- United States

- /

- Airlines

- /

- NYSE:DAL

Do Delta Air Lines’ (DAL) Holiday Disruptions Reveal Deeper Infrastructure Challenges for Investors?

Reviewed by Sasha Jovanovic

- During the past week, Delta Air Lines experienced widespread flight delays and a 1.8% year-over-year decline in air traffic throughput during the busy Thanksgiving holiday period, driven by severe weather and disruptions from a recent U.S. government shutdown.

- This comes as Delta continues to emphasize innovation and recovery, but the operational challenges during a key travel season highlight vulnerabilities in both the company’s logistics and wider industry infrastructure.

- We’ll now explore how Delta’s recent travel disruptions and short-term throughput decline may impact its long-term investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Delta Air Lines Investment Narrative Recap

To be a Delta Air Lines shareholder, you need to believe in the company’s ability to manage margins, grow resilient revenue streams, and maintain operational reliability despite industry challenges. The recent Thanksgiving travel disruptions and a 1.8% year-over-year drop in air traffic throughput temporarily highlight execution risks, but these appear to have limited impact on the core long-term catalysts and do not materially affect the biggest near-term driver: sustained demand for premium and loyalty travel segments.

One recent announcement especially relevant to investors is Delta’s emphasis on technology upgrades and operational recovery after disruptions linked to the U.S. government shutdown. With a $12 billion federal investment targeting air traffic control modernization and Delta’s continued focus on innovation, the company aims to strengthen its logistics and customer service backbone, important attributes as demand fluctuates and competition persists.

By contrast, investors should be aware that economic uncertainty, especially in core domestic and main cabin travel, continues to present risks that could challenge...

Read the full narrative on Delta Air Lines (it's free!)

Delta Air Lines' narrative projects $68.4 billion revenue and $4.6 billion earnings by 2028. This requires 3.4% yearly revenue growth and a $0.1 billion earnings increase from $4.5 billion today.

Uncover how Delta Air Lines' forecasts yield a $71.60 fair value, a 12% upside to its current price.

Exploring Other Perspectives

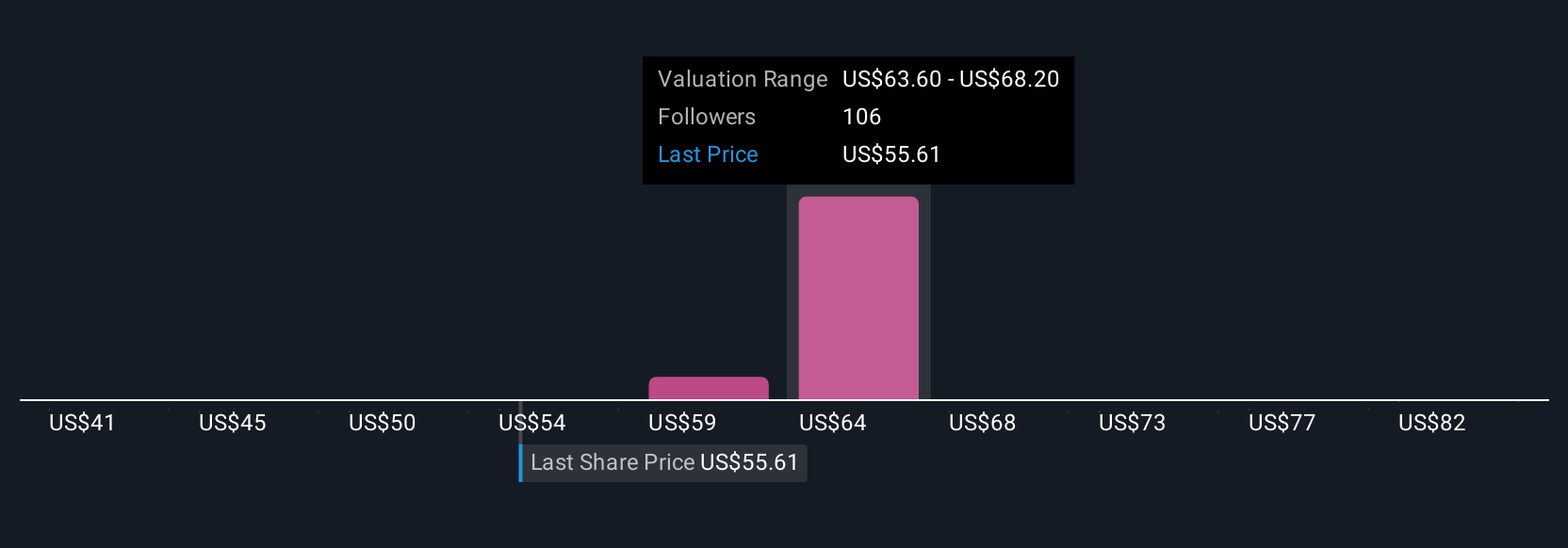

Nine fair value estimates from the Simply Wall St Community for Delta range widely from US$40.57 to US$108.44 per share. While these highlight diverse opinions, intensifying competition in the main cabin segment continues to shape risks around Delta’s ability to maintain pricing power and margins, review more perspectives to see how your outlook compares.

Explore 9 other fair value estimates on Delta Air Lines - why the stock might be worth 37% less than the current price!

Build Your Own Delta Air Lines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Delta Air Lines research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Delta Air Lines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Delta Air Lines' overall financial health at a glance.

No Opportunity In Delta Air Lines?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DAL

Delta Air Lines

Provides scheduled air transportation for passengers and cargo in the United States and internationally.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026