- United States

- /

- Transportation

- /

- NasdaqGS:WERN

Four Days Left Until Werner Enterprises, Inc. (NASDAQ:WERN) Trades Ex-Dividend

Readers hoping to buy Werner Enterprises, Inc. (NASDAQ:WERN) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. You can purchase shares before the 16th of April in order to receive the dividend, which the company will pay on the 4th of May.

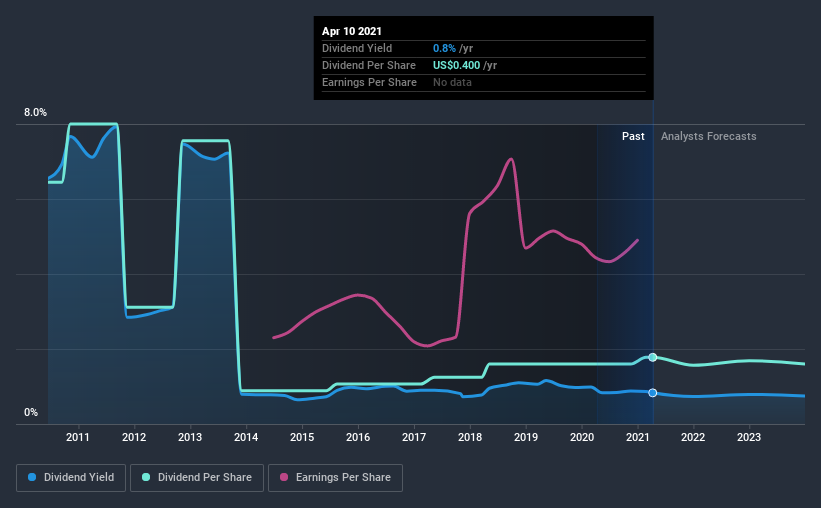

Werner Enterprises's next dividend payment will be US$0.10 per share, and in the last 12 months, the company paid a total of US$0.36 per share. Based on the last year's worth of payments, Werner Enterprises has a trailing yield of 0.8% on the current stock price of $48.15. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to check whether the dividend payments are covered, and if earnings are growing.

View our latest analysis for Werner Enterprises

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Werner Enterprises is paying out just 15% of its profit after tax, which is comfortably low and leaves plenty of breathing room in the case of adverse events. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. Over the last year, it paid out more than three-quarters (76%) of its free cash flow generated, which is fairly high and may be starting to limit reinvestment in the business.

It's positive to see that Werner Enterprises's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. With that in mind, we're encouraged by the steady growth at Werner Enterprises, with earnings per share up 7.3% on average over the last five years. Decent historical earnings per share growth suggests Werner Enterprises has been effectively growing value for shareholders. However, it's now paying out more than half its earnings as dividends. Therefore it's unlikely that the company will be able to reinvest heavily in its business, which could presage slower growth in the future.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Werner Enterprises's dividend payments per share have declined at 12% per year on average over the past 10 years, which is uninspiring. Werner Enterprises is a rare case where dividends have been decreasing at the same time as earnings per share have been improving. It's unusual to see, and could point to unstable conditions in the core business, or more rarely an intensified focus on reinvesting profits.

Final Takeaway

Is Werner Enterprises worth buying for its dividend? Earnings per share have been growing at a steady rate, and Werner Enterprises paid out less than half its profits and more than half its free cash flow as dividends over the last year. Overall we're not hugely bearish on the stock, but there are likely better dividend investments out there.

With that in mind, a critical part of thorough stock research is being aware of any risks that stock currently faces. For example, we've found 1 warning sign for Werner Enterprises that we recommend you consider before investing in the business.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Werner Enterprises or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Werner Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:WERN

Werner Enterprises

Engages in transporting truckload shipments of general commodities in interstate and intrastate commerce in the United States, Mexico, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives