- United States

- /

- Transportation

- /

- NasdaqGS:WERN

Werner Enterprises (WERN): A Fresh Look at Valuation After Challenging Earnings and Analyst Downgrades

Reviewed by Simply Wall St

Werner Enterprises (WERN) recently reported its third quarter earnings results, giving investors plenty to digest. The company saw logistics revenues climb and continued making progress with its technology initiatives, but faced some significant headwinds.

See our latest analysis for Werner Enterprises.

Despite Werner Enterprises’ strong push in logistics and tech upgrades, the share price has struggled, dropping 26% year-to-date. The latest quarterly report, which featured a rare operating loss and a cautious management outlook, appears to have weighed on sentiment. This has contributed to a 1-year total shareholder return of -29.7%, signaling that momentum remains soft as investors digest industry headwinds and regulatory changes.

If you’re reevaluating your portfolio after these results, now’s a good time to branch out and discover fast growing stocks with high insider ownership

That leaves investors asking a pivotal question: after this string of analyst downgrades and a steep share price drop, does Werner Enterprises now represent an undervalued opportunity, or is the market already factoring in its outlook for 2026?

Most Popular Narrative: 2.6% Undervalued

With the widely followed narrative suggesting a fair value slightly above the last close, Werner Enterprises may have more to offer than current sentiment implies. The focus centers on operational improvements and sector shifts that could set the company apart as the freight cycle evolves.

Strong operational execution and disciplined capital allocation, including a modern, low-age fleet and share repurchases at depressed prices, have positioned Werner for efficient scaling as volumes rebound. Incremental margins are likely to accelerate as Dedicated and Logistics growth absorbs fixed costs and technology leverage kicks in.

Curious how bold assumptions about profit margins and strategic upgrades could fuel future gains? The full narrative breaks down which moving pieces must click, and uncovers the rationale behind expectations for a comeback. Find out what the market may be missing.

Result: Fair Value of $27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent insurance costs or ongoing weak freight volumes could quickly undercut optimism and challenge Werner Enterprises’ path to improved margins and recovery.

Find out about the key risks to this Werner Enterprises narrative.

Another View: Multiples Tell a Different Story

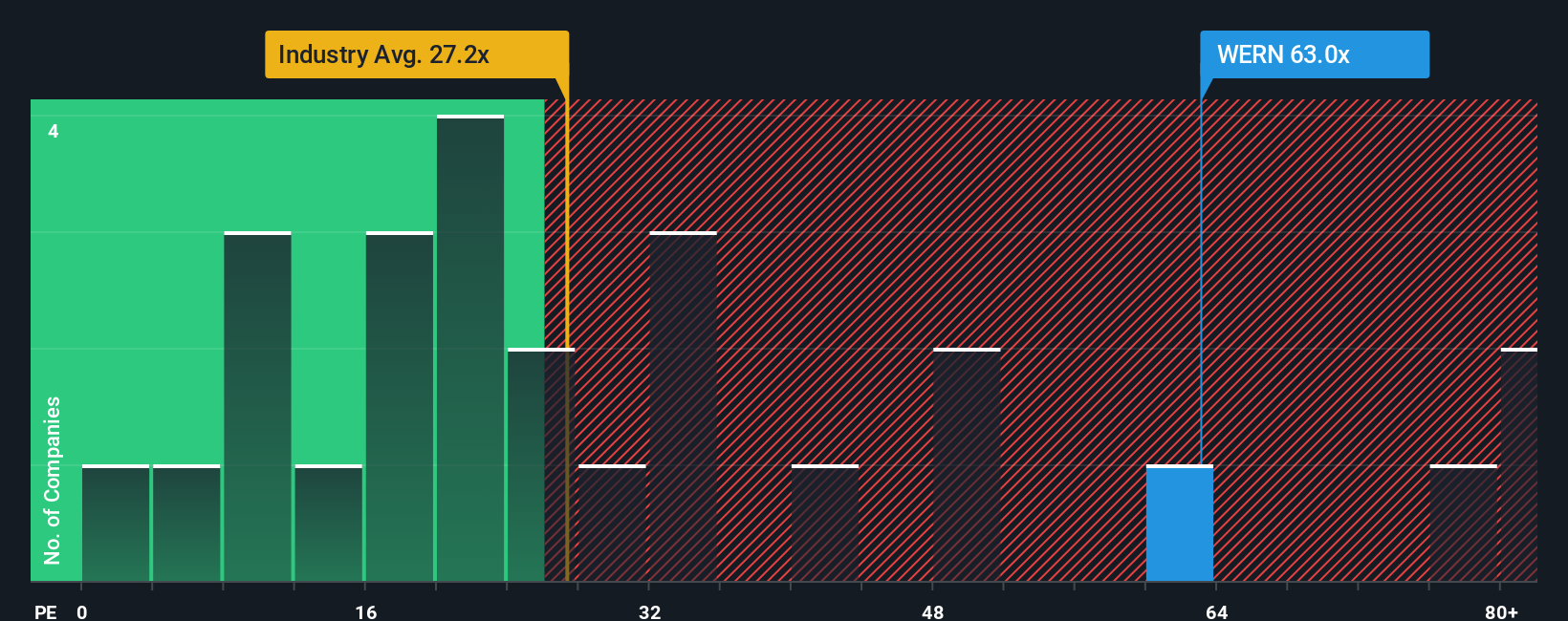

Looking at the commonly used price-to-earnings ratio puts a different spin on Werner Enterprises’ valuation. The company trades at 62.2x, which is much higher than both the US Transportation industry average of 27x and its peers’ 25.9x. This is also double the fair ratio of 31.9x. This wide gap suggests investors could be paying a high premium, raising questions about risk if future expectations are not met. Can this premium hold if operational challenges continue, or will reality catch up to the current price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Werner Enterprises Narrative

If you have a different perspective or want to dig deeper into the numbers, you can build your own Werner Enterprises narrative in just a few minutes. Do it your way

A great starting point for your Werner Enterprises research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't hesitate and miss your next big opportunity. The Simply Wall Street Screener puts powerful investment trends within your reach, opening the door to new growth and value.

- Spot opportunities to grow your portfolio with attractive yield as you evaluate these 20 dividend stocks with yields > 3% offering strong returns above 3%.

- Tap into tomorrow’s innovation by pinpointing leaders in artificial intelligence as you scan these 26 AI penny stocks that are changing how industries operate.

- Secure bargain investments by analyzing these 840 undervalued stocks based on cash flows which could be trading far below their intrinsic worth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Werner Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WERN

Werner Enterprises

Engages in transporting truckload shipments of general commodities in interstate and intrastate commerce in the United States, Mexico, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives