- United States

- /

- Transportation

- /

- NasdaqGS:WERN

A Look at Werner Enterprises's Valuation After Strategic Move Into Lithium Fleet Technology

Reviewed by Simply Wall St

Werner Enterprises (WERN) has taken a meaningful step in fleet innovation by placing its first order for Dragonfly Energy’s Battle Born DualFlow Power Pack systems. These American-assembled lithium-powered units are designed to boost efficiency and reduce emissions.

See our latest analysis for Werner Enterprises.

Despite recently announcing a regular dividend and sharing details at an industry conference, Werner Enterprises’ 1-year total shareholder return is down 37%, and the share price has slid nearly 29% year-to-date. Short-term momentum has improved lately; however, pressure persists from the stock’s longer-term underperformance.

If you’re looking for ideas beyond trucking, consider expanding your search to other sectors and discover fast growing stocks with high insider ownership.

With shares lagging and new efficiency investments underway, the question for investors is clear: is all this weakness a sign of an undervalued stock poised for recovery, or has the market already factored in every bit of future growth?

Most Popular Narrative: 2.6% Undervalued

Werner Enterprises' most widely cited narrative places its fair value slightly above the last close, signaling a potential valuation edge even as the market hesitates. Here is what could be driving this cautious optimism amid ongoing volatility.

Continued investment in fleet modernization, digital platforms, and automation, including EDGE TMS and AI-driven efficiencies, is enabling meaningful structural cost reduction, improved productivity, and enhanced customer service. These investments are expected to drive expanding net margins and support long-term earnings growth as demand trends recover.

Want to know how bold technology bets and an earnings turnaround fuel this price target? There is a powerful catalyst hidden in their growth assumptions. Find out what key drivers, if realized, would push this stock far beyond current expectations.

Result: Fair Value of $25.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor shortages and rising insurance costs could limit Werner’s margin recovery. This may make any turnaround more challenging than bullish scenarios suggest.

Find out about the key risks to this Werner Enterprises narrative.

Another View: Market-Based Valuation Sends a Warning

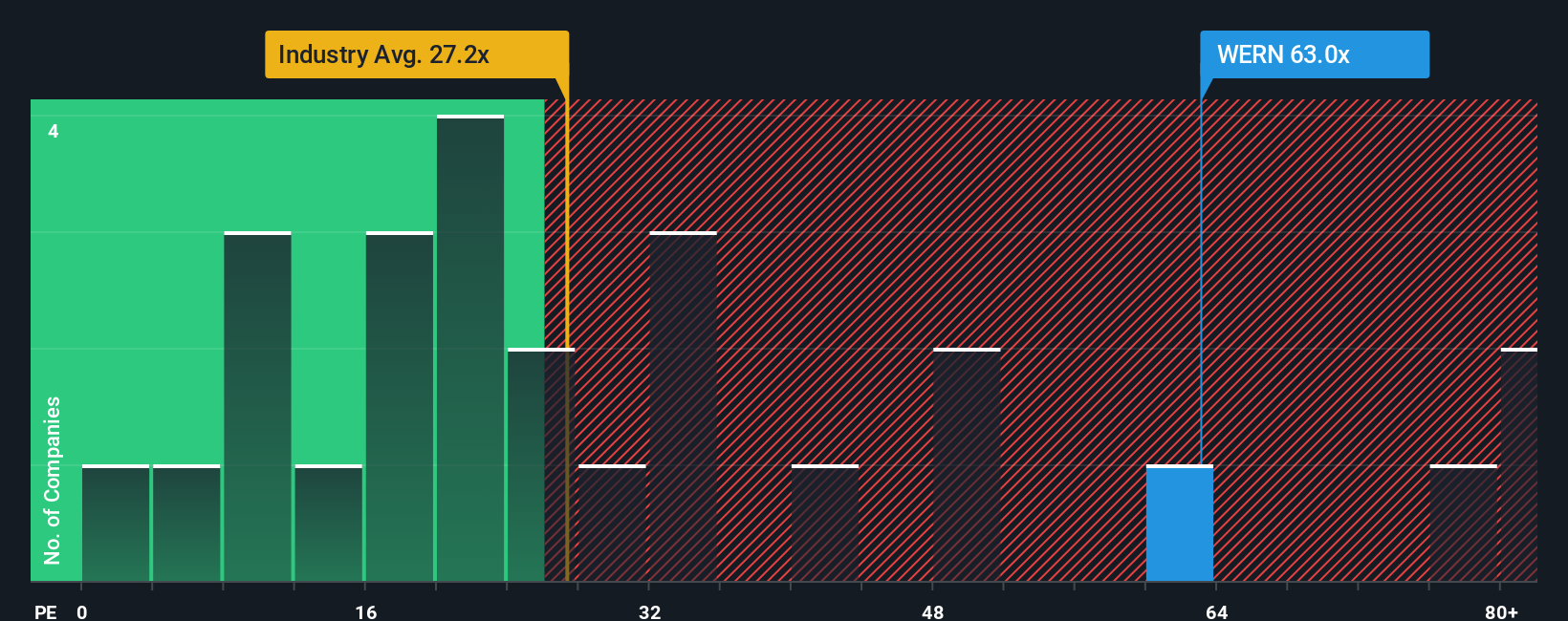

Looking through the lens of the price-to-earnings ratio, Werner shares appear expensive. At 59.6 times earnings, the stock trades far above both its peer average of 27.1 and the industry’s 26.2. Even when compared to a fair ratio of 31.1, the premium is hard to ignore. Does this price truly reflect unrealized opportunity, or does it signal real risk for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Werner Enterprises Narrative

If you want to dive deeper or challenge these conclusions, it only takes a few minutes to investigate the data and shape your own viewpoint. Do it your way.

A great starting point for your Werner Enterprises research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take the next step on your investing journey by uncovering stocks backed by strong trends and sector innovation, all curated for smart investors like you.

- Spot companies with stable earnings and capital appreciation potential by comparing these 14 dividend stocks with yields > 3% offering reliable yields and robust fundamentals.

- Target the future of healthcare by checking these 30 healthcare AI stocks, where advanced AI is revolutionizing patient outcomes and industry growth.

- Jump into rapid growth stories and early-stage opportunities with these 3582 penny stocks with strong financials that have the momentum to outperform the competition.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Werner Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WERN

Werner Enterprises

Engages in transporting truckload shipments of general commodities in interstate and intrastate commerce in the United States, Mexico, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success