- United States

- /

- Infrastructure

- /

- NYSE:CAAP

A Look at Corporación América Airports (NYSE:CAAP) Valuation After Passenger and Flight Numbers Rise in Latest Results

Reviewed by Simply Wall St

Corporación América Airports (NYSE:CAAP) released its latest operating results, drawing attention for year-over-year gains in both passenger numbers and aircraft movements. However, cargo volumes continued to decline compared to the previous period.

See our latest analysis for Corporación América Airports.

Shares of Corporación América Airports have shown strong momentum lately, with a one-month share price return of 23.6% and a 14.8% gain year to date. This reflects renewed optimism after the uptick in passenger and flight numbers. Looking back, the company’s 1-year total shareholder return stands at 17.7%, and its five-year total return is an eye-catching 802%, signaling robust long-term growth and persistent interest from investors.

If the company’s rising traffic has you thinking bigger, why not broaden your search and discover fast growing stocks with high insider ownership

With such a dramatic rally and robust growth numbers, investors may wonder if Corporación América Airports shares remain undervalued or if the market has already priced in most of the potential upside. Is there still a compelling buying opportunity here, or are future gains already reflected in the stock?

Most Popular Narrative: 14.6% Undervalued

Corporación América Airports is trading well below the narrative’s estimated fair value, suggesting room for upside compared to the $22.10 last close. The narrative highlights expanding top-line and margin improvements that shape expectations for the years ahead.

“Sustained passenger growth and expansion into commercial revenue streams are driving resilient earnings and improving margins across multiple markets. Geographic diversification and ongoing infrastructure investments are reducing risk and supporting long-term capacity, competitiveness, and cash flow stability.”

Want to know the bold growth projections at the heart of this valuation? The real surprise is a sharp shift in future profit margins and earnings power. Curious to see what numbers and logic power that fair value? Dive deeper to uncover the catalysts and math behind this eye-catching price target.

Result: Fair Value of $25.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing economic instability in Argentina and regulatory uncertainties around airport concessions could quickly derail these bullish projections.

Find out about the key risks to this Corporación América Airports narrative.

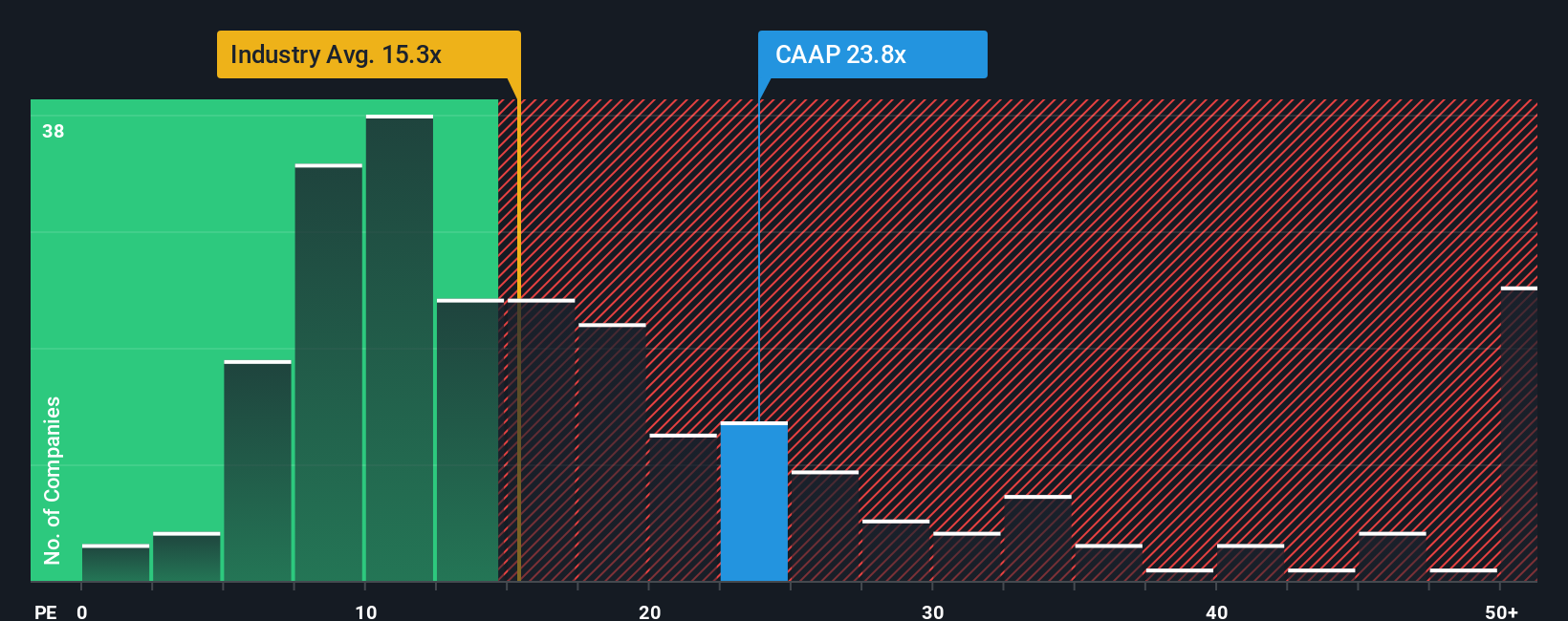

Another View: Multiples Raise a Red Flag

While the fair value estimate indicates upside, a look at the company's price-to-earnings ratio tells a different story. Corporación América Airports trades at 23.8 times earnings, which is noticeably higher than its direct peers (20.5x) and the global industry average (15.3x). Even compared to its fair ratio of 22.5x, the stock is stepping into expensive territory. This gap means investors face more valuation risk if growth or sentiment stumbles. Does the story still add up, or is the price advancing too far ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Corporación América Airports Narrative

If you see the numbers differently or want to dig into your own thesis, you can build a complete narrative from scratch in just a few minutes. Do it your way

A great starting point for your Corporación América Airports research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Sharpen your edge and uncover untapped opportunities that others are missing. With these powerful tools, you can confidently find your next great investment for your portfolio.

- Boost your income potential by targeting companies offering generous yields with these 18 dividend stocks with yields > 3%, and put cash flow to work for your future.

- Ride the AI wave by uncovering visionary businesses at the intersection of artificial intelligence and industry with these 27 AI penny stocks before they become household names.

- Step outside the mainstream and seize overlooked value by searching for tomorrow’s winners among these 3590 penny stocks with strong financials with strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAAP

Corporación América Airports

Through its subsidiaries, acquires, develops, and operates airport concessions.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives