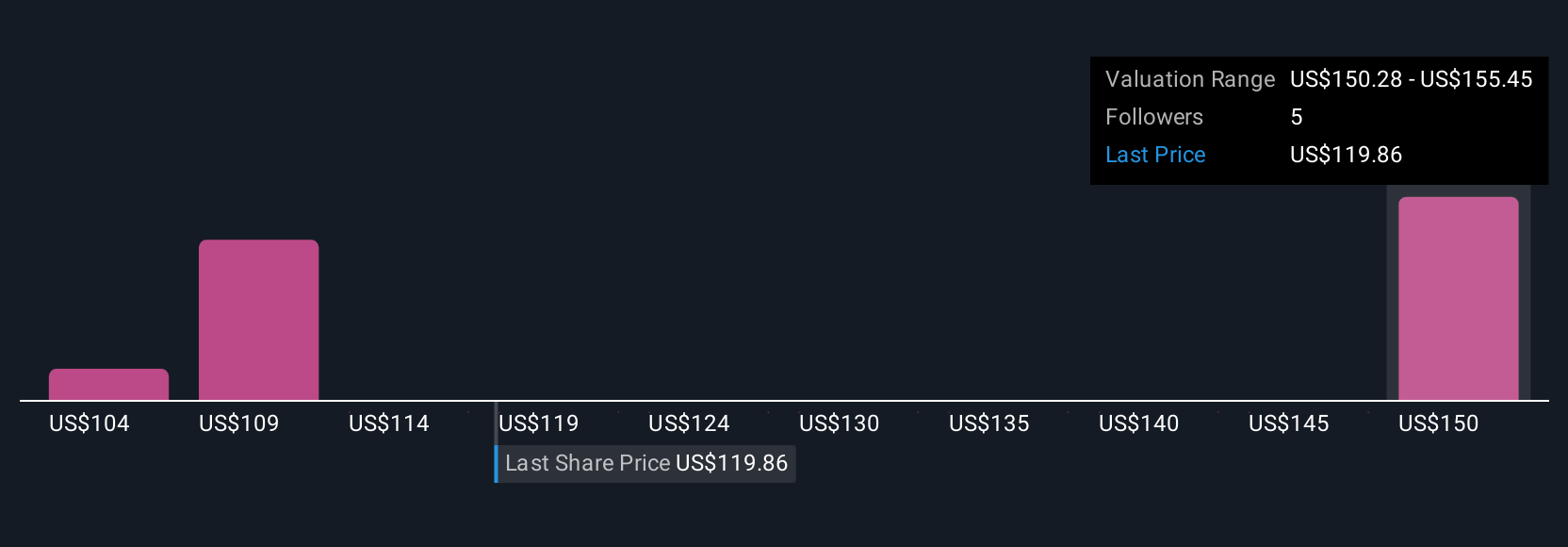

Despite retreating, Expeditors International of Washington's shares might still be trading 22% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on Expeditors International of Washington - why the stock might be worth 13% less than the current price!

Build Your Own Expeditors International of Washington Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Expeditors International of Washington research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Expeditors International of Washington research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Expeditors International of Washington's overall financial health at a glance.

No Opportunity In Expeditors International of Washington?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expeditors International of Washington might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EXPD

Expeditors International of Washington

Provides logistics services in the Americas, North Asia, South Asia, Europe, and MAIR.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives