- United States

- /

- Airlines

- /

- NYSE:ALK

A Fresh Look at Alaska Air Group (ALK) Valuation Following Recent Share Price Slide

Reviewed by Simply Wall St

See our latest analysis for Alaska Air Group.

After a tough month for airlines, Alaska Air Group's 1-month share price return of -18.24% stands out, continuing a decline that has weighed on sentiment this year. Looking at the longer term, the total shareholder return over five years is just 3.88%, which suggests that momentum has been losing steam for a while.

If falling airline stocks have you rethinking your watchlist, it might be the perfect moment to discover fast growing stocks with high insider ownership.

With shares trading well below analyst price targets and recent gains in revenue and net income, investors are left to wonder: is Alaska Air Group undervalued, or is the market already factoring in what lies ahead?

Most Popular Narrative: 41% Undervalued

Compared to the last close of $40.70, the narrative assigns Alaska Air Group a far higher fair value, reflecting bold optimism in long-term catalysts and financial projections. This dramatic gap sets the scene for a closer look at the reasoning behind such a valuation.

The expansion and optimization of the Seattle international gateway, including new long-haul routes and a growing fleet of Boeing 787s, positions Alaska Air Group to benefit from sustained urban growth and increasing travel demand in West Coast cities, anticipated to drive higher passenger volumes and top-line revenue growth.

Want to know the math fueling this sky-high valuation? Bold revenue projections, game-changing cost targets, and a future profit multiple usually reserved for sector frontrunners are at play. The model hinges on pivotal leaps in earnings and margins. Curious which financial stretch drives the fair value? See what details the full narrative reveals.

Result: Fair Value of $68.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising jet fuel costs and execution risks from merging with Hawaiian Airlines could still challenge Alaska Air Group’s ambitious earnings targets.

Find out about the key risks to this Alaska Air Group narrative.

Another View: Looking at Price Ratios

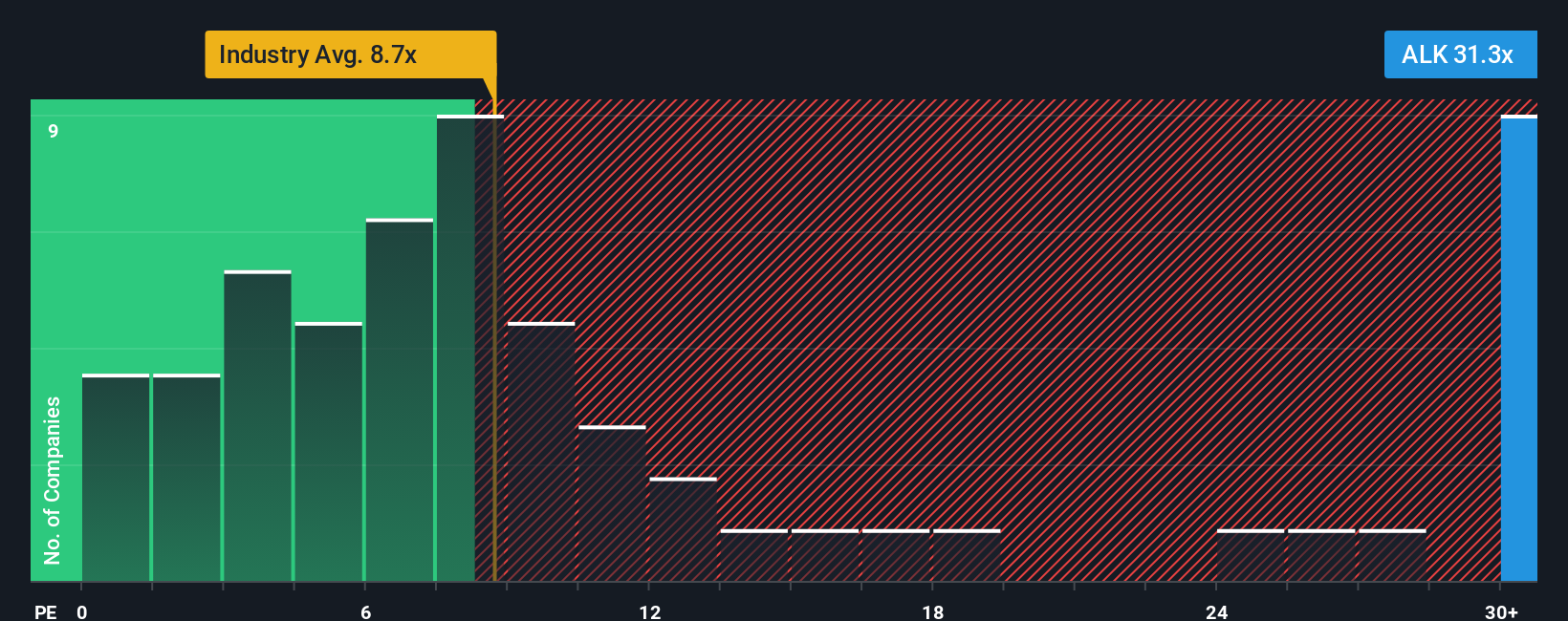

While the fair value approach is optimistic, the market’s favored price-to-earnings multiple paints a cloudier picture. Alaska Air Group trades at 31.3 times earnings, well above the industry average of 8.7 and its own fair ratio of 59.7. This premium raises questions about valuation risk, especially if earnings forecasts stumble.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alaska Air Group Narrative

If you see things differently or enjoy diving into the numbers on your own, it only takes a few minutes to shape your own perspective. Do it your way.

A great starting point for your Alaska Air Group research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Don't let your portfolio stagnate. Put your money where growth and innovation are happening. These curated ideas may provide an edge and help you discover potential opportunities before they become widely recognized.

- Secure your future by considering these 24 dividend stocks with yields > 3%, which offers stable income and yields that can strengthen your returns over time.

- Participate in technological transformation by exploring these 26 AI penny stocks, featuring companies focused on redefining industries through artificial intelligence developments.

- Stay ahead of market trends by examining these 834 undervalued stocks based on cash flows, where strong fundamentals and attractive valuations highlight stocks that may be overlooked by others.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALK

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives