- United States

- /

- Airlines

- /

- NYSE:DAL

Jeanne Jackson Is The Independent Director of Delta Air Lines, Inc. (NYSE:DAL) And They Just Picked Up 195% More Shares

Those following along with Delta Air Lines, Inc. (NYSE:DAL) will no doubt be intrigued by the recent purchase of shares by Jeanne Jackson, Independent Director of the company, who spent a stonking US$580k on stock at an average price of US$22.72. That increased their holding by a full 195%, which arguably implies the sort of confidence required for a shy sweet-natured nerd to ask the most popular kid in the school to go out on a date.

View our latest analysis for Delta Air Lines

The Last 12 Months Of Insider Transactions At Delta Air Lines

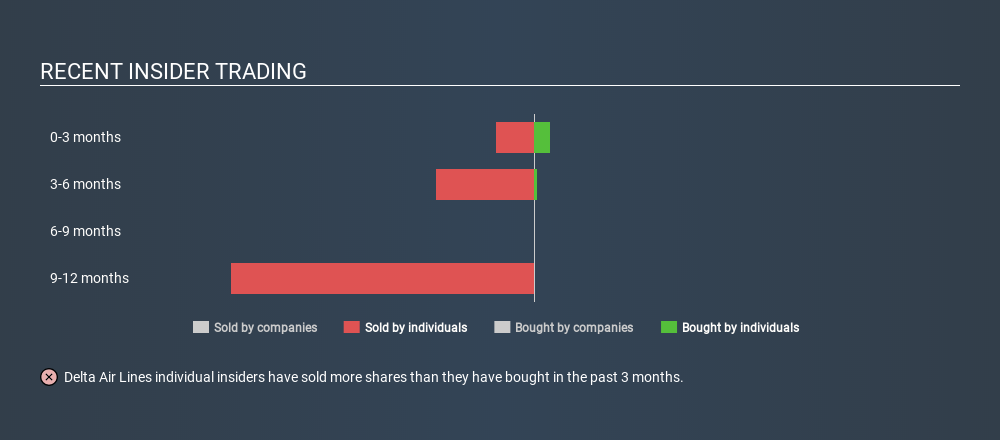

Over the last year, we can see that the biggest insider sale was by the President, Glen Hauenstein, for US$3.2m worth of shares, at about US$63.03 per share. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. The silver lining is that this sell-down took place above the latest price (US$24.34). So it may not shed much light on insider confidence at current levels.

Over the last year, we can see that insiders have bought 31.54k shares worth US$895k. But insiders sold 135098 shares worth US$8.2m. All up, insiders sold more shares in Delta Air Lines than they bought, over the last year. They sold for an average price of about US$60.51. It is certainly not great to see that insiders have sold shares in the company. But we note that the selling, on average, was at well above the recently traded price of US$24.34. You can see a visual depiction of insider transactions (by individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

I will like Delta Air Lines better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Does Delta Air Lines Boast High Insider Ownership?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. We usually like to see fairly high levels of insider ownership. Delta Air Lines insiders own about US$54m worth of shares. That equates to 0.4% of the company. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

What Might The Insider Transactions At Delta Air Lines Tell Us?

It is good to see recent purchasing. But we can't say the same for the transactions over the last 12 months. The more recent transactions are a positive, but Delta Air Lines insiders haven't shown the sustained enthusiasm that we look for, although they do own a decent number of shares, overall. Overall they seem reasonably aligned. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. At Simply Wall St, we found 3 warning signs for Delta Air Lines that deserve your attention before buying any shares.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:DAL

Delta Air Lines

Provides scheduled air transportation for passengers and cargo in the United States and internationally.

Undervalued with proven track record.