- United States

- /

- Logistics

- /

- NYSE:EXPD

Expeditors International (EXPD): Is the Current Valuation Justified After Recent Flat Growth?

Reviewed by Simply Wall St

Expeditors International of Washington (EXPD) has seen its stock reflect a mix of small ups and downs recently, with a modest recovery over the past three months. Investors seem to be weighing near-flat growth in revenue and net income as they consider the company’s long-term returns.

See our latest analysis for Expeditors International of Washington.

After a modest climb through the first part of the year, Expeditors International of Washington’s share price momentum has eased a bit lately, highlighting investor caution in the face of subdued profit growth. Despite this pause, the company still boasts an impressive 41% total shareholder return over the past five years. This indicates it can reward patient holders even when the short-term outlook is mixed.

If you’re weighing your next investment move, this could be a great moment to broaden your search and discover fast growing stocks with high insider ownership

With recent valuations hovering near analyst targets and future growth looking tepid, investors are left to ponder whether Expeditors International offers hidden value at this level or if the market is already factoring in its prospects.

Price-to-Earnings of 18.7x: Is it justified?

Expeditors International of Washington is currently trading at a price-to-earnings (P/E) ratio of 18.7x. This multiple is significantly below the average P/E of its peer group, coming in at close to half their level. However, when compared to broader industry benchmarks, the company does not appear as attractively priced.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of company earnings. A lower P/E can signal undervaluation, but may also reflect expectations for muted growth or underlying challenges. For Expeditors International, the figure suggests investors are pricing in slower future profit growth, which aligns with consensus outlooks for the sector.

Despite the seemingly attractive multiple versus direct peers, the wider logistics industry average stands at 16.1x. This makes Expeditors International’s shares pricier than much of its sector. In addition, the estimated fair price-to-earnings ratio for the company is 12x, indicating the current market price still includes a substantial premium. The market could correct toward this fair level if growth continues to lag.

Explore the SWS fair ratio for Expeditors International of Washington

Result: Price-to-Earnings of 18.7x (OVERVALUED)

However, persistent muted revenue growth and a dip in net income could spark further caution among investors and potentially pressure the stock’s valuation.

Find out about the key risks to this Expeditors International of Washington narrative.

Another View: Discounted Cash Flow Model Sends a Different Signal

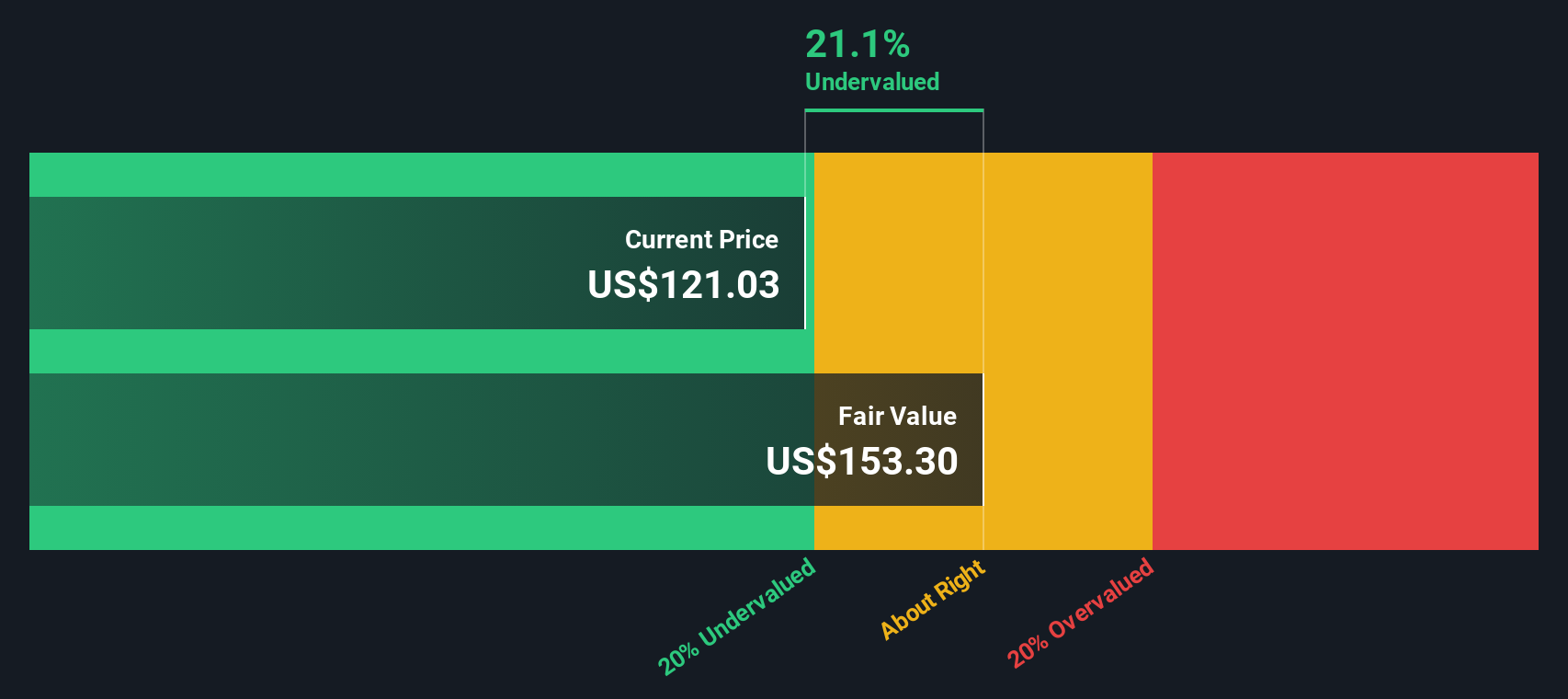

Taking a fresh angle, the SWS DCF model estimates Expeditors International shares are actually trading 23% below their calculated fair value. This suggests the stock could be undervalued based on forward-looking cash flows, even as earnings trends have disappointed. Do fundamentals justify the DCF optimism, or is the market seeing something the model misses?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Expeditors International of Washington for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Expeditors International of Washington Narrative

If you see the story differently or want to dig into the numbers on your own, you can build your own view in just a few minutes with Do it your way.

A great starting point for your Expeditors International of Washington research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Ready to shake up your portfolio? Don’t let the best opportunities slip past you when you can pinpoint stock ideas tailored to your goals right now on Simply Wall Street.

- Tap into powerful long-term yield by checking out these 17 dividend stocks with yields > 3% offering returns above 3%. Capture reliable income while the chance lasts.

- Catch a glimpse of the future and uncover trailblazers transforming healthcare with breakthroughs in artificial intelligence by looking at these 33 healthcare AI stocks today.

- Maximize your growth upside and identify exceptional bargains in undervalued companies with solid financials through these 877 undervalued stocks based on cash flows before market sentiment shifts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expeditors International of Washington might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EXPD

Expeditors International of Washington

Provides logistics services in the Americas, North Asia, South Asia, Europe, and MAIR.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives