- United States

- /

- Airlines

- /

- NasdaqGS:UAL

Why United Airlines (UAL) Is Up 11.2% After Moody’s Credit Upgrade and Strong Revenue Outlook

Reviewed by Sasha Jovanovic

- Recently, United Airlines received an upgrade to its credit rating from Moody’s, reflecting improved operating performance across revenue streams such as premium cabin, basic economy, loyalty, and cargo services.

- This development highlights Moody’s forecast that United Airlines could surpass US$63 billion in revenue by 2026, with further credit upgrades possible if ongoing capital structure changes succeed.

- We’ll now explore how the upgraded credit rating and enhanced revenue outlook may influence United Airlines’ broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

United Airlines Holdings Investment Narrative Recap

To be a shareholder in United Airlines Holdings, one needs to believe that the airline can convert cyclical momentum and premium travel demand into sustainable revenue growth while managing high debt and industry competition. The recent Moody’s credit upgrade offers more signaling value than material near-term impact, as interest expense and leverage remain the most important catalyst and risk currently facing United’s investment case.

United’s Q3 2025 earnings announcement, citing record passenger numbers and a year-over-year uptick in revenue, ties directly into Moody’s revenue outlook and the improving perceptions of United’s financial health. The company’s ability to deliver consecutive quarters of revenue growth supports the near-term outlook for further balance sheet improvement and operating resilience.

But it’s important to remember, by contrast, the ongoing risk that persistent high debt levels and interest costs could still challenge United’s flexibility if airline market conditions shift…

Read the full narrative on United Airlines Holdings (it's free!)

United Airlines Holdings is projected to achieve $67.6 billion in revenue and $4.2 billion in earnings by 2028. This outlook assumes a 5.2% annual revenue growth rate and a $0.9 billion increase in earnings from the current $3.3 billion level.

Uncover how United Airlines Holdings' forecasts yield a $123.20 fair value, a 21% upside to its current price.

Exploring Other Perspectives

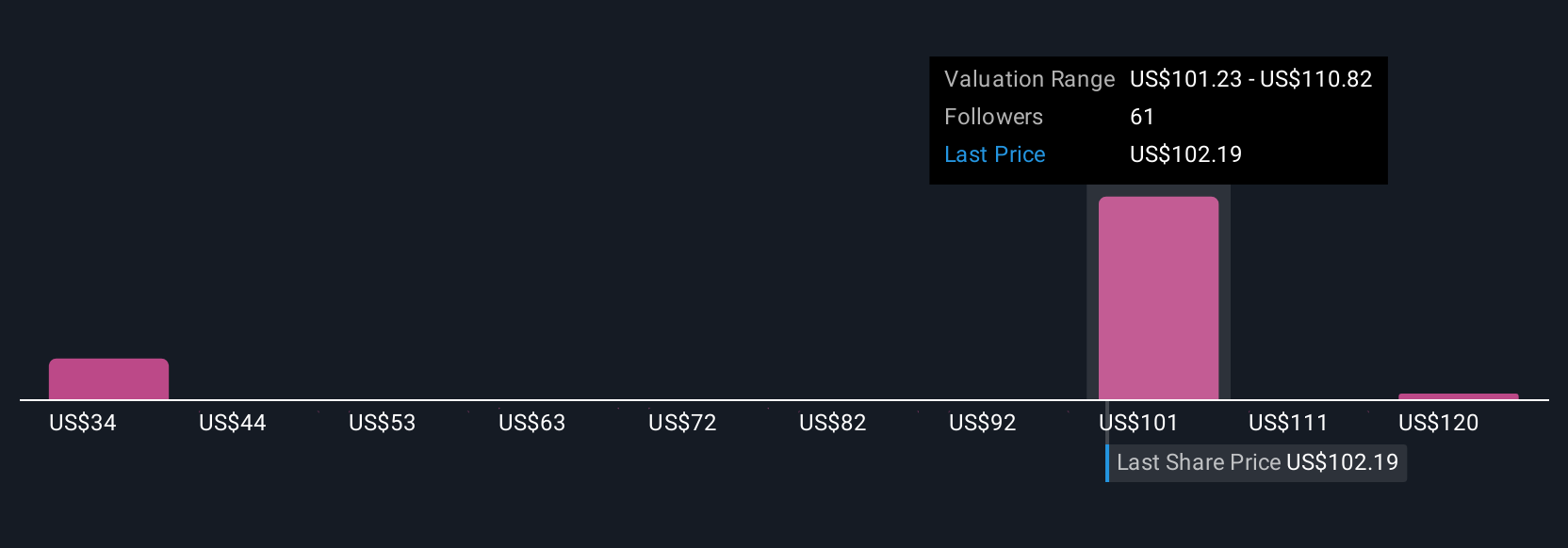

Six fair value estimates from the Simply Wall St Community span from US$102 to over US$205 per share, with several concentrated between US$112 and US$195. While some see considerable upside, many remain focused on United’s strong revenue growth as a crucial driver of its future potential. Explore these alternative views to see how your own analysis compares.

Explore 6 other fair value estimates on United Airlines Holdings - why the stock might be worth just $102.00!

Build Your Own United Airlines Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Airlines Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free United Airlines Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Airlines Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UAL

United Airlines Holdings

Through its subsidiaries, provides air transportation services in the United States, Canada, Atlantic, the Pacific, and Latin America.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success