- United States

- /

- Marine and Shipping

- /

- NYSE:CMRE

Costamare (NYSE:CMRE): Exploring Current Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Costamare.

Costamare’s share price has rallied over the past quarter, with momentum continuing thanks to a 17.6% gain over the last 90 days, even though it remains down for the year. Meanwhile, long-term investors have enjoyed a strong total shareholder return of 25.2% over the past twelve months. This highlights Costamare’s appeal for those seeking both value and growth potential.

If you’re keeping an eye on shifting trends in shipping stocks, it is an ideal moment to broaden your scope and discover fast growing stocks with high insider ownership

With recent gains and a strong return over the past year, investors are asking whether Costamare’s current valuation leaves room for further upside, or if the market has already accounted for the company’s future prospects. Is there a true buying opportunity here? Alternatively, has anticipated growth already been reflected in the share price?

Most Popular Narrative: 13.5% Overvalued

Costamare’s last close at $12.09 stands well above the fair value of $10.65 suggested by the most popular analyst narrative. This sets up a gap between market optimism and underlying financial assumptions.

The company's emphasis on stable counterparties and near 100% fleet employment into 2025, along with a 3.2-year average charter duration, could cause investors to underestimate counterparty risk or the potential for rate renegotiations in a downturn, resulting in optimistic expectations for net margins and cash flows.

Wondering what powers this bullish view despite a forecast revenue decline? The narrative leans hard on sustained profitability, aggressive margin expansion, and a sharp turnaround in the earnings story. The recipe for Costamare’s fair value is anything but obvious. Discover the bold forecasts behind this headline figure.

Result: Fair Value of $10.65 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in global trade patterns or surging compliance costs could disrupt Costamare’s outlook and challenge even the most optimistic forecasts.

Find out about the key risks to this Costamare narrative.

Another View: SWS DCF Model Suggests a Different Story

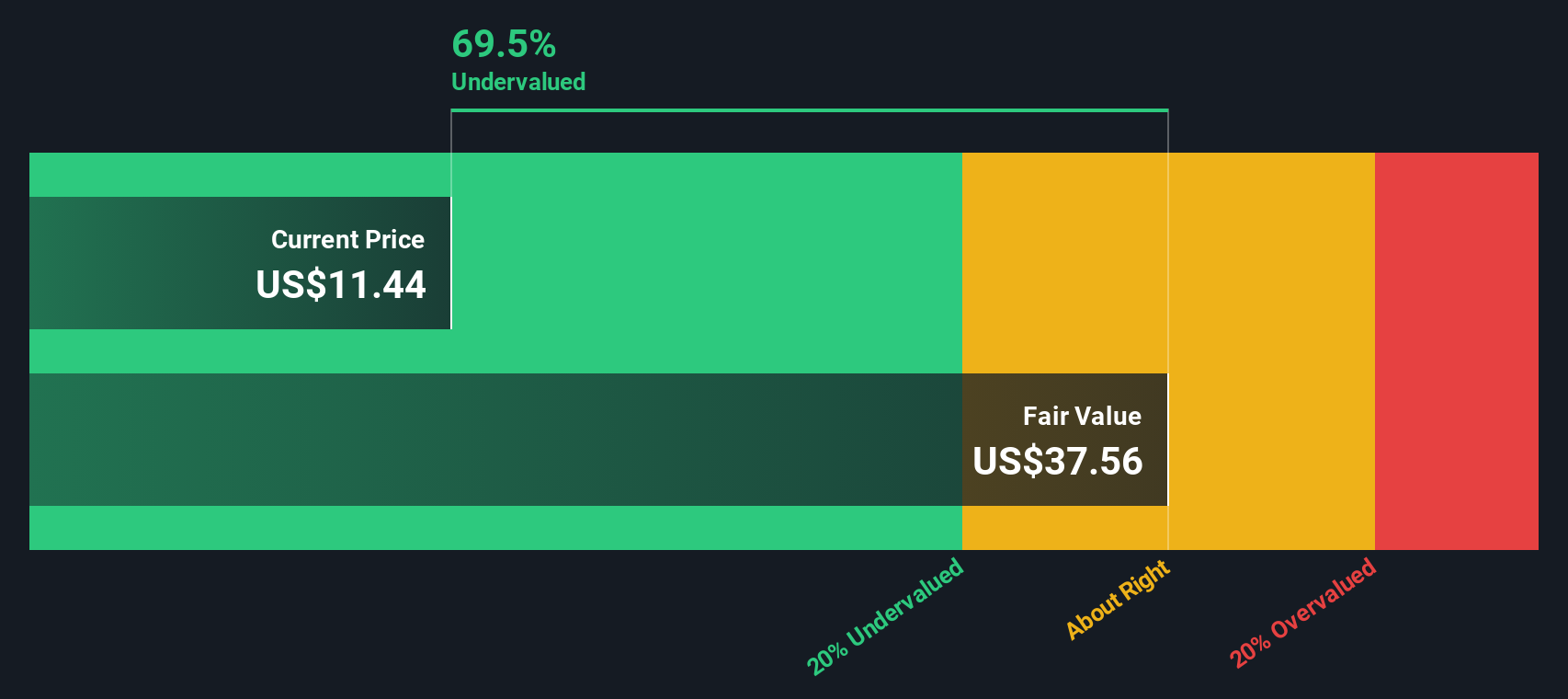

While the analyst narrative pegs Costamare as overvalued compared to its fair value, our SWS DCF model paints a very different picture. By forecasting future cash flows, this model estimates Costamare’s fair value at $38.08, which is far above today’s share price. Does this signal a hidden value, or does it show just how wide expert opinions can be?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Costamare Narrative

If you think the story goes in a different direction, or you want to dig into the numbers yourself, you can craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Costamare research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t wait on the sidelines while new themes and opportunities emerge. Put your strategy in motion with stock ideas uniquely matched to different trends and goals:

- Supercharge your watchlist by tapping into the growth potential behind these 26 AI penny stocks, where artificial intelligence is reshaping entire sectors.

- Unlock returns from overlooked value with these 848 undervalued stocks based on cash flows, which may be under the radar but offer robust fundamentals and attractive pricing.

- Maximize income with these 24 dividend stocks with yields > 3%, offering yields above 3 percent for a reliable boost to your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMRE

Costamare

Owns and operates containerships and dry bulk vessels worldwide.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives