- United States

- /

- Airlines

- /

- NYSE:DAL

Does Delta’s Recent Travel Demand Surge Signal a Mispriced Opportunity for 2025?

Reviewed by Bailey Pemberton

- Wondering if Delta Air Lines is trading at a bargain right now? You are not alone, as more investors are starting to question whether the current price reflects the real story behind the stock.

- While shares have seen some short-term turbulence, posting a -0.8% return in the last week and -2.1% over the past month, the longer-term picture is much rosier with returns of 74.2% over three years and 61.7% over five years.

- News around Delta has highlighted renewed travel demand and updates on pilot contracts, both fueling investor optimism. There has also been buzz about ongoing industry recovery and strategic moves to strengthen operational reliability, providing crucial context for the recent price action.

- If you are keeping score, Delta Air Lines earns a 6 out of 6 on our valuation checks, which is as good as it gets. Here is how analysts arrive at these numbers, and later, we discuss a smarter way to see the full picture of value.

Find out why Delta Air Lines's -7.7% return over the last year is lagging behind its peers.

Approach 1: Delta Air Lines Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a business is worth today by projecting its future cash flows and then discounting those cash flows back to their present value using a required rate of return. This approach helps investors determine if a stock is trading above or below its intrinsic value based on the company's fundamental financial outlook.

For Delta Air Lines, the latest reported Free Cash Flow was $2.3 Billion. Analysts have projected that by 2028, Free Cash Flow could reach $4.7 Billion. While analyst estimates are more robust for the near term, longer-term projections out to 2035 based on Simply Wall St extrapolations suggest a steady growth in Free Cash Flow, with values continuing to rise gradually each year.

Based on this model, Delta's estimated intrinsic value is $106.50 per share. With the current share price reflecting a 45.2% discount to this intrinsic value, the DCF approach signals that Delta Air Lines appears significantly undervalued relative to its future cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Delta Air Lines is undervalued by 45.2%. Track this in your watchlist or portfolio, or discover 886 more undervalued stocks based on cash flows.

Approach 2: Delta Air Lines Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular and effective metric for valuing profitable companies like Delta Air Lines because it allows investors to weigh the company’s current share price against its actual earnings power. When a company is consistently profitable, the PE ratio gives a window into whether the market is being optimistic or cautious about future performance.

Typically, companies with higher growth expectations or lower perceived risk will command a higher "normal" or "fair" PE multiple, while sluggish growth or greater risks tend to bring that number down. Comparing Delta Air Lines' current PE ratio of 8.18x to the broader Airlines industry average of 8.98x and a peer group mean of 19.05x, we can see Delta is priced below both sector and peer benchmarks.

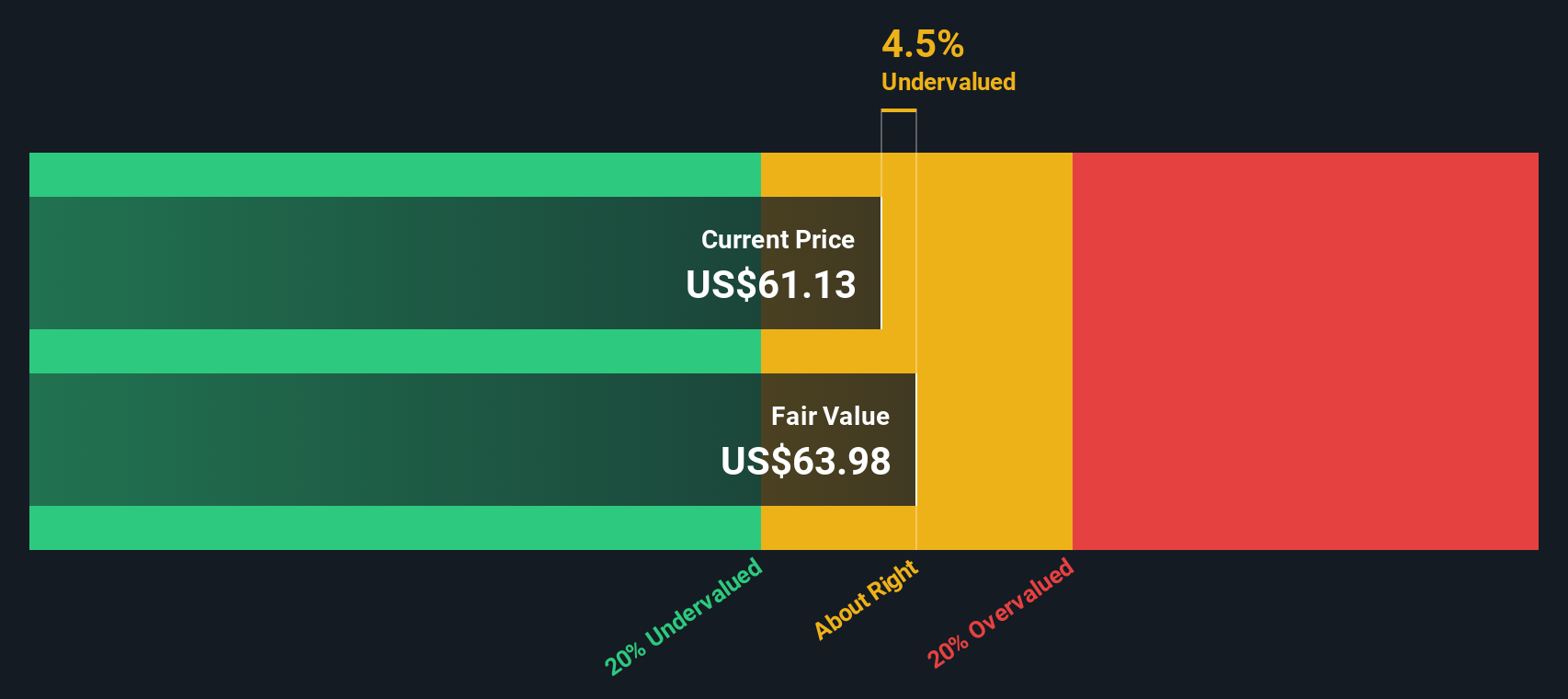

To provide a more nuanced and tailored view, the Simply Wall St "Fair Ratio" sets an expected PE multiple based on Delta's unique fundamentals, such as projected earnings growth, profit margins, risks, industry positioning and overall market capitalization. This makes it a more holistic and forward-looking benchmark than a simple comparison with peers or industry averages. For Delta, the Fair Ratio comes in at 13.28x, which is well above the company’s current PE multiple. This gap suggests that the shares are trading at a noticeable discount to what is warranted given Delta's shown growth, profitability, and risk profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Delta Air Lines Narrative

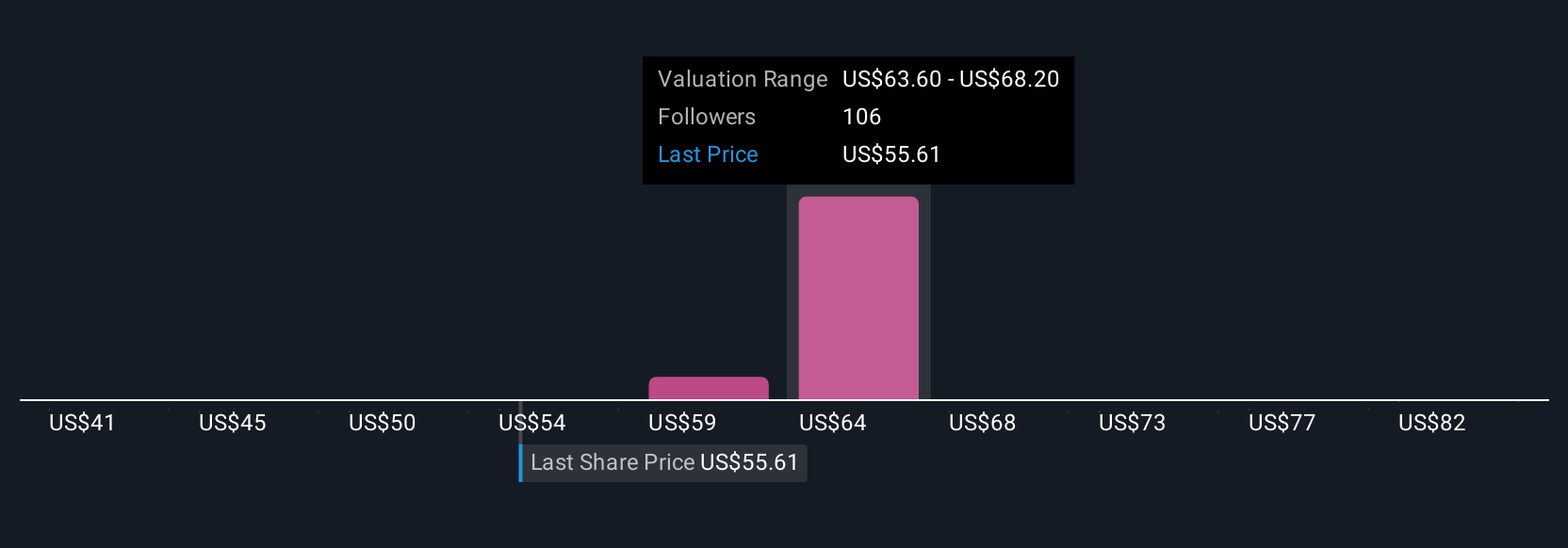

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative lets you go beyond the numbers and articulate your own story about Delta Air Lines by tying together your views on the company’s future revenue, margins, and fair value within a single, easy-to-use forecast.

With Narratives, you connect what is happening in the business or industry to a personalized financial forecast, which then becomes your own fair value estimate. As an accessible tool on Simply Wall St’s Community page (used by millions of investors), Narratives empower you to assess whether to buy, hold, or sell by comparing your Fair Value to today’s Price.

Narratives are dynamic and automatically update whenever new news or earnings data comes in, so your story stays current with the latest developments. For instance, one investor might be very optimistic, with a Narrative projecting a fair value of $90 per share based on robust earnings momentum, while another might see mounting competition and set a more cautious $49 per share.

By exploring and creating your own Narrative, you get a clearer, more tailored view of how Delta Air Lines fits your portfolio and your belief in its future potential.

Do you think there's more to the story for Delta Air Lines? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAL

Delta Air Lines

Provides scheduled air transportation for passengers and cargo in the United States and internationally.

Very undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives